Effective wealth preservation hinges on a nuanced understanding and strategic management of capital gains. As investors navigate the complexities of asset appreciation and market fluctuations, the ability to mitigate taxes becomes pivotal in safeguarding financial legacies. This article explores the intricate relationship between capital gains tax strategies and the broader scope of wealth preservation. By delving into year-end tax planning, maximizing tax deductions, and leveraging tax-deferred investments, investors can optimize their portfolios and enhance their long-term financial security. Entrepreneurs stand to benefit significantly from understanding the tax benefits available to them, ensuring that their business ventures not only prosper but also contribute to their legacy in a tax-efficient manner. Additionally, retirement tax planning and advanced tax minimization techniques are essential components for protecting and transferring family wealth seamlessly across generations. This comprehensive guide aims to provide actionable insights into each of these critical areas, enabling readers to make informed decisions that align with their financial goals.

- Optimizing Capital Gains Management for Wealth Preservation and Tax Efficiency

- Strategic Year-End Tax Planning to Enhance Investment Portfolios

- Leveraging Tax Benefits for Entrepreneurs and Maximizing Deductions for Retirement Planning

Optimizing Capital Gains Management for Wealth Preservation and Tax Efficiency

Entrepreneurs can significantly enhance their wealth preservation and ensure tax efficiency by optimizing capital gains management. Strategic selling of business assets at a lower tax rate through year-end tax planning can yield substantial tax benefits for entrepreneurs. By carefully timing the realization of capital gains, entrepreneurs can align with favorable tax brackets, thereby reducing their overall tax liability. This proactive approach to capital gains management allows for the reinvestment of proceeds into tax-deferred investments, which can compound growth and preserve wealth over time.

In addition to strategic selling, retirement tax planning is another critical component in managing capital gains for long-term financial security. Maximizing tax deductions through charitable contributions or other deductible expenses at year-end can offset capital gains income, thereby minimizing taxes owed. Furthermore, utilizing tax minimization techniques such as trusts, gifting strategies, and retirement accounts can shield a portion of one’s wealth from capital gains taxes. These methods are integral to preserving wealth across generations, ensuring that the benefits of smart capital gains management extend beyond an individual’s lifetime. With careful planning and a comprehensive understanding of tax laws, investors can effectively navigate the complexities of capital gains taxation, safeguarding their financial legacy while optimizing for tax efficiency.

Strategic Year-End Tax Planning to Enhance Investment Portfolios

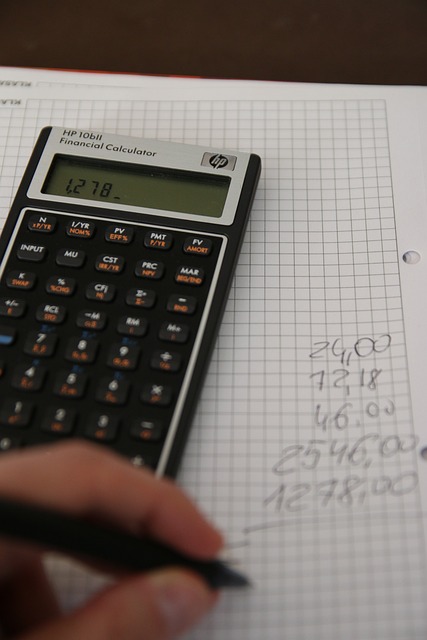

Year-end tax planning is a strategic financial exercise that entrepreneurs and investors should undertake to optimize their investment portfolios and enhance tax benefits. By carefully analyzing past performance data, investors can identify assets with unrealized capital gains or losses and strategically realize losses before year-end to offset taxes on capital gains, thereby reducing their overall tax liability. This practice of “tax-loss harvesting” is a key component of year-end tax planning, allowing for the preservation and growth of wealth by deferring taxes on capital gains.

In addition to loss harvesting, entrepreneurs can leverage various income tax reduction techniques to maximize their tax deductions. Contributions to retirement accounts, if available, can be accelerated into the current year to lower taxable income. Furthermore, exploring tax-deferred investment options such as Roth conversions or setting up certain types of trusts and retirement plans can provide substantial tax minimization benefits. By implementing a combination of these proactive measures, investors can not only enhance their investment portfolios but also ensure a more tax-efficient financial future, effectively supporting wealth preservation across generations. Retirement tax planning is an integral part of this process, as the strategic use of tax-advantaged accounts can significantly impact the growth and longevity of retirement savings. With careful planning and the utilization of these strategies, investors can position themselves to take full advantage of available tax benefits, ultimately contributing to their financial security and investment portfolio’s robustness.

Leveraging Tax Benefits for Entrepreneurs and Maximizing Deductions for Retirement Planning

Entrepreneurs can significantly leverage tax benefits to enhance their financial standing and support business growth. By strategically timing income and deductions, entrepreneurs can optimize their tax liabilities, particularly through year-end tax planning. This approach not only aligns with the fiscal calendar but also takes advantage of allowable deductions that can reduce overall tax burdens. For instance, investing in equipment or inventory before year-end can accelerate deductions, while deferring income to the subsequent year can yield immediate tax savings. Additionally, entrepreneurial ventures that qualify can explore the benefits of tax-deferred investments, which provide a cushion against short-term financial fluctuations and contribute to long-term wealth accumulation.

In the realm of retirement planning, maximizing tax deductions is a cornerstone of effective tax minimization techniques. Retirement tax planning is a prudent strategy that involves selecting the most advantageous retirement accounts, such as Roth IRAs or 401(k)s, to minimize future tax liabilities. Contributions to these accounts can often be made up until the end of the calendar year and may be deductible, thereby reducing current taxable income. By diversifying retirement savings across different account types, individuals can create a tax-efficient withdrawal strategy during retirement years, ensuring that their nest egg is preserved and continues to provide for them in a tax-friendly manner. This proactive approach to retirement planning not only secures financial stability for the individual but also for their beneficiaries, as they are inheriting a well-planned, tax-considerate legacy.

Effective capital gains management stands as a pivotal pillar in the architecture of wealth preservation and tax efficiency. By strategically integrating year-end tax planning and leveraging tax benefits for entrepreneurs, investors can optimize their portfolios and maximize tax deductions, particularly within the context of retirement tax planning. Embracing tax-deferred investments and innovative minimization techniques ensures a robust financial foundation that not only protects current assets but also safeguards family wealth for generations to come. In essence, a thoughtful approach to managing capital gains is an investment in one’s long-term financial security and stability.