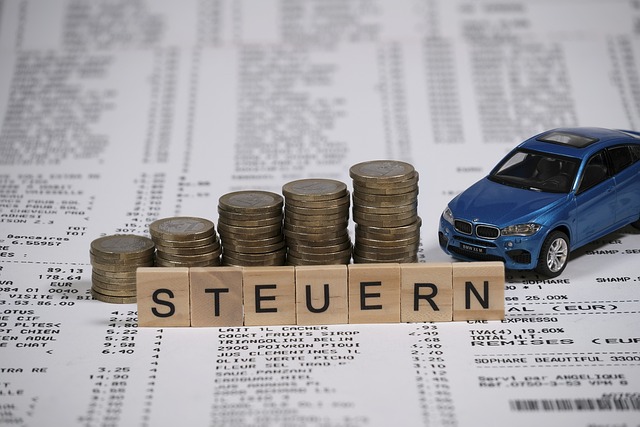

When it comes to the backbone of timely delivery services, businesses rely on well-orchestrated logistics and robust fleet management. A pivotal component of this operation is securing appropriate Business Van Insurance coverage, which acts as a safeguard against potential setbacks. This article delves into the critical aspects of Fleet Van Insurance, Commercial Vehicle Insurance, and Van Liability Insurance for Courier and Delivery Services, guiding businesses on how to navigate the complexities of insurance tailored to their needs. We’ll explore cost-effective solutions like Cheap Commercial Van Insurance while maintaining high coverage standards, ensuring your delivery operations stay protected against a myriad of risks. Whether you manage a small business or a larger fleet, understanding the unique benefits of Courier Van Insurance and Delivery Van Insurance Coverage is paramount for operational resilience and business continuity.

- Navigating the Roads of Commerce: The Necessity of Business Van Insurance for Delivery Operations

- Comprehensive Coverage: Understanding Fleet Van Insurance and Its Role in Protecting Your Delivery Business

- Tailored Protection: Exploring Commercial Vehicle Insurance Options for Diverse Delivery Needs

- Safeguarding Your Small Business: The Advantages of Van Liability Insurance in Courier and Delivery Services

- Budget-Friendly Security: How to Find Affordable Commercial Auto Insurance for Vans Without Compromising on Coverage

Navigating the Roads of Commerce: The Necessity of Business Van Insurance for Delivery Operations

Navigating the complexities of commerce, delivery operations face a myriad of risks on the road. To safeguard these critical business functions, Business Van Insurance emerges as an indispensable safeguard. This specialized coverage extends beyond mere vehicle protection; it encompasses Fleet Van Insurance, Commercial Vehicle Insurance, and tailored Van Liability Insurance policies designed for the demands of delivery services. These insurance solutions are meticulously crafted to address the vulnerabilities inherent in transporting goods, offering robust Van Insurance for Small Businesses against collision, theft, or damage. They also provide essential coverage for drivers and cargo, ensuring that operations continue uninterrupted even in the face of unexpected events. For small business owners, the benefits of such comprehensive protection cannot be overstated, as it serves as a financial buffer against potential liabilities.

In the competitive landscape of commercial transportation, securing Cheap Commercial Van Insurance without compromising on coverage is a strategic advantage. Commercial Auto Insurance for Vans, including Courier Van Insurance and Delivery Van Insurance Coverage, is pivotal in this regard. It not only mitigates the financial impact of accidents but also ensures that businesses adhere to legal requirements while offering flexibility to adapt to the specific needs of different delivery fleets. This coverage is not just a legal necessity but a critical component for maintaining the trust of customers and the stability of operations, allowing businesses to navigate the roads of commerce with confidence and peace of mind.

Comprehensive Coverage: Understanding Fleet Van Insurance and Its Role in Protecting Your Delivery Business

When operating a delivery business, securing comprehensive coverage through fleet van insurance is a critical step in safeguarding your operations. Business van insurance, specifically tailored for such enterprises, encompasses commercial vehicle insurance and courier van insurance, offering robust protection for your vehicles and the goods they carry. This type of insurance goes beyond basic policy offerings by providing van liability insurance that shields your business from third-party claims arising from accidents or damages caused by your fleet. It’s an indispensable form of commercial auto insurance for vans, ensuring that you can navigate the logistical demands of deliveries without the added burden of financial repercussions in the event of unforeseen incidents.

Choosing the right van insurance for small businesses is paramount, and fleet van insurance stands out as a cost-effective solution for companies with multiple vans. This coverage not only protects your vehicles but also the diverse operations they support. With delivery van insurance coverage, you can rest assured that your business’s operational continuity is protected against potential liabilities, whether it be due to vehicle breakdown, theft, or accidental damage. Moreover, seeking out cheap commercial van insurance without compromising on coverage can provide a competitive edge, allowing businesses to allocate savings towards other critical areas of their operations. This comprehensive approach to fleet van insurance ensures that your delivery business is well-equipped to handle the complexities of the road and the dynamic nature of the delivery industry.

