Real-time identity proofing has revolutionized the customer due diligence process by leveraging advanced technologies like biometrics and AI with machine learning to provide instant verification against multiple authoritative data sources. This automation enhances user experience, security, and efficiency during account creation and access, while also facilitating swift risk assessment automation to ensure compliance with stringent regulatory standards. The integration of document and background checks through automated compliance checks offers a thorough understanding of customer risk profiles, safeguarding against fraudulent activities by cross-referencing information from various databases. This approach delivers an efficient, secure, and compliant onboarding process that builds trust in the digital economy, allowing companies to maintain high customer care standards while effectively managing compliance tasks. The system ensures top-tier customer satisfaction by offering a balance between user experience and security, with instant verification solutions that are both efficient and secure, and that uphold strict compliance protocols through a seamless approach that bolsters security defenses against fraud and identity theft. Keywords: Identity proofing, Customer due diligence, Risk assessment automation, Secure identity verification, Automated compliance checks, Instant verification solutions, Customer onboarding automation, Document verification.

In today’s competitive digital landscape, the user experience has become a defining factor that sets brands apart. Recognizing this, businesses are increasingly turning to advanced identity proofing and document verification technologies to streamline customer due diligence processes. This article explores how real-time verification solutions are revolutionizing the way companies handle risk assessment automation, ensuring secure identity verification while facilitating automated compliance checks. By adopting these instant verification tools, organizations can significantly enhance customer satisfaction, optimize onboarding experiences through customer onboarding automation, and boost both conversion rates and retention. Join us as we delve into the transformative impact of real-time verification solutions on the user experience and operational efficiency.

- Embracing Real-Time Identity Proofing for Enhanced Customer Due Diligence

- Streamlining Risk Assessment Automation to Ensure Secure Identity Verification

- The Role of Automated Compliance Checks in Instant Verification Solutions

- Optimizing Customer Onboarding with Document Verification and Digital Verification Tools

- Leveraging Real-Time Verification for Improved Customer Satisfaction and Business Efficiency

Embracing Real-Time Identity Proofing for Enhanced Customer Due Diligence

In today’s fast-paced digital landscape, businesses are increasingly turning to real-time identity proofing as a cornerstone of their customer due diligence strategies. This shift towards instant verification solutions is pivotal in enhancing the overall user experience while ensuring robust security measures for account creation and access. Real-time identity proofing leverages advanced technologies such as biometrics, AI, and machine learning to accurately verify identities against a wide array of trusted data sources. By doing so, it streamlines the process of customer onboarding automation, significantly reducing the time customers spend on tedious manual verification processes. This efficiency not only improves customer satisfaction but also allows for rapid risk assessment automation, enabling businesses to comply with stringent regulatory standards without compromising on speed or user experience.

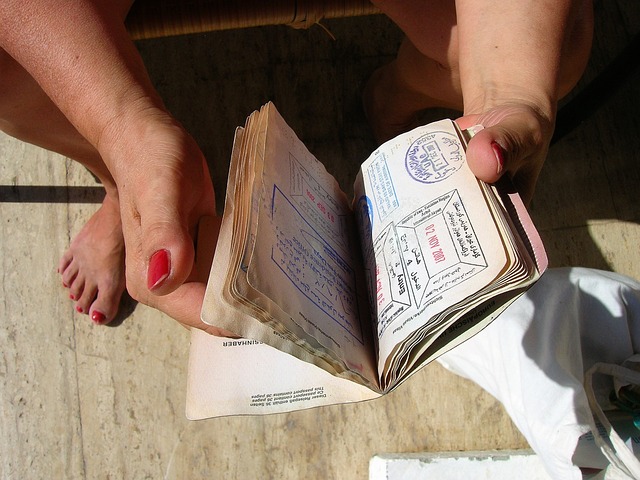

The integration of automated compliance checks is a game-changer in the realm of secure identity verification. It facilitates document verification and background checks in real time, providing businesses with a comprehensive view of customer risk profiles. This proactive approach to customer due diligence ensures that each interaction is secure and compliant. Moreover, it minimizes the potential for fraudulent activities by cross-referencing information across multiple databases. The result is a seamless onboarding process that instills confidence in both the business and its customers. With real-time identity proofing, companies can maintain the highest standards of customer care while effectively managing their compliance obligations, thereby fostering trust and loyalty in an increasingly digital world.

Streamlining Risk Assessment Automation to Ensure Secure Identity Verification

In the current digital landscape, where user experience is paramount and security is non-negotiable, streamlining risk assessment automation plays a pivotal role in ensuring secure identity verification. Identity proofing and customer due diligence are significantly enhanced through advanced algorithms that can analyze and authenticate identities in real-time. These automated compliance checks are not only swift but also sophisticated enough to detect fraudulent activities by cross-referencing data across multiple sources. By integrating document verification into the customer onboarding process, businesses can confidently verify identities without compromising on security or customer satisfaction. This automation not only accelerates the overall onboarding experience but also reduces the risk of manual errors and data breaches, which are all too common in traditional verification methods.

