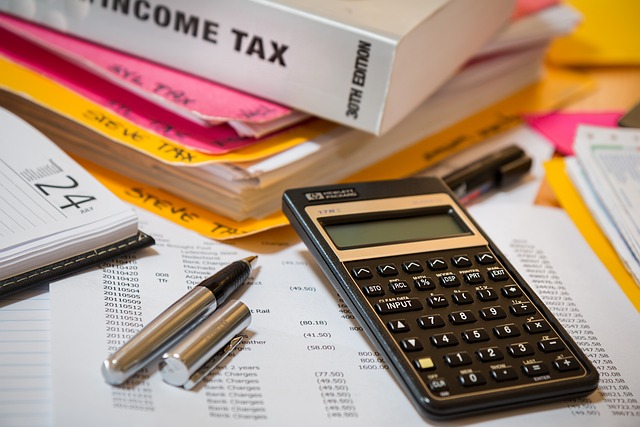

In today’s fast-paced digital age, the paradigm of tax filing has undergone a significant transformation. The advent of income tax e-filing systems has revolutionized how individuals and self-employed persons manage their fiscal obligations. This article delves into the benefits and intricacies of utilizing online tax filing platforms for a seamless and secure tax experience. By harnessing easy tax filing tools, taxpayers can navigate the complexities of tax preparation online with greater ease, leveraging online tax calculators to estimate liabilities and anticipate potential refunds. As we explore the various facets of e-filing, from maximizing your tax refund to enhancing security with online tax forms and tracking, it becomes evident that this digital shift is not just a convenience but a prudent approach for the modern taxpayer.

- Leveraging Income Tax E-Filing for Hassle-Free Tax Season

- Streamlining Tax Processes with Easy Tax Filing Platforms

- Maximizing Your Tax Refund and Enhancing Security with Online Tax Forms and Tracking for Self-Employed Individuals

Leveraging Income Tax E-Filing for Hassle-Free Tax Season

The advent of income tax e-filing has revolutionized the way individuals and businesses approach tax season. For those who have historically found tax preparation to be a daunting task, online tax forms and easy tax filing options now present a streamlined solution. These platforms are designed with user experience in mind, offering intuitive interfaces that guide users through each step of the process. Whether you’re self-employed or an employee, these systems cater to your unique financial situation by providing tailored tax filing assistance. The simplicity and efficiency of e-filing ensure that even the most complex tax returns can be completed with minimal hassle. Additionally, the integration of online tax calculators allows filers to accurately estimate their liabilities and calculate potential refunds, thereby empowering them to make informed decisions regarding their tax obligations.

Security is a paramount concern for many when it comes to handling sensitive financial information. Secure online tax filing systems address this by employing advanced encryption and privacy safeguards. These measures protect your personal data as it travels from your device to the tax authorities, ensuring that your confidential information remains just that—confidential. Moreover, with the ability to track your tax refund status through secure online portals, taxpayers can enjoy peace of mind throughout the processing period. The convenience and security of income tax e-filing make it an indispensable tool for navigating the complexities of tax season, transforming what was once a source of anxiety into a hassle-free experience. Whether you’re looking to file your own taxes or seek professional tax filing assistance, e-filing offers a user-friendly and secure way to fulfill your tax obligations on time and with greater ease than ever before.

Streamlining Tax Processes with Easy Tax Filing Platforms

In recent years, income tax e-filing has become synonymous with streamlining the tax process for individuals and self-employed taxpayers alike. Easy tax filing platforms have emerged as the go-to solution for those looking to navigate the complexities of tax season with ease. These comprehensive online services not only simplify the preparation of online tax forms but also offer intuitive tools such as tax refund tracking, allowing users to monitor their returns with real-time updates. The integration of secure online tax filing ensures that sensitive financial information is protected throughout the process, providing peace of mind alongside convenience. Users benefit from the ability to access personalized tax filing assistance, which guides them through each step of the tax preparation process, ensuring accuracy and maximizing potential tax savings. With the advent of free online tax filing services, the barriers to timely tax filing are significantly reduced, making it accessible for a broader range of taxpayers who may have previously found the process daunting or too complex. As a result, these platforms democratize tax knowledge, enabling individuals to handle their self-employed tax filing with confidence and efficiency, all from the comfort of their own home or on-the-go via mobile devices. The transition to digital tax filings is not just a shift in methodology but a paradigm change that makes the tax experience less burdensome and more user-friendly for millions of Americans each year.

Maximizing Your Tax Refund and Enhancing Security with Online Tax Forms and Tracking for Self-Employed Individuals

Engaging in income tax e-filing represents a significant advantage for self-employed individuals, offering an easy tax filing experience that streamlines their financial management. Utilizing online tax forms facilitates the categorization of various income streams and deductions specific to freelancers, ensuring accuracy and completeness in tax submissions. These platforms provide intuitive interfaces that guide users through the process of claiming all eligible tax deductions online, thereby maximizing their potential tax refunds. Taxpayers can input their financial data into secure online tax filing systems, where sophisticated algorithms calculate their liabilities or refunds with precision. Furthermore, these services often include a feature for tax refund tracking, allowing individuals to monitor the status of their returns in real-time, providing peace of mind and transparency throughout the process. The security protocols employed by reputable e-filing services safeguard sensitive personal and financial information, making digital tax filing an even more attractive option for those looking to enhance the safety of their tax data. Self-employed tax filers can leverage these online tools not only to optimize their tax outcomes but also to confidently manage their fiscal responsibilities with the assurance that their submissions are both efficient and secure. By taking advantage of the comprehensive e-filing solutions available, self-employed individuals can focus more on their business endeavors, knowing their tax obligations are being handled with care and precision.

In conclusion, the shift towards income tax e-filing has undeniably streamlined the tax submission process for individuals and self-employed taxpayers alike. By leveraging easy tax filing platforms, filers can navigate their tax obligations with greater efficiency and security. Online tax forms and tracking systems provide a robust framework for managing tax liabilities and maximizing tax refunds. The availability of free online tax filing services further democratizes access to tax filing assistance, ensuring that taxpayers can find the support they need regardless of financial constraints. As we continue to embrace digital solutions for self-employed tax filing, it is clear that the convenience, precision, and security offered by secure online tax filing systems are transforming how we manage one of life’s most fundamental responsibilities. Embracing these advancements not only simplifies the tax process but also positions individuals to optimize their tax experiences in the digital age.