Notary publics serve a critical role in the verification and authenticity of documents, ensuring their integrity for legal, commercial, and personal transactions. While the vast majority of notaries perform their duties with utmost care, the potential for human error cannot be overstated. Such oversights, though sometimes minor, can lead to significant legal repercussions, exposing notaries to claims of malpractice and the attendant financial burdens. This article delves into the importance of Liability Insurance as a shield against such risks, highlighting its role in protecting notaries’ professional integrity. We will explore Notary Responsibilities, the intricacies of Notarial Acts, and the legal liability implications they carry. Furthermore, we will discuss how E&O Insurance is pivotal in navigating the complex landscape of Notary Law and Ethics, ensuring that notaries can fulfill their duties without undue worry about potential claims. Understanding these aspects is crucial for notaries to operate with confidence and adherence to best practices, thereby safeguarding their professional standing.

- Understanding Notary Malpractice Risks and Consequences

- The Role of Errors and Omissions Insurance in Protecting Notaries

- A Closer Look at Notarial Acts and Legal Liability Implications

- Navigating Notary Responsibilities, Duties, Law, and Ethics with E&O Insurance

Understanding Notary Malpractice Risks and Consequences

Notaries public play a critical role in the legal system by witnessing and certifying the authenticity of documents, ensuring that individuals’ intentions are accurately reflected in written form. However, this responsibility comes with inherent risks. Understanding notary malpractice risks and consequences is essential for notaries to operate within the bounds of their professional duties. A notary’s liability can be triggered by an array of errors during notarial acts, ranging from administrative oversights, such as improperly completing documentation, to more significant lapses, like failing to verify the identity of a signer or administering an oath incorrectly. These mistakes can lead to legal liability, where a claimant may allege that the notary’s conduct was negligent or unethical, resulting in financial harm. In such cases, Notary Law is explicit about the standards of care and conduct expected from notaries.

To safeguard against the potential fallout from notary claims, obtaining Liability Insurance, specifically Errors and Omissions (E&O) insurance, is a prudent step for any notary. This type of insurance is tailored to cover the costs associated with legal defense fees and settlements or judgments that arise when a claim is made against a notary. It serves as a critical financial buffer, ensuring that even if an error occurs during document certification or other professional duties, the notary’s personal and financial well-being remains intact. E&O insurance underscores a notary’s commitment to upholding notary ethics and maintaining compliance with legal standards. It demonstrates a proactive approach to risk management, reinforcing the notary’s dedication to their profession and providing peace of mind that they are prepared for any unforeseen circumstances arising from their notarial acts.

The Role of Errors and Omissions Insurance in Protecting Notaries

Notary malpractice is an area of professional liability that can have severe repercussions for notaries who provide incorrect or incomplete notarial acts. The role of Errors and Omissions (E&O) insurance within this context is critical, as it offers a safety net to notaries facing claims of negligence or misconduct during the performance of their duties. E&O insurance is specifically designed to cover legal fees, court costs, and settlements that arise from such claims. This type of liability insurance is an essential component for notaries, ensuring they are financially protected against the potential fallout from errors in document certification or other responsibilities entrusted to them under notary law.

The protection afforded by E&O insurance underscores the importance of adhering to notary responsibilities and ethics. It is a reflection of the professional standards expected within the field of notarial services, which are governed by stringent legal regulations. Notaries must navigate the intricacies of notarial acts with precision, as even minor oversights can lead to significant legal liability. The insurance serves as a testament to the notary’s commitment to upholding the integrity of document certification and maintaining compliance with the law. By carrying E&O insurance, notaries demonstrate their dedication to fulfilling their professional duties in a manner that is both responsible and protective of the individuals or entities relying on their services.

