When disaster strikes and your home becomes uninhabitable, the disruption to your daily life can be profound. Fortunately, comprehensive personal property coverage within homeowners or renters insurance policies often includes a critical provision known as loss of use coverage. This coverage is designed to alleviate the financial strain associated with additional living expenses incurred when you must temporarily relocate due to property damage from covered perils. This article delves into the essentials of loss of use insurance, guiding homeowners and renters alike on how to navigate this aspect of their policies, understand what is covered, explore temporary housing solutions, and effectively file claims. From safeguarding your personal belongings to maximizing your coverage for both structure and contents, we’ll provide valuable insights to ensure you are well-prepared should you face such an eventuality.

- Navigating Home Disruption: The Role of Loss of Use Coverage in Personal Property Insurance

- Understanding Your Policy: What Loss of Use Insurance Covers for Homeowners and Renters

- Temporary Housing Solutions: How Loss of Use Insurance Supports Additional Living Expenses

- Key Considerations When Filing a Loss of Use Claim

- The Intersection of Personal Property Coverage and Loss of Use Benefits

- Maximizing Your Homeowners or Renters Insurance: Tips for Utilizing Property Damage Protection and Replacement Cost Insurance

- Beyond Structural Damage: Liability Coverage and Protecting Your Personal Belongings During Displacement

Navigating Home Disruption: The Role of Loss of Use Coverage in Personal Property Insurance

When unforeseen events such as fires, natural disasters, or other covered perils render your home uninhabitable, personal property coverage within homeowners or renters insurance becomes a critical safeguard. This coverage not only protects your personal belongings but also offers loss of use insurance, which is pivotal when facing home disruption. Loss of use coverage is designed to mitigate the financial strain that comes with temporary living arrangements. It helps reimburse additional living expenses incurred due to necessary relocation, including costs associated with hotel stays, extended stays with friends or family, or temporary rental properties. This provision ensures policyholders have access to appropriate housing while their primary residence undergoes repairs or restoration, thus preventing a sudden financial burden during an already stressful period.

Property damage protection under your homeowners or renters insurance is tailored to address such scenarios, providing the necessary financial support to maintain a level of normalcy amidst disruption. It’s important for policyholders to understand the scope of their loss of use coverage within their personal property insurance, as this will vary depending on the specific terms of the policy. This includes knowing the daily or total limit for reimbursement and what documentation is required to substantiate these additional living expenses. Additionally, replacement cost insurance can be a valuable component, ensuring that you are compensated for the current value of your lost home rather than its depreciated value. Loss of use coverage complements this by ensuring that policyholders do not have to compromise on their living conditions during the recovery process. Furthermore, liability coverage within these policies can provide an additional layer of protection should there be any legal liabilities arising from the incident that rendered your home uninhabitable. Understanding all aspects of your personal property insurance is essential to ensure you are fully protected in the event of a loss.

Understanding Your Policy: What Loss of Use Insurance Covers for Homeowners and Renters

When disaster strikes and your home is rendered uninhabitable due to a covered event such as a fire or storm, personal property coverage within your insurance policy can be a lifeline. Homeowners and renters alike often have loss of use insurance, which is designed to help cover additional living expenses incurred when you must temporarily relocate. This can include the costs associated with staying in a hotel, renting an apartment, or even boarding with family or friends until your home is habitable again. It’s crucial for policyholders to understand the extent of their loss of use coverage, as it can significantly alleviate the financial strain during an already stressful time. For homeowners, this aspect of insurance is particularly important, as it complements property damage protection by ensuring that you have a place to stay while your home is being repaired. Similarly, renters’ insurance also provides this coverage, safeguarding your living situation even when the physical space is compromised.

Replacement cost insurance plays a pivotal role in loss of use scenarios, as it ensures that you are reimbursed for the current cost to replace your personal belongings, rather than their depreciated value. Additionally, liability coverage within your policy can provide financial protection if someone is injured on your property while it’s uninhabitable, and you’re responsible for their care. It’s essential to carefully review your insurance documents to fully grasp what’s included under loss of use, as terms and coverage limits can vary between policies. By doing so, you can rest assured knowing that if the unexpected happens, you have a safety net for more than just your physical property; your living circumstances are also protected.

