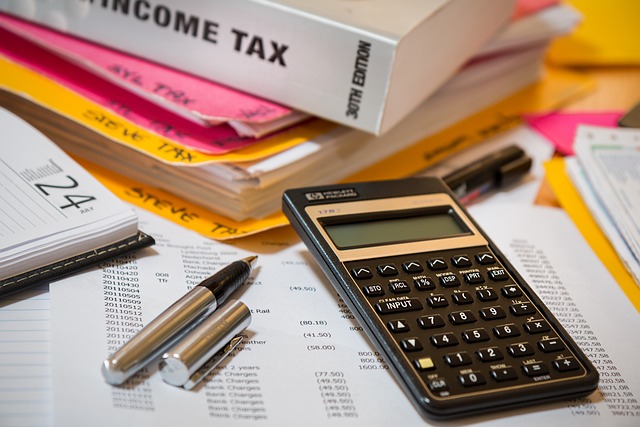

In an era where technology governs the rhythm of our lives, income tax e-filing has become a cornerstone of the annual financial cycle. This article explores the seamless integration of digital tools into the tax filing process, transforming it from a daunting task to a streamlined activity. Easy tax filing platforms now offer robust online tax forms, facilitating accurate and timely submissions for individuals and self-employed filers alike. With user-friendly interfaces and innovative features such as tax calculators and secure online tax filing options, these resources empower taxpayers to manage their fiscal responsibilities with greater ease. As we delve into the sections ‘Navigating the Digital Shift: The Rise of Income Tax E-Filing’ and ‘Streamlining Your Taxes: Easy Tax Filing for Every Taxpayer,’ we will also examine how online tax forms can be accessed and utilized efficiently, ensuring real-time updates on your tax refund status. Additionally, we will highlight the security measures and tax filing assistance provided specifically for the self-employed, making this tax season more efficient and less stressful than ever before.

- Navigating the Digital Shift: The Rise of Income Tax E-Filing

- Streamlining Your Taxes: Easy Tax Filing for Every Taxpayer

- Accessing and Utilizing Online Tax Forms Efficiently

- Real-Time Updates: Tracking Your Tax Refund Status in the Digital Age

- Enhanced Security and Assistance for Self-Employed Tax Filing Online

Navigating the Digital Shift: The Rise of Income Tax E-Filing

The advent of income tax e-filing has revolutionized the way individuals and businesses manage their annual tax obligations. Unlike the traditional paper-based system, e-filing offers a suite of digital tools that facilitate easy tax filing. Taxpayers now have direct access to online tax forms, which can be completed with precision and efficiency from the comfort of their own homes or on the go. These platforms are not only user-friendly but also designed with robust security measures to protect sensitive financial information. For the self-employed, this shift to digital has been particularly beneficial, as it allows for meticulous record keeping and streamlines the tax filing process.

Additionally, the rise of income tax e-filing has made tracking tax refunds a less cumbersome task. Taxpayers can monitor their refund status with real-time updates, reducing anxiety and uncertainty that typically accompanies the tax return process. Furthermore, many e-filing platforms offer free online tax filing services, making tax preparation more accessible to individuals from all financial backgrounds. These platforms often provide additional assistance, such as step-by-step guides and customer support, to ensure users can navigate their tax responsibilities confidently. With the continuous advancement of these digital solutions, the tax season becomes not only more efficient but also significantly less stressful for taxpayers across the nation.

Streamlining Your Taxes: Easy Tax Filing for Every Taxpayer

In the current digital landscape, income tax e-filing has revolutionized the way taxpayers approach their annual obligations. With user-friendly platforms that offer easy tax filing solutions, individuals and self-employed individuals alike can manage their tax responsibilities with greater ease than ever before. These online tax forms are designed to streamline the process, allowing users to fill out their returns with precision and speed. The digital transformation of tax filing eliminates the need for paper forms and manual calculations, making it an efficient choice for those looking to save time and reduce errors.

Moreover, the best online tax platforms provide tools that go beyond basic tax filing assistance. They include secure online tax filing services, ensuring that sensitive financial information is protected throughout the process. Taxpayers can take advantage of features such as online tax calculators to estimate their tax liability and understand the impact of deductions and credits. Additionally, these platforms often offer tax refund tracking capabilities, enabling taxpayers to monitor the status of their refunds in real-time. This level of transparency and accessibility makes tax season less daunting for everyone from the self-employed to those with more complex financial situations, as they can find free online tax filing services tailored to their needs. With these digital resources at hand, staying informed about tax filing deadlines becomes simpler, leading to a more organized and less stressful approach to handling one’s taxes.

