Navigating the complexities of tax season can be a daunting task for many individuals and businesses alike. However, with the right guidance, preparing and filing taxes can be streamlined and stress-free. Our expert certified tax preparers specialize in Year-End Tax Planning, ensuring that you take advantage of all possible tax saving strategies. Whether you’re an individual or a corporation, our comprehensive services are designed to meet your unique needs, from basic filing assistance to advanced tax consulting for the most intricate financial situations. We are committed to optimizing deductions and staying abreast of the latest IRS updates, offering Taxpayer Relief Services when unforeseen issues arise. Our step-by-step guide on Income Tax Calculation demystifies the process, while our tailored Corporate Tax Solutions cater to businesses of all sizes. Let our professional tax advisors simplify your tax experience and provide guidance every step of the way.

- Maximizing Your Year-End Tax Planning with Expert Certified Tax Preparers

- Comprehensive Tax Saving Strategies for Individuals and Corporations

- Navigating Income Tax Calculation: A Step-by-Step Guide with Taxpayer Relief Services

- Advanced Tax Consulting Solutions for Complex Financial Situations

- Leveraging Deductions and Credits to Optimize Your Tax Return

- Staying Compliant with the Latest IRS Updates and Deadlines

- Corporate Tax Solutions: Tailored Approaches for Businesses of All Sizes

Maximizing Your Year-End Tax Planning with Expert Certified Tax Preparers

Engaging in year-end tax planning with our certified tax preparers is a proactive strategy to ensure your financial well-being. As the year draws to a close, it’s crucial to assess your financial situation and identify opportunities to minimize your tax liabilities. Our expert team specializes in Taxpayer Relief Services, offering tailored advice and strategic planning to optimize your income tax calculation outcomes. They meticulously analyze your fiscal position, considering every aspect from investment decisions to charitable contributions, to maximize deductions and credits. By leveraging our Tax Saving Strategies, you can navigate the complexities of tax laws with confidence, ensuring that you’re not paying more than necessary.

For those in the corporate sector, our Certified Tax Preparers provide comprehensive Corporate Tax Solutions that address the unique challenges of business taxation. We stay abreast of the latest IRS updates and changes in tax legislation to ensure your financial strategies are not only compliant but also positioned to take advantage of favorable tax conditions. Our aim is to streamline the tax filing process, alleviate the burden of tax compliance, and help you maintain a competitive edge in your industry. With our guidance, you can approach the new year with a clear understanding of your tax position, ready to implement effective Year-End Tax Planning measures that will secure your financial health and contribute to your long-term success.

Comprehensive Tax Saving Strategies for Individuals and Corporations

Engaging in year-end tax planning with our certified tax preparers can significantly enhance your financial position and alleviate the anxiety associated with tax season. Our comprehensive approach encompasses a thorough analysis of your personal or corporate finances to identify opportunities for tax savings. We leverage our expertise in income tax calculation to ensure you benefit from all available deductions, credits, and incentives, tailoring strategies to your unique situation. By anticipating changes in tax laws and IRS updates, our taxpayer relief services position you to optimize your financial outcomes while maintaining compliance.

For corporations, our strategic corporate tax solutions are designed to navigate the complexities of business taxation. We go beyond mere tax filing; we delve into the intricacies of your business structure, operations, and long-term objectives to craft personalized tax saving strategies that align with your economic goals. Our aim is to minimize your tax liability, improve cash flow, and enhance the overall financial health of your enterprise. With our proactive approach, you can rest assured that every legal dollar is retained within your business, and every compliance deadline is met with precision and expertise.

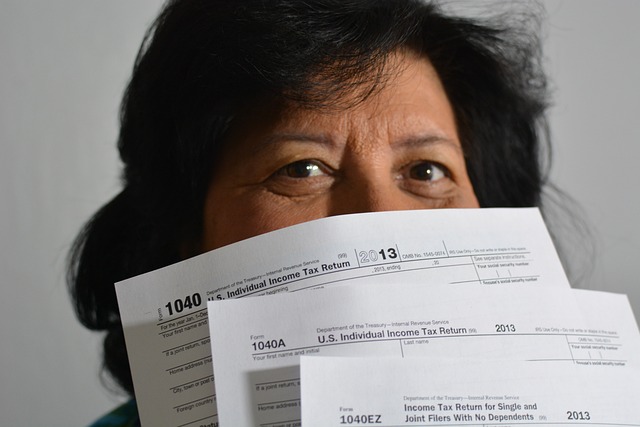

Navigating Income Tax Calculation: A Step-by-Step Guide with Taxpayer Relief Services

Navigating income tax calculation can be a complex task for many taxpayers, but with the right guidance, it doesn’t have to be a source of stress. Our year-end tax planning services are designed to help individuals and businesses anticipate and manage their tax liabilities effectively. By engaging our certified tax preparers, you gain access to personalized strategies tailored to optimize your financial position. We delve into every aspect of your finances, ensuring that all potential deductions and credits are considered to minimize your tax burden legally.

