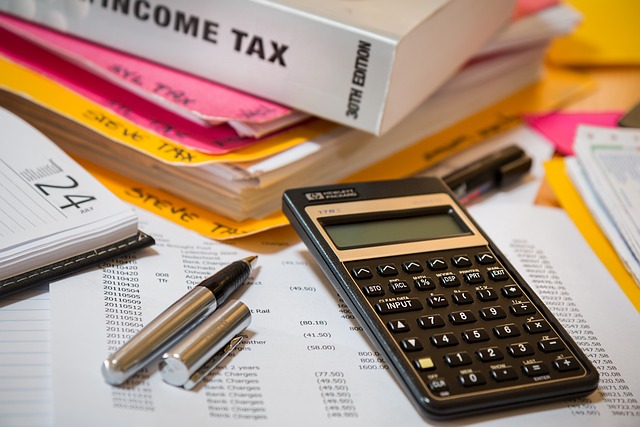

navigating the complexities of income tax can be a daunting task for individuals and businesses alike. Our comprehensive tax services are engineered to streamline your tax experience, providing expert guidance through each step of the process. With the IRS’s recent initiatives aimed at simplifying the tax code, our seasoned Certified Tax Preparers are equipped to offer personalized Year-End Tax Planning strategies, ensuring you reap the full benefits of available deductions and avoid common pitfalls. Our Taxpayer Relief Services are specifically tailored to ease the burden on individuals and businesses, while our Corporate Tax Solutions are meticulously designed to optimize your income tax calculation. Rest assured, with our commitment to accuracy and compliance, your tax returns will be filed punctually and correctly.

- Mastering Year-End Tax Planning with Our Expert Certified Tax Preparers

- Tailored Tax Saving Strategies for Individuals and Businesses through Taxpayer Relief Services

- Leveraging Corporate Tax Solutions to Optimize Your Income Tax Calculation

- Ensuring Accuracy and Compliance with Timely Filing Assistance and Consulting

Mastering Year-End Tax Planning with Our Expert Certified Tax Preparers

Our expert certified tax preparers are adept at navigating the complexities of Year-End Tax Planning to ensure that clients optimize their financial positions. As the year draws to a close, it’s crucial to review past transactions and forecast future ones to implement effective tax-saving strategies. Our team is well-versed in the latest tax laws and regulations, providing personalized advice tailored to each individual’s or business’s unique situation. By leveraging our Taxpayer Relief Services, clients can rest assured that they are making informed decisions to minimize their tax liabilities and maximize their financial benefits.

In addition to expert guidance, our Corporate Tax Solutions are designed with the foresight of a corporate tax environment in mind. We assist businesses in mastering the intricacies of income tax calculations, ensuring compliance with both federal and state regulations. Our strategic approach encompasses a thorough analysis of your business’s financial activities throughout the year to identify opportunities for tax savings. With our assistance, clients can confidently enter the new fiscal year with a clear understanding of their tax position, ready to implement effective Year-End Tax Planning to achieve the best possible outcome.

Tailored Tax Saving Strategies for Individuals and Businesses through Taxpayer Relief Services

Our tax saving strategies are meticulously crafted to cater to the unique financial situations of individuals and businesses alike, ensuring optimal tax outcomes. Utilizing our Year-End Tax Planning services, clients can proactively organize their finances to align with ever-evolving tax laws, thereby minimizing liabilities and maximizing savings. Our Certified Tax Preparers bring a wealth of knowledge and expertise, applying corporate tax solutions that are both innovative and compliant with the latest IRS initiatives. These professionals conduct thorough income tax calculations, employing a suite of tools and strategies tailored to each client’s specific needs, which collectively form part of our comprehensive Taxpayer Relief Services.

Furthermore, our commitment to staying abreast of changes in tax legislation allows us to offer personalized advice that adapts to the shifting landscape of fiscal regulations. We ensure that every deduction is thoroughly scrutinized and every credit rightfully claimed, all while maintaining a diligent approach to compliance. Our aim is to alleviate the stress associated with tax season, providing peace of mind and confidence that your returns are not only accurate but also filed in a timely manner, reflecting the best possible tax saving strategies for your individual or business circumstances. With our support, you can navigate complex tax scenarios with ease, knowing that you have a dedicated partner working to secure your financial well-being.

Leveraging Corporate Tax Solutions to Optimize Your Income Tax Calculation

Our Corporate Tax Solutions are meticulously crafted to align with the evolving tax landscape, ensuring that businesses like yours can navigate the complexities of income tax calculation with confidence. By leveraging our Year-End Tax Planning services, companies benefit from a proactive approach that identifies opportunities for tax savings well before the end of the fiscal year. Our certified tax preparers delve into your financial records to devise robust strategies that not only comply with current tax laws but also optimize your overall tax position.

Incorporating Tax Saving Strategies tailored to your unique business needs, our team at Taxpayer Relief Services works diligently to minimize your tax liability and maximize your financial returns. We understand that each business has its own set of challenges and opportunities; therefore, our approach is personalized to fit your specific situation. Our expertise in Corporate Tax Solutions extends beyond mere income tax calculation—we provide comprehensive support for federal and state tax returns, ensuring compliance while also seeking out potential tax credits and deductions. Our goal is to alleviate the burden of tax season, allowing you to focus on what you do best: running your business. With our assistance, you can rest assured that your taxes are filed accurately and on time, providing peace of mind throughout the year.

Ensuring Accuracy and Compliance with Timely Filing Assistance and Consulting

Our income tax services are meticulously crafted to alleviate the complexities of tax season for both individuals and businesses. Utilizing our expertise, we ensure that every aspect of your year-end tax planning is addressed with precision and care. Our team of Certified Tax Preparers delves into your financial specifics to implement strategic tax-saving measures, optimizing your returns while adhering to the intricacies of the tax code. With the recent IRS initiatives aimed at streamlining the tax process, our services are more relevant than ever, offering timely filing assistance and consulting to guarantee that your tax obligations are fulfilled with accuracy and compliance.

Our commitment to excellence extends beyond mere calculation; we provide comprehensive income tax solutions tailored to the unique needs of each client. Our approach is proactive, employing advanced strategies to navigate the complexities of corporate tax solutions. We stay abreast of the latest tax laws and regulations to ensure that our clients’ tax filings are not only correct but also optimized for maximum benefit. Our Taxpayer Relief Services are designed to offer peace of mind, knowing that your financial interests are being protected by seasoned professionals who prioritize timely execution and meticulous attention to detail.

In conclusion, navigating the complexities of income tax no longer necessitates the stress and confusion that once accompanied it. Our comprehensive suite of tax services, including Year-End Tax Planning advice from Certified Tax Preparers, ensures individuals and businesses alike can confidently approach tax season with Taxpayer Relief Services tailored to their unique situations. By implementing strategic Tax Saving measures through our expert guidance, clients benefit from optimized Corporate Tax Solutions that accurately calculate income taxes. Our commitment to precision and compliance, coupled with timely filing assistance and consulting, positions us as the trusted ally you need in the financial landscape. Let us handle the intricacies of tax law so you can focus on what matters most to you, secure in the knowledge that your tax obligations are being expertly managed.