E-filing taxes has revolutionized the way individuals and businesses manage their fiscal responsibilities. With the advent of user-friendly online tax platforms, the intricacies of income tax e-filing are now within reach, offering a streamlined experience for easy tax filing. These digital solutions cater to a wide array of taxpayers, including the self-employed, providing comprehensive services from tax preparation online to submitting your online tax return with precision and efficiency. Enhanced by online tax calculators that estimate liabilities and potential refunds, e-filing has become synonymous with convenience, accuracy, and security. This article delves into the pivotal aspects of e-filing, guiding readers through mastering the process, navigating online tax forms for seamless self-assessment, and utilizing tax refund tracking tools for hassle-free financial management. Additionally, it emphasizes the importance of secure online tax filing practices, leveraging advanced encryption and authentication measures to protect sensitive information. Whether you’re self-employed or an individual taxpayer, this guide will equip you with the knowledge and resources necessary for optimizing your tax experience.

- Mastering Income Tax E-Filing: A Guide to Easy Tax Filing

- Navigating Online Tax Forms for Seamless Self-Assessment

- Utilizing Tax Refund Tracking Tools for Hassle-Free Financial Management

- Ensuring Secure Online Tax Filing with Advanced Encryption and Authentication Measures

- Leveraging Tax Filing Assistance: Resources for the Self-Employed

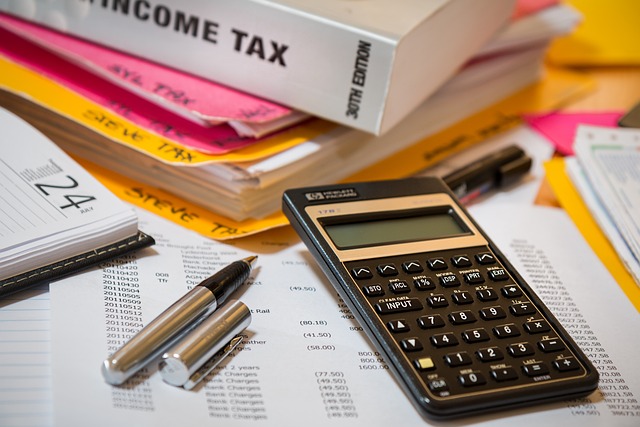

Mastering Income Tax E-Filing: A Guide to Easy Tax Filing

Mastering income tax e-filing can significantly streamline the process for individuals and self-employed taxpayers alike, offering a seamless transition from tax preparation to submission. The advent of online tax forms has made it easier than ever to navigate the complexities of tax season. Taxpayers can access a variety of user-friendly platforms that simplify the process by guiding them through each step, ensuring accuracy and completeness in their filings. These platforms are designed with intuitive interfaces that allow users to effortlessly input their financial data, calculate their liabilities, and estimate potential refunds using online tax calculators.

Furthermore, these income tax e-filing systems often provide tax filing assistance, helping users to understand and claim the appropriate tax deductions available to them. With the added convenience of tax refund tracking features, taxpayers can monitor the status of their returns with ease. Security is paramount in online transactions, and secure online tax filing protocols are in place to protect sensitive personal and financial information throughout the process. This not only safeguards your data but also instills confidence in the digital submission of your taxes. Whether you’re self-employed or an individual taxpayer, leveraging these e-filing solutions can optimize your tax experience, ensuring compliance with tax filing deadlines and providing a straightforward approach to fulfilling your tax obligations.

Navigating Online Tax Forms for Seamless Self-Assessment

With the advent of income tax e-filing, the process of self-assessment has become significantly easier and more efficient for taxpayers. Online tax forms are meticulously designed to guide individuals through each step of the tax preparation process, ensuring that even the most complex returns can be filed with ease. These digital forms are often structured in a user-friendly manner, allowing users to navigate through various sections such as income, deductions, and credits seamlessly. For the self-employed, this transition to digital has been particularly transformative, as it provides a platform where they can accurately report their business activities, expenses, and profits without the need for physical documentation or visits to tax professionals.

The convenience of easy tax filing extends beyond the initial submission; it also encompasses robust tools like online tax forms that assist in estimating liabilities and calculating potential refunds. Taxpayers can utilize these tools throughout the year, not just at tax time. Additionally, secure online tax filing ensures that sensitive financial information is protected. Tax refund tracking services are integrated into many platforms, providing real-time updates on the status of one’s return. This level of accessibility and transparency means tax filers can confidently manage their tax obligations with peace of mind. For those who require additional support, tax filing assistance is readily available online, offering guidance to navigate forms and ensure that all applicable deductions are considered for a more optimized tax experience.