Accessing and Utilizing Online Tax Forms Efficiently

In the digital era, income tax e-filing has revolutionized the way individuals and businesses manage their tax obligations. Accessing online tax forms has never been more straightforward, with a plethora of secure online tax filing platforms readily available. These platforms offer a diverse array of tax forms that can be filled out electronically, eliminating the need for paper forms and reducing the environmental impact of tax season. For the self-employed or those with complex tax situations, these digital resources are particularly beneficial, providing tailored easy tax filing solutions. Users can efficiently locate the necessary forms, such as W-2s or 1099s, input their financial data, and submit their returns directly from their computers or mobile devices.

Furthermore, the process of tax refund tracking has been streamlined through these platforms. Once a return is filed, taxpayers can monitor the status of their tax refund with real-time updates, reducing uncertainty and anticipation. This feature ensures that individuals receive their due refunds promptly, and in the event of any discrepancies or issues, tax filing assistance is readily available. The platforms are designed to be user-friendly, guiding users through each step of the process, from initial form selection to final submission. With features like online tax calculators, taxpayers can also get a head start on planning for their tax liabilities or refunds, making informed decisions about their financial situation. Utilizing these advanced digital tools not only simplifies the tax filing process but also empowers taxpayers to approach their fiscal responsibilities with greater confidence and less time spent on cumbersome paperwork.

Real-Time Updates: Tracking Your Tax Refund Status in the Digital Age

In the digital age, income tax e-filing has revolutionized the way individuals and businesses manage their tax obligations. With the advent of secure online tax filing platforms, self-employed tax filers, as well as traditional employees, can access a plethora of online tax forms, eliminating the need for paper-based submissions. These digital portals not only offer an easy tax filing interface but also provide real-time updates on the status of your tax refund. This feature is particularly beneficial as it enables taxpayers to monitor their returns with unparalleled precision and without the usual anxieties associated with postal delays or bureaucratic hold-ups. The platforms ensure that once your tax return is submitted, you can track your tax refund status from preparation to approval, offering a transparent and efficient process. Tax refund tracking through these digital means is designed to be user-friendly, allowing individuals to check the progress of their refund with just a few clicks, thereby simplifying the often complex tax filing procedure.

Furthermore, these platforms are equipped with robust security measures to protect sensitive financial data, making online tax filing a secure option for taxpayers. The ease and accessibility of these services mean that anyone, regardless of their financial complexity or situation, can take advantage of free online tax filing services. For those who may require additional assistance, tax filing help is often available through virtual support centers, ensuring that even the least tech-savvy taxpayers can navigate the digital tax landscape with confidence. The integration of tax refund tracking into these comprehensive e-filing systems underscores the modern taxpayer’s ability to handle their fiscal responsibilities effectively and with less stress during the tax season.

Enhanced Security and Assistance for Self-Employed Tax Filing Online

The shift towards digital tax filing has significantly elevated the security and ease of self-employment tax submission. With income tax e-filing, self-employed individuals can now file their taxes with a level of confidence that was previously unattainable. Digital platforms specializing in online tax forms ensure that each return is processed through secure online tax filing protocols, safeguarding sensitive financial information against potential breaches. These robust security measures are complemented by user-friendly interfaces designed to make easy tax filing a reality for the self-employed. The integration of online tax calculators within these platforms allows users to accurately compute their tax liabilities and optimize their financial planning. Additionally, real-time guidance and assistance are available throughout the process, ensuring that even those with complex financial situations can navigate their tax obligations without undue stress. This not only streamlines the tax filing process but also provides peace of mind.

Furthermore, the most reputable digital tax platforms offer comprehensive support for self-employed tax filers, including tax refund tracking features. These services enable individuals to monitor the progress of their tax refund applications from submission to disbursement. The ability to track one’s refund status is a significant advantage, as it eliminates uncertainty and keeps taxpayers informed every step of the way. The platforms also cater to those who may require assistance with more intricate aspects of self-employed tax filing by providing step-by-step guidance and answering frequently asked questions. This support system is instrumental in ensuring compliance with tax regulations while facilitating a smoother, more efficient tax season for all self-employed individuals.

In closing, the shift towards digital income tax e-filing has undeniably streamlined the tax process for millions of individuals and self-employed taxpayers. With user-friendly interfaces and robust online tax forms, easy tax filing is now within everyone’s reach. The ability to track your tax refund status in real-time adds a layer of transparency and reassurance. As the digital tools continue to evolve with enhanced security measures, the convenience and accessibility of secure online tax filing are evident. This evolution not only simplifies the process but also democratizes it by providing free online tax filing services to accommodate various financial needs. Embracing these advancements ensures a more efficient and less stressful tax season for all filers. As we continue to navigate this digital shift, staying informed and leveraging these resources is key to making tax filing as straightforward as possible.