2023 heralds a new era in tax management as the digital revolution transforms income tax e-filing into an accessible and efficient process for millions. This article navigates through the landscape of easy tax filing, illuminating the benefits and features of online tax preparation platforms. From simplifying complex tax forms to maximizing your refund potential, these tools empower individuals with the knowledge and resources needed to navigate their fiscal responsibilities effectively. Delve into how tax refund tracking offers real-time updates, and discover the security measures in place for self-employed tax filing. Whether you’re a sole proprietor or an individual taxpayer, online tax solutions are tailored to suit your needs, ensuring that tax season becomes less of an obligation and more of a manageable task.

- Maximize Your Refund with Income Tax E-Filing: A Comprehensive Guide to Easy Tax Filing

- Navigating Online Tax Forms: Simplifying Your Tax Filing Experience

- The Advantages of Tax Refund Tracking: Real-Time Updates on Your Return

- Secure Online Tax Filing for Self-Employed Individuals: Streamlining Your Financial Obligations

- Tax Filing Assistance at Your Fingertips: Online Tools and Resources for Efficient Tax Preparation

- Understanding Tax Deductions Online: Strategies to Enhance Your Refund Potential

- E-Filing Deadlines Demystified: How to Stay Ahead of the Tax Season Curve

Maximize Your Refund with Income Tax E-Filing: A Comprehensive Guide to Easy Tax Filing

embarking on the process of income tax e-filing can significantly streamline your tax preparation experience. Utilizing online tax forms and filing software, self-employed individuals and others can easily navigate through complex tax codes and maximize their refund potential. The digital interface of these platforms offers a user-friendly environment where taxpayers can input their financial data accurately and efficiently. With access to comprehensive databases of the latest tax laws and regulations, tax filing assistance is readily available to guide users through each step of the process. This ensures that no critical deductions or credits are overlooked, potentially increasing one’s refund.

Furthermore, the ease of e-filing extends beyond simply submitting your return. It includes tracking your tax refund status in real-time, a feature that provides peace of mind and financial foresight. The security measures implemented by reputable online tax filing services safeguard your sensitive information throughout the process. These platforms employ encryption and other advanced cybersecurity practices to protect your data from unauthorized access. By leveraging these resources, taxpayers can file their taxes with confidence, knowing that their financial information is handled with the utmost care and that they are making informed decisions to optimize their tax situation.

Navigating Online Tax Forms: Simplifying Your Tax Filing Experience

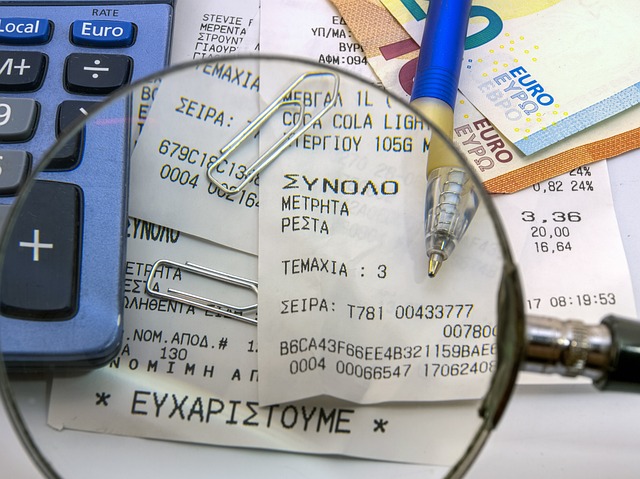

The advent of online tax preparation has significantly streamlined the process for individuals and self-employed taxpayers alike. With income tax e-filing, the cumbersome task of manually sifting through physical tax forms is a thing of the past. Taxpayers now have access to a plethora of user-friendly online tax forms that are easily navigable within comprehensive tax filing software platforms. These digital forms are designed with simplicity in mind, making easy tax filing accessible to everyone. The intuitive interface guides users through each step, from gathering personal information and income data to accurately filling out the necessary tax returns. Furthermore, these platforms often include features such as online tax calculators, which help taxpayers understand their financial situation better and optimize their refund potential by identifying available tax deductions.