Temporary Housing Solutions: How Loss of Use Insurance Supports Additional Living Expenses

When a covered peril renders your home uninhabitable, loss of use insurance within your homeowners or renters insurance policy serves as a critical safety net. This coverage is designed to support additional living expenses, which encompass costs associated with temporary housing solutions such as hotels, short-term rentals, or extended stays with family or friends. Understanding the scope of your personal property coverage within this context is crucial, as it often includes loss of use provisions that help mitigate the financial strain caused by unexpected displacement. Homeowners and renters insurance policies with property damage protection can provide reimbursement for the extra costs incurred during the interim period when your primary residence is under repair. This ensures that policyholders are not left without a roof over their heads or faced with daunting out-of-pocket expenses at a time when they are already dealing with the stress of property damage.

Furthermore, replacement cost insurance, which is distinct from actual cash value coverage, ensures that you are reimbursed for the cost to replace your personal belongings without deductions for depreciation. This aspect of your policy works in tandem with loss of use insurance, offering comprehensive support. It’s important to note that the specifics of these coverages can vary by insurer and policy, so it’s advisable to review your individual policy details or consult with your insurance provider to fully understand the extent of your liability coverage and how it interacts with loss of use provisions. This proactive approach can provide peace of mind, knowing that you have a robust financial buffer in place for temporary housing solutions when facing property damage.

Key Considerations When Filing a Loss of Use Claim

When your home is rendered uninhabitable by a covered event such as a fire or natural disaster, filing a loss of additional living expenses claim is crucial for mitigating the impact on your daily life. Personal property coverage within homeowners or renters insurance often includes loss of use insurance, which provides reimbursement for the extra costs incurred due to temporary relocation. It’s important to review your policy details to understand the specific coverage limits and the process for filing a claim. Homeowners should verify whether their policy covers the full replacement cost of their dwelling, including personal belongings, or if it is based on actual cash value. Renters, on the other hand, should ensure their policy explicitly includes loss of use coverage, as some policies may only offer this as an add-on or endorsement.

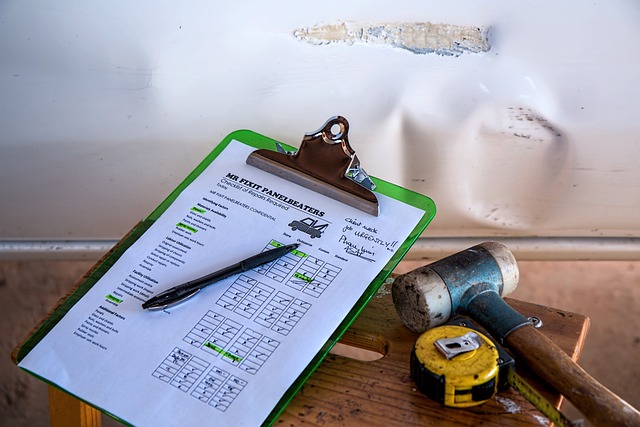

Property damage protection under loss of use insurance typically covers the additional housing expenses accrued while your primary residence is being repaired. This can include the cost of hotels, short-term leases, or even increased utility costs if your temporary living situation requires more energy consumption. To leverage this coverage effectively, document all additional living expenses meticulously, keeping receipts and tracking all temporary housing costs. It’s advisable to report the loss promptly to your insurance provider, as some policies have time-sensitive reporting requirements. Additionally, ensure that you understand any sublimits or caps on loss of use coverage so there are no surprises during the claims process. Liability coverage may also play a role if the damage to your home was caused by a covered liability incident, ensuring comprehensive financial protection in the wake of property damage.

The Intersection of Personal Property Coverage and Loss of Use Benefits

When disaster strikes and your home is rendered uninhabitable by a covered peril, such as a fire or natural disaster, personal property coverage within homeowners or renters insurance becomes paramount. This aspect of insurance not only compensates for the damage to your personal belongings but also intersects with loss of use benefits, which are designed to cover additional living expenses incurred when you must temporarily relocate. These expenses can include costs associated with hotels, short-term rentals, or even meals and transportation if your permanent residence is unavailable. Loss of use insurance, a critical component of comprehensive property damage protection, steps in to provide financial support during this transitional period, ensuring that policyholders are not left without shelter or facing mounting bills for temporary housing.