Our approach begins with a thorough analysis of your financial situation, followed by the development of a comprehensive plan that aligns with your specific needs. Our tax saving strategies are not merely reactive; they are proactive measures that keep you ahead of the curve, ensuring compliance with the latest IRS updates and regulations. For those facing unexpected challenges or changes in their financial status, our Taxpayer Relief Services offer timely assistance to alleviate the stress associated with tax-related issues. We strive to provide corporate tax solutions that are not only effective but also transparent, giving you peace of mind as you navigate the intricacies of income tax calculation. Our professional tax advisors are your partners throughout the process, offering guidance and support every step of the way.

Advanced Tax Consulting Solutions for Complex Financial Situations

Navigating the intricacies of complex financial situations requires a nuanced approach and a deep understanding of the tax code. Our Advanced Tax Consulting Solutions are tailored for individuals and businesses that face multifaceted tax challenges, offering Year-End Tax Planning to strategize well before the fiscal year concludes. Our certified tax preparers delve into intricate income tax calculations, ensuring each deduction is optimized to maximize savings. They leverage their expertise to craft personalized strategies that align with your financial goals, providing you with peace of mind and a solid foundation for financial stability.

For those encountering particularly demanding scenarios, our Taxpayer Relief Services are an invaluable resource. We address the unique challenges posed by corporate tax solutions, offering sophisticated analysis and innovative planning to manage complex tax obligations. Our consultants stay abreast of the latest IRS updates and guidelines, ensuring that your tax-saving strategies remain compliant and effective. With our guidance, you can confidently navigate the complexities of tax law, knowing that every effort is being made to secure your financial well-being and minimize your tax liabilities.

Leveraging Deductions and Credits to Optimize Your Tax Return

Engaging in year-end tax planning with our certified tax preparers can significantly impact the outcome of your tax return. By strategically leveraging deductions and credits, we ensure that every eligible expense is accounted for, from business-related costs to charitable contributions. Our taxpayer relief services are designed to navigate the complexities of the tax code, identifying opportunities for tax savings that align with your financial situation. We understand the importance of precise income tax calculation and remain updated with the latest IRS guidelines to avoid any pitfalls.

Our approach goes beyond mere filing; it’s a proactive strategy to optimize your tax position. Our team of seasoned professionals employs advanced tax consulting techniques tailored for both individuals and corporations. Whether you’re an entrepreneur or a small business owner, our corporate tax solutions are crafted to minimize your tax liability while maximizing your financial well-being. With our guidance, you can confidently approach the tax season, knowing that every possible tax-saving strategy has been thoughtfully implemented by experts in the field.

Staying Compliant with the Latest IRS Updates and Deadlines

Navigating the complexities of tax laws can be a daunting task for individuals and businesses alike. To maintain compliance with the intricate updates from the Internal Revenue Service, it is imperative to have access to up-to-date information and strategies tailored to your specific financial situation. Our year-end tax planning services are designed to align with the latest IRS guidelines, ensuring that your returns are not only accurate but also optimized for the best possible tax savings. Our certified tax preparers delve into the nuances of tax law to identify opportunities for deductions and credits that you might otherwise overlook. By leveraging their expertise, clients can confidently manage their income tax calculations and adhere to stringent deadlines without the stress often associated with tax season.

Furthermore, staying abreast of the ever-evolving tax landscape is a full-time commitment. Our team’s dedication to continuous education and professional development means that we are always equipped with the most current tax saving strategies. Whether you’re an individual looking for personalized taxpayer relief services or a corporate entity in need of sophisticated tax solutions, our advisors provide comprehensive support throughout the process. By entrusting your tax needs to our seasoned professionals, you can rest assured that your financial interests are safeguarded and that you are fully prepared to meet the challenges of the tax year ahead.

Corporate Tax Solutions: Tailored Approaches for Businesses of All Sizes

Our corporate tax solutions are meticulously designed to cater to businesses of all sizes, ensuring that each client receives a tailored approach to their unique tax challenges. We understand that effective year-end tax planning is pivotal for businesses aiming to minimize their tax liabilities and maximize their financial health. Our team of certified tax preparers employs sophisticated strategies that align with the latest IRS updates, ensuring compliance while navigating the complexities of income tax calculation. By leveraging our expertise, businesses can take proactive steps to optimize their tax position, capitalizing on legitimate deductions and credits.

We pride ourselves on offering comprehensive tax saving strategies tailored to each business’s individual circumstances. Our approach is not one-size-fits-all; instead, we delve into the specific financial intricacies of your company to devise a robust plan that addresses both current and future tax implications. Our commitment to staying abreast of tax laws and regulations allows us to provide timely and effective taxpayer relief services. Whether you’re a start-up or an established enterprise, our corporate tax solutions are crafted with the intention of alleviating the burden of tax compliance, so you can focus on what you do best – running your business.

Navigating the complexities of tax preparation and planning can be a daunting task for many. However, with our comprehensive suite of services designed to cater to both individuals and corporations, we transform this often-stressful process into a seamless experience. Our Certified Tax Preparers are adept at Year-End Tax Planning, ensuring that clients maximize their tax savings through strategic approaches outlined in our Corporate Tax Solutions and Tax Saving Strategies sections. We provide expert guidance on Income Tax Calculation with the added assurance of Taxpayer Relief Services for those who encounter challenges. Our commitment to staying abreast of the latest IRS updates and meeting all deadlines guarantees compliance and peace of mind. Trust our professional advisors to simplify your tax obligations and offer personalized support every step of the way, making tax season a less burdensome part of your financial management.