The benefits of online tax return services extend beyond simplicity; they offer a secure and efficient method to manage your taxes. By filing taxes electronically, taxpayers can ensure the highest level of accuracy and compliance with current tax laws. The convenience of e-filing also means that tax deadlines are met promptly, avoiding potential penalties. Additionally, tax refund tracking has been revolutionized; taxpayers can now track their tax refund status in real-time, receiving their refunds faster than ever before. Online tax filing services often provide a dedicated support system for those who may require additional tax filing assistance. This ensures that all taxpayers, regardless of their tax situation or familiarity with the process, can confidently and efficiently manage their tax obligations from the comfort of their own home.

The Advantages of Tax Refund Tracking: Real-Time Updates on Your Return

The advent of income tax e-filing has significantly streamlined the tax refund process, offering self-employed individuals and taxpayers at large a seamless experience. With easy tax filing, taxpayers can submit their returns with a fraction of the effort and time required by traditional methods. A pivotal advantage of this modern approach is the ability to track tax refunds in real-time. This feature provides a level of transparency and reassurance, as taxpayers can monitor the status of their returns from submission to approval. Online tax forms are readily accessible within these platforms, ensuring that individuals have all the necessary documentation at their fingertips. The real-time updates on your return serve as a critical tool for managing expectations and reducing anxiety during the refund waiting period. Moreover, tax filing assistance is often integrated into these systems, guiding users through each step of the process, which is particularly beneficial for those navigating self-employed tax filing complexities. The security measures in place for secure online tax filing further enhance the user experience, protecting sensitive financial information and providing peace of mind throughout the tax season. By leveraging these advanced features, taxpayers can efficiently manage their fiscal responsibilities, optimize their refund potential, and engage with the tax system with greater confidence and control.

Secure Online Tax Filing for Self-Employed Individuals: Streamlining Your Financial Obligations

Self-employment brings with it a unique set of financial responsibilities, including the need to meticulously manage income tax obligations. Traditionally, this could be a complex and time-consuming task, but with the advent of income tax e-filing, self-employed individuals now have access to easy tax filing solutions that streamline their fiscal duties. Online tax forms and filing assistance are readily available, making it simpler for entrepreneurs to submit their returns accurately and efficiently. These digital platforms not only offer a comprehensive suite of tax tools, including online tax calculators, but they also ensure compliance with the latest tax laws and regulations. The ability to understand and utilize available tax deductions online can significantly boost one’s refund potential, providing a financial advantage that was previously out of reach for many.

Furthermore, the convenience of secure online tax filing extends beyond the initial submission. Taxpayers who are self-employed can benefit from real-time tax refund tracking features, which allow them to monitor their refund status without the typical delays associated with postal services. This transparency is invaluable for those who rely on their refunds for business reinvestment or personal financial planning. The security of online tax filing is paramount, with robust encryption and data protection measures that safeguard sensitive financial information throughout the e-filing process. By embracing these modern tax return services, self-employed individuals can not only save precious time but also manage their taxes in a secure and efficient manner, ensuring they fulfill their tax obligations with ease and confidence.

Tax Filing Assistance at Your Fingertips: Online Tools and Resources for Efficient Tax Preparation

The advent of digital technology has transformed income tax e-filing into a streamlined and user-friendly process. Self-employed individuals and taxpayers alike can now access easy tax filing solutions through online platforms specifically designed to simplify their financial obligations. These platforms offer a suite of tools, including comprehensive online tax forms that cater to a variety of tax situations. With intuitive interfaces and step-by-step guidance, these resources ensure that even those with limited knowledge of tax laws can navigate their responsibilities with confidence. The integration of tax refund tracking features allows users to monitor the status of their returns in real-time, providing peace of mind throughout the process. This feature eliminates the uncertainty and waiting periods associated with traditional mail-based systems. Furthermore, these secure online tax filing services are equipped with advanced encryption and privacy protections, safeguarding sensitive financial information against unauthorized access. The convenience of having tax filing assistance at your fingertips means that individuals no longer need to dedicate hours to manual calculations or risk errors associated with paper filings. Instead, they can efficiently manage their tax obligations from anywhere, at any time, ensuring compliance and maximizing refund potential while saving valuable time.

