embarking on the journey of homeownership as a first-time buyer brings a mix of excitement and trepidation. Amidst the whirlwind of mortgage considerations, it’s crucial to secure your investment with robust home insurance. This article navigates the essential aspects of home insurance, from understanding its role in protecting your new property to finding the most affordable plans through home insurance comparison tools online. We delve into the nuances of selecting home insurance for high-value homes and uncover strategies for seniors to find the best home insurance options with low premiums, ensuring peace of mind without straining finances. With a focus on homeowners insurance discounts and policy customization, first-time buyers can tailor coverage that suits their unique needs, making informed decisions for a secure future.

- Navigating the Housing Market: A First-Time Buyer's Guide to Home Insurance Essentials

- The Importance of Home Insurance for High-Value Homes and How to Secure It

- Strategies for Finding Affordable Home Insurance Quotes Online with Low Premiums

- Tailoring Your Coverage: Understanding Homeowners Insurance Discounts and Policy Customization

- Optimal Home Insurance Solutions for Senior Homeowners: Balancing Comprehensive Coverage with Budget

Navigating the Housing Market: A First-Time Buyer's Guide to Home Insurance Essentials

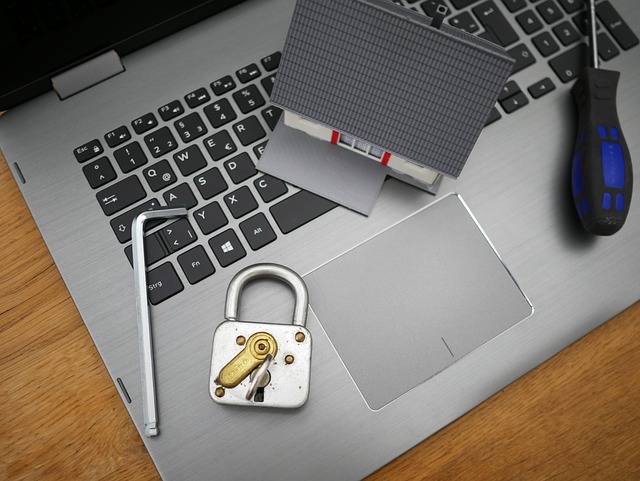

Navigating the housing market as a first-time buyer necessitates careful consideration of various financial and protective measures, with home insurance being paramount among them. A comprehensive home insurance policy is not just a legal requirement but also a critical safeguard for your new investment against the myriad unforeseen events that could potentially impact your property. When entering the housing market, it’s essential to explore different home insurance options and compare policies to find the best coverage at an affordable price. Utilizing online platforms to gather home insurance quotes from multiple providers is a prudent step for first-time buyers, as it allows you to assess various offers and select a policy that aligns with both your budget and coverage needs.

When seeking home insurance, it’s important to consider the type of home you’re purchasing. Home insurance for high-value homes often requires tailored coverage due to their unique features or higher replacement costs. Additionally, first-time buyers should be aware of potential homeowners insurance discounts that can significantly lower premiums. These discounts may be available based on a range of factors, including the installation of safety devices, the material your home is made from, and your claims history. For seniors, the best home insurance options will consider their lifestyle and any specific risks they might face. By carefully evaluating these aspects, first-time buyers can ensure they are well-protected while also making cost-effective decisions. Online tools and resources make it easier than ever to find the most suitable home insurance for your circumstances, providing peace of mind as you embark on this exciting new chapter.

The Importance of Home Insurance for High-Value Homes and How to Secure It

Navigating the housing market as a first-time buyer is a significant milestone that comes with its share of financial decisions, one of which is securing comprehensive home insurance. For those who have invested in high-value homes, the importance of tailored home insurance cannot be overstated. These properties often come with unique risks and assets that require specialized coverage to adequately protect them. Homeowners of high-value homes should consider policies that offer robust protection against events such as natural disasters, theft, or other unforeseen incidents that could compromise their investment.

To secure the best home insurance for high-value homes without breaking the bank, it’s prudent to engage in a thorough home insurance comparison. Utilizing online platforms to obtain home insurance quotes allows potential homeowners to evaluate various policies side by side. These platforms can help identify options with low premiums while ensuring that the coverage is comprehensive enough to meet the specific needs of high-value homes. Additionally, exploring homeowners insurance discounts can further reduce costs. For instance, installing security systems or making improvements that mitigate potential risks may lead to lower rates. Similarly, older homeowners might find that some insurers offer tailored policies as part of the best home insurance for seniors, taking into account factors such as the condition of the property and the value of its contents. By carefully analyzing home insurance quotes online and considering available discounts, high-value homeowners can find coverage that balances protection with affordability.

