Navigating the intricate web of IRS regulations can be a daunting task for individuals and businesses alike. As tax laws evolve and become more complex, the importance of expert guidance in Year-End Tax Planning becomes paramount. Our comprehensive suite of services is designed to demystify the process, offering tailored solutions through Certified Tax Preparers who excel in precise Income Tax Calculation. We empower you with Tax Saving Strategies that optimize your financial standing and guide you through Corporate Tax Solutions, ensuring your business thrives. In the event of an IRS audit, our Taxpayer Relief Services provide the support needed to navigate these challenges confidently, helping you maintain compliance and avoid penalties. With our expertise at your disposal, you can confidently face the complexities of tax compliance head-on.

- Mastering Year-End Tax Planning for Individuals and Businesses

- The Advantage of Engaging Certified Tax Preparers for Accurate Income Tax Calculation

- Comprehensive Tax Saving Strategies to Optimize Your Financial Position

- Navigating Corporate Tax Solutions: A Guide for Business Owners

- Understanding and Utilizing Taxpayer Relief Services in Times of IRS Audits

- Leveraging Expertise in Income Tax Calculation to Avoid Penalties and Maintain Compliance

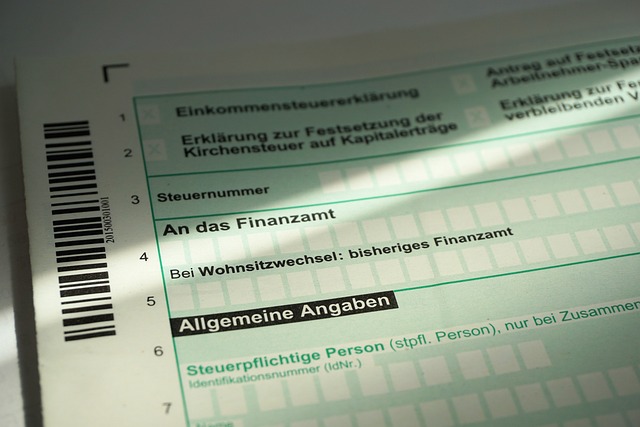

Mastering Year-End Tax Planning for Individuals and Businesses

Engaging in meticulous Year-End Tax Planning is a pivotal step for individuals and businesses to optimize their financial positions and minimize tax liabilities. Our Certified Tax Preparers specialize in crafting tailored strategies that consider the unique circumstances of each client. They leverage their deep understanding of income tax calculation and the intricacies of corporate tax solutions to ensure compliance with the latest tax laws and regulations. This proactive approach allows for the identification of potential deductions and credits, enabling clients to retain more of their hard-earned income.

As the fiscal year draws to a close, it’s crucial to review all financial activities to maximize tax savings. Our Taxpayer Relief Services provide comprehensive analysis and advice, guiding individuals and businesses through complex decisions involving investments, business operations, and personal financial planning. With our assistance, clients can navigate the often-daunting process of Year-End Tax Planning with confidence, knowing that every effort has been made to align their financial strategies with tax-saving opportunities. Our expertise in this area ensures that clients are well-positioned to face the new tax year with a solid foundation and a clear understanding of their financial obligations and potential savings.

The Advantage of Engaging Certified Tax Preparers for Accurate Income Tax Calculation

Engaging certified tax preparers is a prudent step for individuals and businesses alike seeking to navigate the complexities of income tax calculation with precision and accuracy. These professionals are well-versed in the nuances of year-end tax planning, ensuring that all legal tax-saving strategies are leveraged to optimize financial outcomes. Their expertise extends beyond mere computation; certified tax preparers provide strategic insights that can lead to significant savings for taxpayers. By staying abreast of the latest changes in tax laws and regulations, they guide clients through the intricacies of corporate tax solutions, ensuring compliance while maximizing tax benefits. This proactive approach not only simplifies the often daunting process of income tax calculation but also positions clients to make informed decisions that affect their financial health throughout the year.

Furthermore, certified tax preparers from reputable taxpayer relief services are instrumental in managing and reducing tax liabilities effectively. Their role is critical in scrutinizing financial records to identify potential deductions or credits that might have been overlooked otherwise. With a keen understanding of each client’s unique situation, these experts tailor their advice to align with individual objectives, providing personalized income tax calculation services. This bespoke approach ensures that clients are not only compliant with current tax laws but also positioned to take advantage of any future changes in the tax code, thereby safeguarding their financial well-being and contributing to sustainable growth for businesses.

Comprehensive Tax Saving Strategies to Optimize Your Financial Position

Engaging certified tax preparers is a prudent step for individuals and businesses seeking to optimize their financial positions through year-end tax planning. Our comprehensive approach ensures that every deduction and credit is explored to minimize your tax liability. By leveraging our expertise in income tax calculation, we meticulously analyze your financial situation, identifying opportunities for tax savings that align with your unique needs and objectives. Our strategies are tailored to not only comply with the intricate IRS regulations but also to position you favorably within the tax framework.

