Navigating the complexities of tax season can be a daunting task for many individuals. However, with the advent of income tax e-filing systems, the process has become increasingly streamlined and user-friendly. This article delves into how digital tax filing tools are revolutionizing the way we approach tax preparation, offering clear guidance, accurate online tax forms, and intuitive calculators to ensure precision in your filings. Discover how these resources can make your tax experience more accessible, with free options available for broader participation. Additionally, learn key strategies to maximize your returns by understanding tax deductions and staying on top of deadlines, leading to improved financial outcomes. Furthermore, gain insights into maintaining the security of your personal information when filing taxes online as a self-employed individual. Lastly, explore the advantages of utilizing online tax refund tracking systems for up-to-date statuses of your returns. With these digital tools at your disposal, tax season becomes less about the burden and more about the benefits.

- Simplifying Tax Season with Income Tax E-Filing: A Step-by-Step Guide to Easy Tax Filing

- Leveraging Online Tax Forms and Calculators for Precise and Efficient Tax Preparation

- Accessibility in Tax Filing: Free Online Tax Filing Options for a Wider Audience

- Maximizing Your Returns: Understanding Tax Deductions and Deadlines for Better Financial Outcomes

- Secure Online Tax Filing: Ensuring the Safety of Your Personal Information While E-Filing as a Self-Employed Individual

Simplifying Tax Season with Income Tax E-Filing: A Step-by-Step Guide to Easy Tax Filing

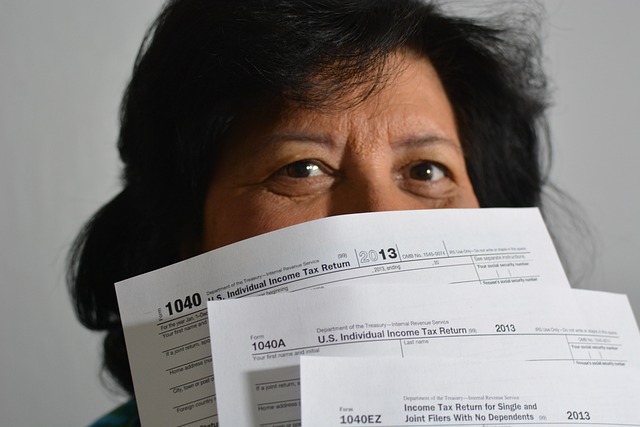

Income tax e-filing has revolutionized the way Americans approach tax season, simplifying what was once a complex and time-consuming task. The transition to digital tax filing through online platforms offers self-employed individuals and all taxpayers an intuitive, easy tax filing experience. With user-friendly interfaces, these e-filing systems guide users step by step, from gathering necessary information to completing and submitting their returns. Online tax forms are available at the click of a button, eliminating the need for physical copies and reducing clutter. These digital forms are designed with precision, ensuring accuracy and clarity in your tax filings. For those who qualify, there are free online tax filing options that make the process even more accessible. Moreover, these e-filing tools often include tax refund tracking features, allowing you to monitor the status of your return with ease. The security of your personal and financial information is paramount, and secure online tax filing protocols are in place to protect against unauthorized access and data breaches. This added layer of protection ensures that your sensitive data remains confidential throughout the process, giving you peace of mind as you navigate the complexities of tax season.

For those requiring additional assistance, many e-filing services offer support through online tax filing help centers or customer service teams. These resources can provide guidance on self-employed tax filing specifics, tax deductions, and credits, helping you to maximize your financial outcomes and ensure compliance with tax laws. With the deadlines for tax filing set in stone, utilizing these digital tools not only streamlines the process but also helps taxpayers avoid penalties by keeping track of important dates. The ease and efficiency of income tax e-filing make it an indispensable tool for anyone looking to manage their tax obligations with minimal stress and maximum precision.

Leveraging Online Tax Forms and Calculators for Precise and Efficient Tax Preparation

Income tax e-filing has revolutionized the way individuals and self-employed taxpayers approach tax season. With the advent of online tax forms, the once daunting task of tax preparation is now streamlined into an easy tax filing process. These digital forms are designed with clarity in mind, allowing users to fill out their financial information accurately without the risk of misinterpretation or errors that can come from paper-based returns. Online tax calculators further assist filers by providing precise calculations of potential refunds or tax liabilities, ensuring that each entry is accounted for and that the final figure reflects the true financial situation of the individual. For those who may have forgotten to include certain income sources or deductions during their self-employed tax filing, these tools can offer a second chance to review and adjust entries before submission, fostering confidence in the accuracy of their filings.