Understanding Tax Deductions Online: Strategies to Enhance Your Refund Potential

Income tax e-filing has become synonymous with ease and efficiency in managing one’s financial obligations. By utilizing online tax preparation tools, self-employed individuals and those with complex finances can navigate through their tax deductions with greater precision. These platforms offer a plethora of features, such as easy tax filing interfaces that guide users step by step, ensuring they do not miss out on any legitimate deductions that could enhance their refund potential. The integration of online tax calculators allows for real-time calculations, providing an accurate estimate of potential refunds based on the user’s financial situation and eligible deductions. This feature is particularly valuable as it empowers individuals to strategically plan their tax filings and maximize their returns. Additionally, access to comprehensive online tax forms simplifies the process, making it more accessible for those who may have found the traditional paper-based system cumbersome or intimidating.

Furthermore, with secure online tax filing, taxpayers can submit their returns with confidence, knowing that their sensitive financial information is protected by robust cybersecurity measures. E-filing also streamlines the process of tracking a tax refund, as tax authorities provide real-time updates on the status of one’s refund. This eliminates uncertainty and allows individuals to plan their finances accordingly. Tax filing assistance, often available through these online services, ensures that users are fully supported throughout the process, whether they are seeking guidance on which deductions to claim or how to accurately report self-employed income. The convenience, security, and comprehensive support provided by online tax preparation tools make them an indispensable resource for anyone looking to optimize their tax filings and potentially increase their refund.

E-Filing Deadlines Demystified: How to Stay Ahead of the Tax Season Curve

The advent of income tax e-filing has streamlined the process for individuals and self-employed taxpayers alike, allowing them to meet deadlines with greater ease and efficiency. E-Filing deadlines are critical dates set by tax authorities that dictate when tax returns must be submitted to avoid penalties. Staying ahead of the tax season curve is achievable with easy tax filing solutions that guide taxpayers through each step of the process. These solutions include comprehensive online tax forms, which are readily available and can be filled out at any time, providing a convenient alternative to paper-based submissions. By utilizing these digital resources, taxpayers can accurately report their income and take advantage of available deductions, thereby maximizing their potential tax refund.

Moreover, tax refund tracking services offer transparency and peace of mind by allowing individuals to monitor the status of their refund in real-time. This feature is particularly valuable as it eliminates uncertainty and keeps taxpayers informed every step of the way. Secure online tax filing ensures that sensitive financial information is protected throughout the e-filing process, giving taxpayers confidence in using these services. With professional tax filing assistance readily available online, navigating the complexities of self-employed tax filing is simplified, making the entire experience user-friendly and tailored to the needs of each taxpayer. By staying informed about e-filing deadlines and utilizing the full range of online tools and resources, individuals can effectively manage their tax obligations and maintain compliance with ease.

Income tax e-filing has undeniably reshaped the landscape of personal finance management. This article has explored the multifaceted benefits of utilizing online tax preparation services, from easy tax filing to understanding tax deductions and ensuring secure online tax filing for self-employed individuals. By leveraging the provided tools and resources, taxpayers can navigate their fiscal responsibilities with greater ease and confidence. As we continue to advance in the digital era, the advantages of these services will only expand, offering even more support and efficiency to those managing their income tax obligations. Embracing this modern approach not only simplifies the tax filing process but also empowers individuals to maximize their refund potential and stay ahead of deadlines with tax refund tracking. In summary, online tax preparation is a testament to the strides made in making personal finance more accessible and user-friendly for everyone.