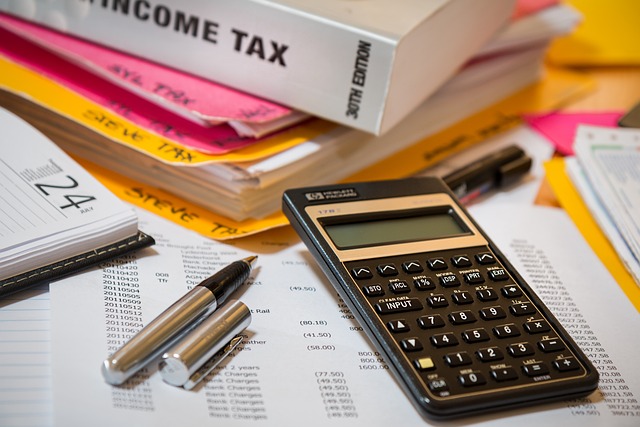

Effective tax management is a cornerstone of robust business financial planning. It encompasses more than mere compliance; it’s a strategic tool that can significantly influence a company’s fiscal health and success. This article delves into the nuances of tax exemption eligibility, the perils of IRS penalties and interest, and the complexities of nonprofit tax filing. Businesses will gain insights on identifying tax-efficient investments that align with their financial objectives, staying abreast of tax code changes, and optimizing their filing status for greater tax efficiency. By mastering these elements, companies can not only avoid legal pitfalls but also leverage tax strategies to enhance their overall financial position.

- Maximizing Tax Exemption Eligibility for Businesses: A Strategic Approach to Financial Health

- Avoiding IRS Penalties and Interest: The Importance of Tax Compliance in Business Operations

- Navigating Nonprofit Tax Filing: Key Considerations for Charitable Organizations

- Identifying Tax-efficient Investments to Align with Your Business's Financial Goals

- Staying Ahead of the Curve: Year-end Tax Planning and Adapting to Tax Code Changes

Maximizing Tax Exemption Eligibility for Businesses: A Strategic Approach to Financial Health

Businesses can significantly bolster their financial health by strategically maximizing their eligibility for tax exemptions. Understanding the nuances of Tax Exemption Eligibility under the Internal Revenue Service (IRS) is paramount. Nonprofits, in particular, must navigate the complex landscape of Nonprofit Tax Filing requirements to maintain their exempt status and avoid IRS Penalties and Interest. These organizations must demonstrate adherence to specific guidelines that dictate their operations and fundraising activities. By meticulously adhering to these rules and providing clear documentation, nonprofits can ensure they remain in good standing, thereby preserving their tax-exempt status and the benefits it affords.

In addition to nonprofit considerations, for-profit entities must also stay abreast of Tax Code Changes to leverage Tax-efficient Investments. Strategic planning involves not only identifying investment opportunities that offer favorable tax treatments but also understanding how proposed legislation might alter the tax landscape. Filing Status Optimization is another key strategy that businesses can employ to reduce their overall tax liability. This entails selecting the most advantageous filing status and making informed decisions throughout the year to align with this choice. By staying agile and informed, businesses can not only enhance their financial efficiency but also ensure compliance with ever-evolving tax regulations, thereby positioning themselves for sustained success in a dynamic economic environment.

Avoiding IRS Penalties and Interest: The Importance of Tax Compliance in Business Operations

Navigating the complexities of tax compliance is a critical aspect for businesses aiming to avoid IRS penalties and interest. The Internal Revenue Service imposes strict guidelines and timelines for tax filings, and noncompliance can result in costly penalties and interest. Nonprofit organizations are particularly susceptible to these consequences if they fail to adhere to the specific tax filing requirements that apply to them, such as securing their Tax Exemption Eligibility under section 501(c)(3) of the tax code. Understanding the nuances of the current tax code and its changes is imperative for businesses to ensure they are eligible for any applicable tax exemptions and are not inadvertently subjecting themselves to additional scrutiny or financial burdens.

Businesses must also engage in tax-efficient investments and optimize their filing status to minimize their tax liabilities. Strategic investment decisions, informed by an up-to-date knowledge of the tax code, can lead to substantial savings. For instance, certain investments may offer tax deductions or deferrals that align with the business’s financial objectives. Moreover, selecting the appropriate filing status can also yield tax benefits. By proactively engaging in year-end tax planning, businesses can assess their financial performance and implement strategies to optimize their tax outcomes, ensuring they are well-positioned to face the new tax year. This diligent approach not only safeguards against IRS penalties and interest but also enhances overall financial efficiency and compliance with tax regulations.