Understanding the relationship between personal property coverage and loss of use benefits is crucial for policyholders. While replacement cost insurance covers the cost to replace your personal belongings with new items of similar kind and quality, loss of use insurance helps mitigate the financial strain of relocation by reimbursing you for the increased expenses you face while your primary residence is being repaired. This dual protection is particularly valuable, as it addresses both the tangible losses of your possessions and the intangible comfort of having a roof over your head during uncertain times. Both homeowners and renters insurance policies can offer these protections, but it’s essential to review your policy details carefully to fully understand the coverage limits and the claims process for personal property and loss of use.

Maximizing Your Homeowners or Renters Insurance: Tips for Utilizing Property Damage Protection and Replacement Cost Insurance

When your personal property is damaged or destroyed by a covered peril, maximizing your homeowners or renters insurance can provide significant financial relief. Understanding and utilizing your personal property coverage within these policies is crucial for ensuring that your belongings are adequately protected. This coverage typically compensates you for the value of your personal belongings at the time of loss, minus any deductible. To fully leverage this aspect of your policy, maintain an up-to-date inventory of your possessions, including receipts and photographs when possible, as this will expedite the claims process. Additionally, familiarize yourself with the replacement cost insurance provision. Unlike actual cash value that accounts for depreciation, replacement cost insurance covers the cost to replace your property with new items of similar kind and quality without deducting for depreciation.

In the event that your dwelling becomes uninhabitable, loss of use insurance kicks in to help cover additional living expenses. This is where personal property coverage intersects with loss of use coverage: not only does it protect your belongings, but it also ensures you have a place to live while repairs are underway. Ensure that your policy includes adequate loss of use coverage, and consider the potential duration you might need alternative housing to accurately assess the limits you purchase. Beyond material possessions, homeowners and renters insurance also typically include liability coverage, which protects you financially if someone is injured on your property and decides to sue you. This comprehensive protection ensures that whether it’s your personal property, your living space, or your legal well-being, you’re covered. Always review your policy annually to ensure it aligns with your current needs and to make any necessary adjustments, especially as the value of your belongings or your living situation changes.

Beyond Structural Damage: Liability Coverage and Protecting Your Personal Belongings During Displacement

When your residence suffers damage from a covered peril beyond mere structural integrity—such as a catastrophic event that renders it uninhabitable—your personal property coverage within homeowners or renters insurance becomes paramount. This aspect of your policy is designed to protect not just the structure of your home but also your personal belongings. In the event of displacement, your personal belongings insurance ensures that the items you hold dear are safeguarded from potential further damage or theft while your home undergoes repairs. Additionally, it’s crucial to consider liability coverage as part of your homeowners insurance. This coverage extends beyond the physical confines of your abode, offering protection even when you’re temporarily residing elsewhere. Should an incident occur at a temporary dwelling, such as a hotel or with a relative, liability coverage can help mitigate the financial impact of any third-party claims for bodily injury or property damage that may arise. Thus, both personal property coverage and liability coverage are integral components of your insurance portfolio, safeguarding your possessions and offering peace of mind during what could be a tumultuous time of displacement and repair. With the right insurance in place, you can navigate the complexities of property damage protection and replacement cost insurance with confidence, knowing that your personal belongings are protected, regardless of your living situation. Loss of use insurance, specifically designed to cover additional living expenses during such events, complements these coverage types, ensuring that you have a safety net for both your home and your lifestyle in the face of unexpected upheavals.

When a covered peril renders your home temporarily uninhabitable, the security provided by personal property coverage within your homeowners or renters insurance becomes paramount. This comprehensive protection not only safeguards your belongings but also includes loss of use coverage, an essential component that helps mitigate the financial strain associated with temporary housing solutions. Understanding the scope of your policy, especially in terms of additional living expenses and replacement cost insurance, is crucial for navigating home disruption without undue hardship. For both homeowners and renters, this insurance serves as a safety net, ensuring that your personal belongings are protected even when you’re away from your primary residence. Loss of use insurance is a testament to the foresight of insurers in addressing the myriad challenges that come with property damage protection. By maximizing these benefits and considering liability coverage, policyholders can approach such disruptive events with confidence, knowing they have robust personal property coverage and support throughout the recovery process.