A Closer Look at Notarial Acts and Legal Liability Implications

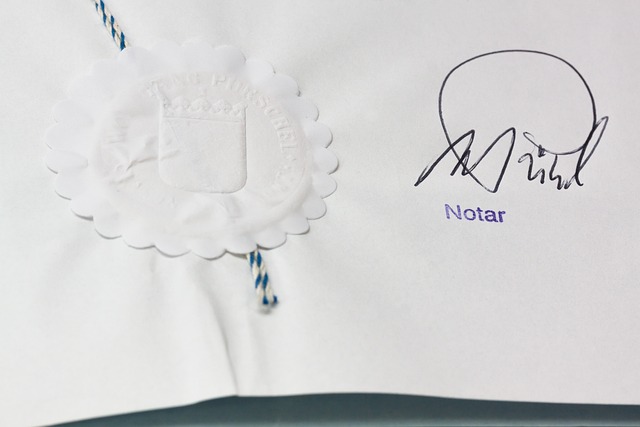

Notarial acts are formal acts performed by a notary public that authenticate the identity of the individuals who appear before them and attest to the validity of signatures on various documents. These acts, which include document certification, affirmations, jurats, and acknowledgments, are integral to the legal system, as they provide assurance that the parties involved in a transaction have been properly identified and that the document’s contents have been voluntarily executed. However, the gravity of these acts necessitates a high standard of professionalism and accuracy from notaries. Any lapse in diligence or oversight during a notarial act can expose a notary to legal liability. Such errors may lead to accusations of notary misconduct or negligence, which can result in significant repercussions including financial loss, reputational damage, and disciplinary action. In the event of a claim against a notary, whether groundless or substantiated, Legal Liability Insurance serves as a vital safeguard. It offers coverage for both the legal defense costs and any potential settlements or damages awarded against the notary. This form of Liability Insurance is indispensable for notaries, ensuring that they can fulfill their Notary Responsibilities without undue fear of the economic impact of unforeseen errors. It underscores the importance of adhering to Notary Law and upholding Notary Ethics, as it directly relates to the ability to perform Notary Duties with confidence and professionalism. By securing this coverage, notaries demonstrate their commitment to their role within the legal framework and their dedication to serving the public with integrity.

Navigating Notary Responsibilities, Duties, Law, and Ethics with E&O Insurance

Notaries public play a critical role in the authenticating and certifying documents, which are integral to a wide array of legal and commercial transactions. The responsibilities and duties they undertake must be executed with precision and adherence to notary law, which includes strict ethical standards. Navigating this landscape without adequate liability insurance can expose notaries to significant risks. E&O insurance is a vital tool in the professional arsenal of a notary, offering protection against legal liability that may arise from errors or omissions during notarial acts. This coverage extends to various scenarios where a document’s integrity could be compromised due to a notary’s oversight, misstatement, or failure to follow proper procedures. For instance, if a notary fails to verify the identity of a signatory effectively, leading to disputes over the authenticity of a document, E&O insurance can shield them from the financial repercussions of subsequent legal challenges. It is not just a safeguard but also a means for notaries to operate with confidence, knowing that they have a financial safety net in place. This allows them to focus on upholding their duties and responsibilities, including maintaining accurate records, ensuring the proper administration of oaths or affirmations, and fulfilling all legal requirements associated with document certification. With E&O insurance, notaries can navigate the complex terrain of notary law and ethics more securely, reducing the potential for claims against them and providing a mechanism to address notary claims that may arise from allegations of negligence or misconduct. This insurance is not just an optional add-on but an essential aspect of a responsible notary’s professional practice. It underscores a commitment to upholding the highest standards in document certification and maintaining public trust in the notarization process.

Notary malpractice, while infrequent, can have far-reaching repercussions, underscoring the importance of stringent professional practices and robust liability insurance. A single oversight in notarial acts can lead to substantial legal complications for notaries, potentially resulting in costly litigation. To safeguard against such eventualities, Errors and Omissions (E&O) insurance is a critical tool for notaries, offering protection from the financial burdens of claims alleging negligence or improper conduct during document certification and other professional duties. This coverage not only shields individual notaries but also reinforces adherence to notary laws and ethics, ensuring that their vital services are delivered with due diligence and within legal parameters. Consequently, investing in E&O insurance is a testament to a notary’s commitment to upholding their responsibilities and duties, thereby significantly reducing the inherent risks associated with their profession.