When safeguarding the backbone of your business, prioritizing robust protection for your fleet with tailored Business Van Insurance is not just a precaution—it’s a strategic investment. As you navigate the complexities of commercial vehicle insurance, understanding the nuances between Fleet Van Insurance, Commercial Vehicle Insurance, and specialized options like Courier and Delivery Van Insurance Coverage becomes paramount. This article delves into the essential aspects of Van Liability Insurance and the cost-effective solutions available for small businesses, ensuring your operations continue to thrive without interruption. We’ll guide you through key insurance components and explore how to secure comprehensive coverage at a price point that aligns with your budget, all within the realm of Commercial Auto Insurance for Vans.

- Understanding the Importance of Business Van Insurance for Your Operations

- Tailored Commercial Vehicle Insurance: Coverage Options for Every Business Need

- Fleet Van Insurance: Managing Multiple Vehicles with Efficiency and Security

- Key Components of Van Liability Insurance and What It Means for Your Business

- Cost-Effective Solutions: Van Insurance for Small Businesses on a Budget

- Exploring Cheap Commercial Van Insurance: Finding the Best Deals Without Compromising Coverage

- Specialty Vehicle Insurance: Courier and Delivery Van Insurance Coverage Options

Understanding the Importance of Business Van Insurance for Your Operations

Ensuring the safety and security of your business assets is paramount in the realm of commerce, and one critical aspect of this protection is securing comprehensive Business Van Insurance. Whether your operations involve a single courier van or an extensive fleet, possessing tailored Fleet Van Insurance is essential to mitigate risks associated with road accidents, vehicle theft, and third-party liabilities. Commercial Vehicle Insurance serves as a financial safeguard against unforeseen events that could disrupt your delivery services, which are often the lifeline of courier and delivery businesses. For small enterprises, the importance of Van Liability Insurance cannot be overstated; it provides cost-effective solutions that allow for uninterrupted operations.

When contemplating the various insurance options available, it’s crucial to consider not just the immediate costs but also the long-term benefits and coverage that Van Insurance for Small Businesses offers. Cheap Commercial Van Insurance doesn’t have to mean compromising on quality or protection. Instead, it’s about finding an optimal balance between cost and comprehensive coverage. The right policy can include options like Commercial Auto Insurance for Vans, which encompasses both liability and physical damage protection. This ensures that whether your vans are in transit delivering goods or parked safely at the end of a long day, they are covered against a myriad of potential risks. Tailoring your coverage to fit your specific needs is key to safeguarding your investments and maintaining the integrity of your business operations.

Tailored Commercial Vehicle Insurance: Coverage Options for Every Business Need

When it comes to safeguarding your business assets, tailored commercial vehicle insurance plays a pivotal role in protecting your investment. Business van insurance is not one-size-fits-all; it’s designed to cater to the unique needs of every enterprise. For businesses with a single van or an entire fleet, selecting the right coverage is essential. Options for commercial vehicle insurance range from basic van liability insurance to comprehensive policies that cover accidents, theft, and third-party liabilities. Van insurance for small businesses often includes features that are tailored to their specific challenges, such as breakdown cover, which ensures minimal disruption to operations. Moreover, fleet van insurance offers scalable solutions that can be customized according to the size and scope of your operations.

Cost-effective yet comprehensive, cheap commercial van insurance is available for those looking to balance affordability with quality protection. It’s crucial for small business owners to explore these options thoroughly to find a policy that aligns with their budget while still providing robust coverage. Commercial auto insurance for vans can include additional benefits like haul and trailer cover, goods in transit protection, and personal effects cover—all of which are vital for courier and delivery van insurance operations. By carefully considering the type of cargo transported and the nature of your business activities, you can tailor a policy that not only meets your current needs but also anticipates future growth. This thoughtful approach to selecting commercial vehicle insurance ensures that your vehicles—and by extension, your business—are well-protected against unforeseen events.

Fleet Van Insurance: Managing Multiple Vehicles with Efficiency and Security

When managing a fleet of commercial vans, it’s imperative to secure comprehensive Fleet Van Insurance that addresses the unique challenges and risks associated with multiple vehicles. This tailored coverage not only streamlines the management process but also ensures robust protection against various eventualities. Businesses can benefit from Fleet Van Insurance by having all their vehicles insured under a single policy, which simplifies administration and potentially reduces costs. This approach is particularly advantageous for small businesses, as it allows for cost-effective insurance solutions that don’t compromise on coverage. It’s essential to consider the specific needs of your fleet, such as the types of cargo carried, the driving routes, and the individual usage patterns of each van.