For those navigating the complexities of corporate tax solutions, our taxpayer relief services offer invaluable support. We understand that staying abreast of the ever-changing tax laws can be daunting. Our team of seasoned professionals is adept at interpreting and applying these changes to your advantage. We assist in structuring your finances in a manner that optimizes savings while ensuring compliance with the latest tax compliance and filing requirements. Our proactive approach during the year-end tax planning phase ensures that you are well-positioned to take full advantage of potential relief measures, thereby reducing your overall tax burden and enhancing your financial stability.

Navigating Corporate Tax Solutions: A Guide for Business Owners

As the intricacies of corporate tax solutions often surpass the expertise of many business owners, seeking professional assistance is prudent for year-end tax planning. Our certified tax preparers specialize in devising comprehensive strategies tailored to your business’s unique financial landscape. By engaging with our taxpayer relief services, you can navigate the complex maze of income tax calculations and regulatory requirements. We help businesses identify and implement tax-saving opportunities that align with their operational goals and financial objectives. Our expertise ensures that all potential deductions and credits are optimized, thereby reducing your overall tax liability. With the ever-changing landscape of tax laws and compliance demands, our services provide invaluable support to keep your business in good standing with the IRS. We stay abreast of the latest developments, offering you peace of mind as you focus on running your business rather than facing the complexities of corporate tax solutions alone. Our approach is to anticipate and address tax challenges proactively, leveraging our extensive knowledge of tax saving strategies to secure your company’s financial health. By partnering with us for your corporate tax needs, you’re not just following the letter of the law but also understanding the spirit in which it is meant to be applied, ensuring your business thrives amidst the dynamic tax environment.

Understanding and Utilizing Taxpayer Relief Services in Times of IRS Audits

When the IRS initiates an audit, it can be a daunting experience for taxpayers who are unprepared for the scrutiny and complexity involved. Navigating this process without expert guidance can lead to unnecessary stress and potential missteps. However, with Taxpayer Relief Services, individuals and businesses facing an audit have access to a team of seasoned professionals skilled in the intricacies of tax law. These services are designed to provide support throughout the audit process, from initial correspondence to final resolution. By leveraging the expertise of Certified Tax Preparers, taxpayers can ensure that all documentation is accurately presented and that their rights are upheld during the audit. This professional assistance not only facilitates a smoother audit experience but also helps in identifying any potential adjustments or additional liabilities, thereby minimizing the impact on your financial position.

Furthermore, Taxpayer Relief Services offer more than just audit support; they are an invaluable resource for Year-End Tax Planning and implementing effective Tax Saving Strategies. These services encompass a comprehensive approach to tax management, which includes income tax calculation and the development of Corporate Tax Solutions tailored to your specific needs. By engaging with these services, you can proactively address complex tax issues and take advantage of legal tax-saving opportunities. The goal is to optimize your tax situation, ensuring compliance while maximizing your savings. With the ever-evolving landscape of tax regulations, relying on Taxpayer Relief Services can provide peace of mind that your tax planning is aligned with current laws and regulations, keeping you in good standing with the IRS.

Leveraging Expertise in Income Tax Calculation to Avoid Penalties and Maintain Compliance

Navigating the complexities of income tax calculation is a critical aspect of maintaining compliance and avoiding penalties, especially with the dynamic nature of tax laws. Our IRS tax help services are equipped with certified tax preparers who specialize in year-end tax planning. These experts work diligently to ensure that each client’s financial situation is optimized for tax savings. By leveraging their deep understanding of the latest tax codes and regulations, they devise personalized strategies tailored to individual or corporate needs. This proactive approach not only helps in identifying potential deductions and credits but also in structuring financial decisions throughout the year to maximize savings while minimizing tax liabilities. Our team’s proficiency in income tax calculation is complemented by a suite of tax saving strategies, ensuring that clients are well-prepared for audit defense and compliance adherence. Additionally, our taxpayer relief services offer peace of mind, knowing that should complications arise, there is expert support to navigate the IRS system effectively and efficiently. With a commitment to staying abreast of the ever-evolving tax landscape, our clients can rest assured that their financial well-being is in capable hands. Our corporate tax solutions are designed to handle the intricacies of business taxation, ensuring that every dollar saved is a result of informed, strategic decision-making aligned with IRS regulations.

Navigating the complexities of tax compliance can be a daunting task for individuals and businesses alike. As the fiscal landscape evolves, mastering year-end tax planning becomes ever more critical. Our IRS tax help services stand ready to assist, offering expert guidance through Certified Tax Preparers who ensure accurate income tax calculation and the implementation of effective tax saving strategies. These strategies are designed to optimize your financial position while navigating the nuances of corporate tax solutions. In the event of an IRS audit, our Taxpayer Relief Services provide invaluable support, alleviating stress and ensuring adherence to regulations. By leveraging our expertise, individuals and businesses can maintain compliance and avoid penalties, securing their financial standing with the IRS. Trust in our comprehensive services to simplify your tax experience.