Utilizing Tax Refund Tracking Tools for Hassle-Free Financial Management

When tax season arrives, individuals and self-employed tax filers alike seek out efficient and secure methods to manage their income tax e-filing obligations. Utilizing online tax forms has become synonymous with easy tax filing, as these digital resources streamline the entire process from preparation to submission. A pivotal tool within this ecosystem is the tax refund tracking feature, which allows filers to monitor the status of their returns post-submission. This real-time visibility into the processing of one’s tax return offers a level of financial management that was previously unattainable. The tax refund tracking system provides peace of mind by offering detailed updates and insights, effectively transforming the often stressful waiting period for a tax refund into an experience marked by transparency and convenience.

For those navigating self-employed tax filing, the advantages of secure online tax filing are particularly pronounced. These platforms are designed to cater to the unique needs of freelancers and entrepreneurs, offering tailored tax filing assistance that includes comprehensive tax preparation online services. The integration of tax refund tracking tools within these platforms means that individuals can effortlessly keep tabs on their returns while also leveraging sophisticated online tax forms to ensure accuracy and compliance with tax laws. The result is a simplified, hassle-free approach to managing one’s financial obligations, all under the security framework that online tax filing systems provide. This not only enhances the user experience but also reinforces the trust in digital platforms as a reliable means for handling tax matters.

Ensuring Secure Online Tax Filing with Advanced Encryption and Authentication Measures

In an era where digital transformation has reshaped financial management, income tax e-filing stands out as a testament to efficiency and convenience in handling tax obligations. The shift towards online platforms for easy tax filing has been embraced by individuals and self-employed taxpayers alike, owing to the seamless integration of user-friendly interfaces and automated tax calculation tools. These platforms are equipped with advanced encryption and authentication measures to ensure that sensitive financial data remains protected throughout the tax filing process. The utilization of robust security protocols, such as multi-factor authentication and end-to-end encryption, safeguards users’ personal information against unauthorized access, thus providing a secure online tax filing experience. Moreover, these platforms offer real-time tax refund tracking, allowing taxpayers to monitor the status of their returns with ease. Online tax forms are designed to be intuitive, guiding filers through each step, from calculating potential liabilities and identifying eligible tax deductions to finalizing and electronically transmitting their tax returns to the relevant authorities. For those who may require additional assistance, many online tax filing services provide support through virtual chat or phone, ensuring that tax filing assistance is readily available to navigate any complexities in self-employed tax filing or other tax situations. The integration of such comprehensive security features and user-centric design has made e-filing the preferred method for millions, as it not only streamlines the tax submission process but also instills trust in the digital handling of one’s financial obligations.

Leveraging Tax Filing Assistance: Resources for the Self-Employed

The digital transformation in income tax e-filing has been a boon for the self-employed, offering a suite of resources that simplify the often complex process of tax filing. Easy tax filing platforms are now equipped with intuitive interfaces and online tax forms tailored to freelancers and independent contractors. These platforms are designed to automate the calculations involved in self-employed tax filing, ensuring that every deductible expense is accounted for. With the advent of secure online tax filing systems, taxpayers can confidently submit their returns without the risk of paper filings getting lost in transit or being vulnerable to data breaches. The integration of online tax calculators and refund tracking tools within these platforms allows self-employed individuals to estimate their tax liabilities, understand their potential tax refunds, and monitor the status of their claims with ease. Additionally, many of these services offer free options, making tax filing assistance accessible to a broader range of taxpayers. By leveraging these digital resources, the self-employed can navigate their tax obligations with greater clarity and efficiency, ensuring they maximize their financial position while adhering to tax laws and deadlines.

Furthermore, the evolution of online tax filing has not only streamlined the process for the self-employed but also provided additional layers of support. Tax filing assistance, often available through live chat or customer service hotlines, ensures that any questions or uncertainties are swiftly addressed. These services often include step-by-step guides and FAQs to help users navigate through the online tax forms and understand the nuances of self-employed tax filing. The ability to prepare and file taxes electronically is a testament to the strides made in making tax compliance less daunting for those who work for themselves. With the combination of user-friendly software, comprehensive tax filing assistance, and the security of submitting returns online, the self-employed can manage their tax responsibilities with confidence and peace of mind.

Incorporating income tax e-filing into your fiscal management not only streamlines the process but also empowers taxpayers with easy tax filing options. By leveraging online tax forms and tax filing assistance resources, self-employed individuals can navigate their financial obligations with greater confidence and efficiency. The integration of tax refund tracking tools ensures a transparent and hassle-free experience in managing potential returns. With the robust security measures in place for secure online tax filing, individuals can trust that their sensitive information is protected throughout the process. Embracing these digital advancements, taxpayers can optimize their tax experience, meeting deadlines and maximizing deductions with ease. As e-filing continues to evolve, it stands as a testament to the digital revolution in personal finance management, offering a user-friendly and secure avenue for fulfilling income tax obligations.