Tailored Protection: Exploring Commercial Vehicle Insurance Options for Diverse Delivery Needs

When it comes to safeguarding your delivery business, tailored protection through commercial vehicle insurance is paramount. Business van insurance, specifically designed for delivery operations, ensures that your fleet is covered against a multitude of risks, from minor accidents to extensive damage or theft. This type of insurance is not one-size-fits-all; it’s crafted to meet the diverse needs of businesses ranging from small local courier services to larger fleets operating across different regions. For instance, fleet van insurance is an excellent option for companies with multiple vehicles, offering comprehensive coverage that can be tailored to each vehicle’s specific role in your delivery process. It includes van liability insurance, which addresses the financial repercussions of third-party claims, and van insurance for small businesses, providing a safety net that allows your operation to continue without major interruptions.

Investing in cheap commercial van insurance is a strategic decision that can protect your bottom line while still offering robust coverage. Commercial auto insurance for vans goes beyond basic policy requirements, often including additional benefits such as replacement vehicle cover or goods in transit protection. Courier van insurance and delivery van insurance coverage are specifically tailored to the demands of the delivery industry, ensuring that no matter the size or scale of your operation, you’re equipped with the right level of insurance. This not only protects your business from potential financial strain but also provides peace of mind, allowing you to focus on delivering exceptional service to your customers. With a range of options from comprehensive coverage to more cost-effective solutions, businesses can select the commercial vehicle insurance that aligns with their specific operational needs and budget constraints. It’s essential to work with an insurance provider who understands the intricacies of the delivery sector and can offer tailored advice on the best insurance solutions to secure your business against the unpredictable nature of deliveries.

Safeguarding Your Small Business: The Advantages of Van Liability Insurance in Courier and Delivery Services

When it comes to safeguarding your small business in the courier and delivery sector, investing in comprehensive van liability insurance is a prudent step. Business van insurance tailored for couriers and delivery services provides robust protection against liabilities and damages that can arise from road accidents or incidents while delivering goods. This coverage is indispensable, as it not only safeguards your vehicles but also offers financial security against third-party claims for property damage or personal injury. With fleet van insurance, small businesses can insure multiple vehicles under one policy, ensuring efficient management and cost savings. This type of commercial vehicle insurance is designed to accommodate the dynamic nature of delivery operations, offering flexibility to add or remove vehicles as your business grows or contracts.

Investing in van liability insurance for small businesses is a strategic decision that extends beyond mere compliance with legal requirements; it’s about securing peace of mind. Van insurance for small businesses can be customized to include comprehensive coverage, protecting against theft, fire, and other unforeseen events that could disrupt your operations. Moreover, seeking out cheap commercial van insurance without compromising on quality is possible by comparing quotes from different providers. Commercial auto insurance for vans can be tailored to your specific needs, ensuring that you’re not overpaying for coverage you don’t require, while also having the necessary protection in place when needed. Courier van insurance and delivery van insurance coverage are critical components of risk management, contributing to a resilient business model that can withstand the challenges inherent in the delivery industry.

Budget-Friendly Security: How to Find Affordable Commercial Auto Insurance for Vans Without Compromising on Coverage

When it comes to safeguarding your delivery operations, securing comprehensive business van insurance is a prudent step. For small businesses and fleets alike, finding affordable commercial auto insurance for vans is a critical aspect of risk management. It’s not always about spending the most; it’s about getting the right coverage at a price that keeps your budget intact without compromising on the essential protections you need. Van liability insurance is a cornerstone of this coverage, as it shields your business from third-party claims arising from accidents or damages caused by your delivery vans.

To ensure your van insurance for small businesses remains cost-effective while still being robust, consider the following strategies: first, evaluate different insurers to compare quotes and policies. This due diligence can yield significant savings without sacrificing coverage quality. Secondly, opt for higher deductibles if your business can handle out-of-pocket expenses in the event of a claim, as this can lower premiums. Additionally, fleet van insurance can be more economical than insuring each vehicle individually because it consolidates your assets under one policy, often leading to better rates. Finally, ensure that your commercial vehicle insurance is tailored to the specific risks associated with your delivery services. This includes considering the value of the goods being transported, the locations you’re delivering to, and the driving habits of your employees. With careful planning and comparison shopping, you can secure cheap commercial van insurance that provides the comprehensive coverage your business needs to thrive without breaking the bank. Courier van insurance and delivery van insurance coverage are not just about legal compliance; they’re about peace of mind and financial security for your operations on the road.

In conclusion, as businesses in the delivery sector continue to navigate the dynamic demands of commerce, securing robust business van insurance is a prudent step towards safeguarding operations and financial stability. Fleet van insurance and commercial vehicle insurance offer tailored protection that addresses the unique risks inherent in transporting goods, ensuring peace of mind for small business owners. By investing in appropriate van liability insurance, courier and delivery services can mitigate potential liabilities and damages, allowing for seamless delivery operations even in the face of unforeseen events. Entrepreneurs are advised to explore a range of options for commercial auto insurance for vans to find cost-effective solutions that do not compromise on coverage, thereby protecting their business assets without overextending their budgets. With the right van insurance in place, businesses can confidently manage their delivery operations, knowing they are equipped to handle whatever the road ahead may bring.