Furthermore, the implementation of instant verification solutions is a testament to the advancements in technology that facilitate legitimate customer interactions while thwarting potential threats. The integration of real-time identity verification into the customer onboarding automation framework ensures that each step of the process adheres to stringent compliance protocols. This seamless approach to risk assessment automation allows businesses to maintain a robust defense against fraud and identity theft, all while providing an effortless experience for customers. The result is a fortified security posture that protects both the business and its clients, fostering trust and encouraging long-term engagement.

The Role of Automated Compliance Checks in Instant Verification Solutions

In the current digital landscape, identity proofing stands at the forefront of secure customer interactions. Automated compliance checks play a pivotal role in instant verification solutions by providing real-time assurance of a user’s identity. These advanced systems facilitate customer due diligence by integrating document verification with risk assessment automation, thereby streamlining the process of verifying identities against various databases and watchlists. This integration is instrumental in ensuring that customer onboarding adheres to stringent compliance standards without compromising user experience. The efficiency of these automated checks not only accelerates the verification process but also significantly reduces the potential for fraud, as each step is scrutinized for irregularities. Businesses leveraging instant verification solutions can thus offer a seamless, secure experience that meets regulatory requirements while enhancing customer satisfaction through swift and reliable service.

Furthermore, the automation of compliance checks within instant verification solutions offers unparalleled accuracy in evaluating risks associated with user onboarding. By employing sophisticated algorithms and machine learning techniques, these systems can analyze vast amounts of data to detect anomalies that may indicate a fraudulent attempt or identity theft. This level of precision in risk assessment automation ensures that legitimate customers are expedited through the process while potential threats are flagged for further investigation. The adoption of such technology not only underpins trust and security but also positions businesses at the cutting edge of innovation, capable of adapting to the evolving digital ecosystem with agility and foresight.

Optimizing Customer Onboarding with Document Verification and Digital Verification Tools

In today’s digital landscape, optimizing customer onboarding is pivotal for businesses aiming to provide a seamless user experience. Identity proofing and document verification are integral components of this process, ensuring that customer due diligence is conducted efficiently and effectively. By leveraging advanced digital verification tools, companies can automate compliance checks, which not only accelerates the onboarding process but also enhances security through risk assessment automation. These instant verification solutions offer a secure identity verification system that minimizes the potential for fraud and streamlines interactions between businesses and their clients. The automation of such checks allows for real-time data validation, reducing manual errors and the time customers would typically spend submitting and waiting for documents to be processed. As a result, businesses can achieve higher conversion rates as well as improved customer retention by offering a frictionless onboarding experience that respects the user’s time and privacy.

Furthermore, the integration of digital verification tools into customer onboarding processes facilitates continuous monitoring for ongoing compliance. This proactive approach to secure identity verification not only safeguards against unauthorized activities but also adapts to evolving regulatory standards without causing disruptions to the user journey. By utilizing a combination of document verification and automated compliance checks, organizations can maintain a robust defensive posture while providing the swift and straightforward service that modern consumers expect. This synergy between efficiency, security, and regulatory compliance ensures that businesses remain at the forefront of customer satisfaction and trust, positioning them favorably in an increasingly competitive market.

Leveraging Real-Time Verification for Improved Customer Satisfaction and Business Efficiency

In the current digital landscape, where user experience is paramount to success, real-time verification emerges as a pivotal tool for enhancing customer satisfaction and streamlining business operations. Identity proofing through advanced real-time solutions provides immediate confirmation of a customer’s identity, thereby eliminating delays that are often associated with traditional verification methods. This instantaneous capability not only accelerates the customer onboarding process but also significantly improves the overall user experience by minimizing wait times and reducing friction points. The integration of customer due diligence processes with these real-time verification systems allows for comprehensive risk assessment automation, ensuring that businesses can maintain stringent compliance standards without compromising on efficiency. These automated compliance checks are integral in delivering secure identity verification, which is crucial for maintaining trust and security within the digital ecosystem. By adopting instant verification solutions, companies can authenticate documents, verify identities, and perform necessary background checks with precision and speed, all of which contribute to a robust customer onboarding automation framework that fosters both customer satisfaction and business efficiency. This synergy between real-time identity proofing and automated compliance checks not only accelerates the initial engagement but also lays the groundwork for sustained customer relationships by setting a foundation of trust and reliability.

In today’s fast-paced digital landscape, the integration of real-time identity proofing stands as a pivotal advancement for businesses seeking to enhance their customer due diligence processes. The adoption of instant verification solutions, facilitated by advanced document verification and automated compliance checks, not only streamlines risk assessment automation but also fortifies secure identity verification. This fusion of technology and security ensures that customer onboarding is both efficient and effective, leading to higher conversion rates and improved retention. As businesses continue to prioritize user experience as a key differentiator, the implementation of these solutions will undoubtedly set a new standard for customer satisfaction and operational excellence in the digital realm.