Choosing the right Fleet Van Insurance opens up access to Van Liability Insurance, ensuring that your business is protected against third-party claims resulting from accidents involving your vehicles. Additionally, Commercial Vehicle Insurance for vans can be customized to include coverage for theft, damage due to natural disasters, or any other unforeseen circumstances. For those seeking budget-friendly options without skimping on quality, Cheap Commercial Van Insurance can be procured by comparing quotes from various insurers. It’s a strategic move for small businesses looking for Courier Van Insurance or Delivery Van Insurance Coverage to keep their operations running smoothly and protect against costly disruptions. Opting for Commercial Auto Insurance for Vans tailored to your specific operational needs ensures that whether on local deliveries or long-haul courier services, your fleet is comprehensively safeguarded.

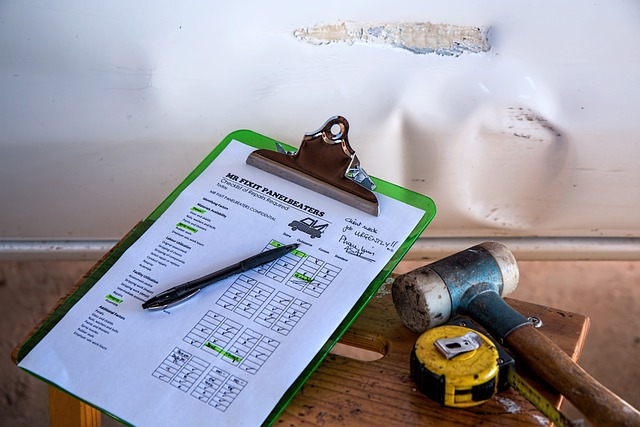

Key Components of Van Liability Insurance and What It Means for Your Business

When considering the key components of van liability insurance within the context of your business operations, it’s important to understand the breadth of coverage that commercial vehicle insurance offers. Business van insurance is tailored to address the unique needs of businesses that rely on vans for their daily activities. This includes fleet van insurance and affordable options like cheap commercial van insurance, which are designed to protect multiple vehicles under one policy. Van liability insurance, a cornerstone of commercial vehicle insurance, safeguards your business against third-party claims arising from property damage or bodily injury caused by your vans. It’s essential to ensure that this coverage is comprehensive enough to handle potential legal costs and settlements without jeopardizing your business’s financial stability.

Furthermore, the right van insurance for small businesses extends beyond liability. Comprehensive policies can also provide coverage against accidents, theft, and other unforeseen events. Options like commercial auto insurance for vans are available to cater to the varying needs of courier van insurance and delivery van insurance coverage. These policies often include additional benefits such as cover for tools, equipment, or even the loss of earnings if your vehicle is off the road due to an insured event. Tailoring your insurance package to match the specific demands of your business ensures that you’re not only meeting legal requirements but also actively safeguarding one of your most valuable assets—your fleet of vans. This level of protection enables businesses to operate with confidence, knowing they are equipped to handle potential vehicle-related issues without significant disruption to their services or finances.

Cost-Effective Solutions: Van Insurance for Small Businesses on a Budget

For small business owners, the safety and security of their commercial vehicles are paramount to maintaining a steady flow of operations. Investing in comprehensive Business Van Insurance tailored for small enterprises is not just about adhering to legal requirements; it’s an essential measure to protect your assets from unforeseen events. Opting for van insurance for small businesses can be cost-effective, offering customizable policies that cater to the unique needs of each operation. These tailored solutions often include Fleet Van Insurance, which is particularly beneficial for businesses with multiple vehicles. By choosing a plan designed for small businesses, owners can enjoy coverage against accidents, theft, and third-party liabilities without overspending.

When it comes to finding affordable yet robust protection, Cheap Commercial Van Insurance doesn’t have to mean compromising on quality. Small business operators can explore a range of options that balance cost and coverage, such as Commercial Vehicle Insurance and Commercial Auto Insurance for Vans. Additionally, Courier Van Insurance and Delivery Van Insurance Coverage are specialized forms of insurance designed specifically for businesses in the courier and delivery sectors. These policies are crafted to address the day-to-day risks associated with these industries, ensuring that your operations can continue smoothly even if one of your vans encounters an issue on the road. It’s important to compare different providers to find a policy that offers the right level of protection at a price point that supports your budget constraints, allowing you to focus on growing your business with peace of mind.