Moreover, the ease and accessibility of online tax filing are complemented by its security features. Secure online tax filing protocols protect personal and financial information from unauthorized access, giving peace of mind to users who might have hesitated to submit sensitive data over the internet in the past. Tax refund tracking services also add to the convenience, allowing filers to monitor the status of their returns with a few clicks, eliminating the need for constant communication with tax professionals or the Internal Revenue Service (IRS). This level of digital interaction not only simplifies the tax filing process but also enhances user experience by providing real-time updates and assistance when needed, making tax season more manageable than ever before.

Accessibility in Tax Filing: Free Online Tax Filing Options for a Wider Audience

The advent of income tax e-filing has revolutionized the way individuals and self-employed entities approach tax season. With the proliferation of user-friendly online tax preparation tools, taxpayers can navigate their financial obligations with unprecedented ease. These digital platforms offer a suite of services including step-by-step guidance through complex tax laws, online tax forms tailored to various income brackets and financial situations, and intuitive tax refund tracking systems that simplify the entire process. The inclusion of free online tax filing options has significantly broadened accessibility, allowing a wider audience to benefit from these services without incurring additional costs. This democratization of tax preparation not only caters to the less affluent but also supports the self-employed in managing their tax liabilities efficiently. Furthermore, secure online tax filing ensures that sensitive personal and financial information is protected, providing peace of mind while facilitating a more efficient process. These advancements in technology have made it possible for taxpayers to accurately and confidently submit their returns, optimizing their potential tax refunds and ensuring compliance with deadlines set by the tax authorities. As a result, e-filing has become a cornerstone for tax filing assistance, enhancing transparency and fostering a more streamlined approach to fulfilling tax obligations.

Maximizing Your Returns: Understanding Tax Deductions and Deadlines for Better Financial Outcomes

Engaging in income tax e-filing can be a prudent step for those looking to maximize their returns and ensure accurate filings. With easy tax filing platforms, self-employed individuals and taxpayers alike can navigate complex financial situations with online tax forms that simplify the process. These digital resources often include tax refund tracking features, allowing users to monitor their return status in real time. Understanding tax deductions is crucial for optimizing financial outcomes; taxpayers can leverage online tax calculators to estimate their potential savings and identify which deductions are most beneficial given their unique circumstances. Staying abreast of tax filing deadlines is equally important, as timely submissions can prevent penalties and ensure that any owed refunds are processed promptly. By utilizing these online tools, taxpayers can file their taxes with confidence, knowing that their information is protected through secure online tax filing systems designed to safeguard sensitive data. Tax filing assistance is readily available for those who need guidance, making the process more accessible and less daunting. With meticulous attention to detail and user-friendly interfaces, these platforms streamline the tax preparation process, making it easier for individuals to focus on maximizing their returns and achieving better financial outcomes.

Secure Online Tax Filing: Ensuring the Safety of Your Personal Information While E-Filing as a Self-Employed Individual

As self-employment continues to rise, the complexity of income tax e-filing for individuals who work for themselves necessitates robust and secure online systems. Unlike traditional paper filing, which can be prone to errors and security risks, online tax filing offers a streamlined process with built-in checks that ensure accuracy and completeness. For the self-employed, easy tax filing is complemented by user-friendly online tax forms designed to simplify the reporting of various income sources, deductions, and credits. These digital forms are not only convenient but also reduce the likelihood of human error, which can be costly for those managing their own finances.

Security in e-filing is paramount, as personal and financial information is particularly sensitive for self-employed individuals. Secure online tax filing employs state-of-the-art encryption and authentication measures to protect data integrity. The Internal Revenue Service (IRS) and authorized third-party providers implement these measures to safeguard your information throughout the e-filing process. With secure online tax filing, self-employed individuals can confidently submit their returns knowing that their personal and business details are protected against unauthorized access. Moreover, with tax refund tracking available online, there’s a heightened level of transparency and control over the status of one’s return, further enhancing the security and efficiency of the digital tax filing system for those who are self-employed.

In conclusion, the advent of income tax e-filing has revolutionized the way taxpayers, particularly self-employed individuals, approach tax season. The availability of easy tax filing through user-friendly online tools and comprehensive tax forms simplifies the process, making it more accessible to a diverse range of filers. With free options and precise tax calculators at one’s disposal, individuals can navigate their tax obligations with confidence, ensuring they maximize their returns and meet critical deadlines for better financial outcomes. Moreover, the enhanced security measures in place during secure online tax filing offer peace of mind to those concerned about personal data protection. This transition underscores the importance of embracing digital advancements in tax preparation, providing valuable tax filing assistance that streamlines the process without compromising on accuracy or safety.