Navigating Nonprofit Tax Filing: Key Considerations for Charitable Organizations

Charitable organizations must navigate the complex landscape of nonprofit tax filing to maintain their tax-exempt status under Section 501(c)(3) of the Internal Revenue Service (IRS) code. Understanding Tax Exemption Eligibility is paramount, as it ensures these entities are properly registered and adhering to the strict operational and governance requirements set forth by the IRS. Failure to comply can result in significant IRS Penalties and Interest, which can undermine an organization’s financial stability. To maintain tax-exempt status, nonprofits must diligently file annual returns, such as the Form 990 series, which provide a transparent account of their finances and activities.

In addition to maintaining tax-exempt status, nonprofits should be adept at Nonprofit Tax Filing to leverage Tax Code Changes to their advantage. This includes optimizing their Filing Status Optimization, ensuring that they are utilizing the most favorable provisions available for charitable organizations. By staying abreast of these changes, nonprofits can strategically manage their resources and focus on their mission-driven work. Moreover, investing in Tax-efficient Investments is a prudent approach for nonprofit financial management. These investments should be aligned with the organization’s values while also providing a return that considers the tax implications associated with the income generated. By integrating thoughtful investment strategies with a keen understanding of the evolving tax landscape, charitable organizations can not only safeguard their operational integrity but also enhance their long-term sustainability and impact within the communities they serve.

Identifying Tax-efficient Investments to Align with Your Business's Financial Goals

Navigating the complexities of tax-efficient investments is a strategic move for businesses aiming to align their financial goals with favorable tax outcomes. Businesses must stay abreast of Tax Code Changes, as these can significantly impact investment decisions and eligibility for tax exemptions. For instance, certain types of investments may offer tax benefits to entities that qualify under specific provisions of the Internal Revenue Service (IRS) code. By thoroughly reviewing their financial status and understanding their Tax Exemption Eligibility, businesses can identify opportunities that not only contribute to their growth objectives but also reduce potential tax liabilities.

It is imperative for businesses, especially those with nonprofit tax filing statuses, to carefully plan their investment portfolio to maximize the advantages afforded by the tax code. This includes optimizing filing status to enhance tax efficiency and ensuring compliance to avoid IRS Penalties and Interest. A strategic approach to tax-efficient investments involves diversifying assets across different classes that are known to offer tax benefits, such as municipal bonds which often provide tax-exempt income. By leveraging these investment types and staying informed about the latest tax regulations, businesses can effectively manage their taxable income, leading to significant savings and a stronger financial position.

Staying Ahead of the Curve: Year-end Tax Planning and Adapting to Tax Code Changes

As the fiscal year draws to a close, businesses must engage in year-end tax planning to stay ahead of the curve and adapt to recent tax code changes. This strategic approach not only ensures compliance with current IRS regulations but also positions companies to maximize their tax exemption eligibility and minimize potential IRS Penalties and Interest. By meticulously reviewing financial transactions throughout the year, businesses can identify opportunities for making tax-efficient investments, which are pivotal in optimizing their overall tax liabilities. This proactive stance is particularly crucial for nonprofit organizations, where accurate nonprofit tax filing is essential to maintaining credibility and financial integrity. The ever-evolving tax landscape demands that businesses remain vigilant and responsive to new legislation and adjust their tax strategies accordingly.

Moreover, understanding the nuances of the tax code changes is vital for businesses aiming to leverage tax exemption eligibility effectively. It’s imperative to assess one’s filing status to ensure it aligns with the latest regulations, as this can significantly impact the outcomes of one’s tax filings. The IRS regularly updates its guidelines, and staying informed is key to avoiding costly mistakes. By adapting to these changes and planning ahead, businesses can optimize their filing status, take advantage of new tax incentives, and position themselves for a more favorable tax position come the next fiscal year. This diligence not only safeguards against penalties but also contributes to the long-term financial health and sustainability of the business.

businesses must proactively engage with tax strategies to fortify their financial standing. Mastery of tax exemption eligibility, as detailed in “Maximizing Tax Exemption Eligibility for Businesses,” ensures compliance and avoids costly IRS penalties and interest, a topic elaborated upon in “Avoiding IRS Penalties and Interest: The Importance of Tax Compliance in Business Operations.” For nonprofits, understanding the intricacies of nonprofit tax filing, as discussed in “Navigating Nonprofit Tax Filing: Key Considerations for Charitable Organizations,” is paramount. Additionally, strategically identifying tax-efficient investments, a subject covered in “Identifying Tax-efficient Investments to Align with Your Business’s Financial Goals,” aligns financial objectives with tax savings. The dynamic nature of the tax code mandates businesses stay informed and agile, as highlighted in “Staying Ahead of the Curve: Year-end Tax Planning and Adapting to Tax Code Changes.” By integrating these strategies and staying current with filing status optimization, businesses can not only safeguard their financial health but also navigate the complex tax landscape effectively. This comprehensive approach underscores the importance of a robust tax strategy in achieving and maintaining fiscal responsibility and efficiency.