Strategies for Finding Affordable Home Insurance Quotes Online with Low Premiums

When embarking on the home ownership journey, securing comprehensive yet affordable home insurance is a pivotal step to safeguard your investment. Utilizing online platforms for a home insurance comparison can yield significant advantages. These digital tools allow you to input specific details about your property and desired coverage, then generate a range of home insurance quotes online from various insurers competing for your business. This competition often translates into lower premiums without compromising the quality of protection. To find the most cost-effective policies, consider the following strategies:

Firstly, evaluate homeowners insurance discounts that may apply to you. Many insurance providers offer reductions for a variety of reasons, such as installing safety features like burglar alarms or smoke detectors, maintaining a good credit score, bundling your policy with other insurance products, or being a first-time buyer. Additionally, if you’re looking for home insurance for high-value homes, ensure that the policies you compare offer adequate coverage for the replacement cost of your property, not just its market value. This is particularly important to protect your investment adequately.

For senior homeowners, it’s beneficial to explore insurers known for providing the best home insurance for seniors. These policies can include additional discounts and tailored coverage options that cater to the specific needs of an older demographic, often at lower premiums. By carefully comparing these online home insurance quotes, you can make an informed decision that aligns with your financial situation while ensuring peace of mind regarding the safety of your home. Always ensure that the coverage selected meets your specific needs and that you understand the terms and conditions associated with the policy you ultimately choose.

Tailoring Your Coverage: Understanding Homeowners Insurance Discounts and Policy Customization

Navigating the housing market as a first-time buyer necessitates a comprehensive approach, and this includes securing robust home insurance. Tailoring your coverage to fit your unique needs is paramount when safeguarding your investment against the unexpected. Homeowners insurance discounts can significantly impact your financial planning, offering a way to secure coverage without straining your budget. By exploring home insurance comparison tools online, you can identify policies with low premiums that still provide the robust protection you need. These tools enable you to sift through various plans, including those tailored for high-value homes, ensuring that regardless of your property’s worth, you have access to the best home insurance options available.

Furthermore, understanding the array of homeowners insurance discounts can lead to substantial savings. From multi-policy discounts that reward policyholders who bundle their auto and home insurance, to discounts for homes with security systems or claims-free histories, there are numerous avenues to explore. For seniors, particularly those looking for the best home insurance, there are specialized policies that account for the reduced risk profile associated with older homeowners. These tailored options can offer comprehensive coverage at lower premiums, making them an attractive choice for the budget-conscious and value-driven consumer alike. Whether you’re seeking the most affordable option or the most suitable cover for your high-value home, leveraging online home insurance quotes is a prudent step in customizing a policy that aligns with both your needs and your financial comfort zone.

Optimal Home Insurance Solutions for Senior Homeowners: Balancing Comprehensive Coverage with Budget

As senior homeowners navigate the complexities of the housing market and secure their homes, finding optimal home insurance solutions that balance comprehensive coverage with budget considerations is paramount. It’s essential to tailor home insurance to fit the unique needs of this demographic, which often includes a desire for extensive protection alongside the practical need to manage expenses. Home insurance comparison tools and online quotes for home insurance are invaluable resources for these homeowners. They allow for an informed comparison of policies, ensuring that seniors can find the best home insurance options without breaking the bank. These tools help identify plans with low premiums that still offer robust coverage, which is particularly important for those who may be living in high-value homes or in areas prone to specific risks. Additionally, many insurers offer homeowners insurance discounts specifically designed for senior citizens, reflecting a recognition of their often-impeccable safety records and stability as policyholders.

In the pursuit of the best home insurance for seniors, it’s crucial to look beyond just the premium rates. While low premiums are attractive, comprehensive coverage is equally important. This includes considering home insurance for high-value homes if that describes the senior’s dwelling. It also means evaluating the inclusions and exclusions of each policy to ensure that the necessary aspects of the home, such as valuable personal belongings or home modifications for accessibility, are adequately covered. By leveraging online resources and comparing various policies, senior homeowners can find the right balance between cost-effectiveness and coverage depth, ensuring peace of mind without compromising on their financial well-being.

Navigating the housing market as a first-time buyer is indeed a multifaceted endeavor, but securing robust home insurance is an integral part of protecting your new investment. This article has highlighted the essential aspects of home insurance, from understanding its importance for high-value homes to strategizing on obtaining competitive quotes online for home insurance with low premiums. By exploring homeowners insurance discounts and tailoring policies to fit your unique needs, you can ensure both comprehensive coverage and financial prudence. For seniors, finding the best home insurance options that balance thorough protection with budget constraints is key. In summary, whether you’re a first-time buyer or an experienced homeowner, a home insurance comparison remains a critical step in your journey, ensuring peace of mind and safeguarding against the unpredictable. With the right approach and information from this guide, you are well-equipped to make informed decisions about your home insurance needs.