Exploring Cheap Commercial Van Insurance: Finding the Best Deals Without Compromising Coverage

When safeguarding your business assets, securing robust and cost-effective Business Van Insurance is paramount for any enterprise that relies on commercial vehicles for their operations. Whether you’re running a courier service or managing a fleet of delivery vans, the right insurance policy can shield you against unforeseen events such as accidents, theft, and third-party claims. Opting for Fleet Van Insurance tailored to your specific needs ensures that each vehicle under your business is adequately covered, providing a comprehensive safety net without straining your budget. In the competitive landscape of commercial vehicle insurance, finding cheap yet reliable coverage requires strategic decision-making. It’s essential to compare policies from various providers to identify which offers the best balance between cost and coverage.

Van Liability Insurance, a key component within Commercial Vehicle Insurance packages, is critical for protecting your business from legal ramifications resulting from vehicle operation. For small businesses, Van Insurance for Small Businesses presents an array of options that cater specifically to your operational scale. These policies can include coverage for commercial auto insurance for vans, ensuring that your vehicles are not just protected but also that your day-to-day operations can continue without major interruptions if an incident occurs. When exploring cheap Commercial Van Insurance, it’s important to consider the extent of the coverage provided by Delivery Van Insurance Coverage options. These policies often come with add-ons like breakdown assistance, which can be invaluable when unexpected issues arise. By carefully evaluating your insurance needs and shopping around for the most competitive rates, you can find cost-effective solutions that maintain your business’s financial stability and operational continuity.

Specialty Vehicle Insurance: Courier and Delivery Van Insurance Coverage Options

When it comes to securing your courier or delivery business, having the right insurance in place is paramount. Business Van Insurance tailored for couriers and delivery services ensures that every package and every route are protected. This specialized coverage goes beyond the basics, offering comprehensive protection against a wide range of risks, from accidents involving your vans to losses due to theft or damage. It’s designed to keep your operations running smoothly, minimizing downtime and financial strain should an incident occur. For those with a fleet of vans, Fleet Van Insurance is a cost-effective solution that provides the same level of protection for all your vehicles under one policy. This can include multi-van fleets, where each van’s usage and risk profile are considered to provide tailored coverage at a competitive rate.

Investing in Van Liability Insurance is a critical aspect of commercial vehicle insurance, safeguarding your business against third-party claims arising from accidents or injuries that your drivers may cause. It’s an essential layer of protection for small businesses, as it covers the legal costs and compensation that could otherwise be financially crippling. Additionally, Van Insurance for Small Businesses can be customized to suit your specific operational needs, offering flexibility in coverage options. This allows you to select the right level of protection at a price point that aligns with your budget, ensuring that you’re not overpaying for insurance. Cheap Commercial Van Insurance doesn’t have to compromise on quality; with the right broker, you can find affordable yet comprehensive policies that fit your needs without cutting corners. Lastly, Commercial Auto Insurance for Vans encompasses a broad range of coverages, including collision, comprehensive, and uninsured motorist protection. It’s designed to address the unique exposures faced by courier and delivery businesses, providing peace of mind and ensuring that your business assets are adequately protected on every journey. Courier Van Insurance and Delivery Van Insurance Coverage options are specifically crafted to meet the demands of the fast-paced courier and delivery sectors, offering the assurance that no matter where your vans go or what they carry, they’re covered against the unexpected.

Protecting your business assets is a multifaceted task, and securing robust Business Van Insurance stands out as an integral aspect of this. As outlined in the preceding sections, whether you run a solitary van or oversee a sizable fleet, tailored Commercial Vehicle Insurance solutions are indispensable for safeguarding against accidents, theft, and third-party claims. For small business owners, specific insurance packages offer both value and protection, ensuring your commercial activities proceed smoothly.

When considering Fleet Van Insurance, efficiency and security are paramount, with coverage options designed to meet the unique demands of your operations. Van Liability Insurance is a key component, providing a financial shield that can mitigate potential risks associated with your business. Moreover, for those seeking cost-effective solutions without compromising on essential coverages, exploring options like Cheap Commercial Van Insurance and Commercial Auto Insurance for Vans can yield both peace of mind and budget relief.

For courier and delivery services, specialized Courier and Delivery Van Insurance Coverage Options are available to address the specific risks inherent in your line of work. It’s clear that investing in the right insurance is not just a financial decision but a strategic one that fortifies your business against unforeseen events. As you evaluate your coverage needs, remember that finding the best Van Insurance for Small Businesses can be facilitated through careful consideration and comparison of available plans, ensuring that your enterprise remains protected and prepared to face whatever the road ahead may bring.