navigating notary public risk protection is paramount for notaries in safeguarding their professional practices and personal assets against potential financial repercussions. This article explores the essential role of professional liability insurance tailored specifically for notaries, highlighting how it provides a shield against negligence, errors, or omissions claims. With a focus on Notary Legal Liability and ensuring Financial Security for Notaries, we delve into the importance of Notary Business Insurance in mitigating risks associated with notarial duties. Additionally, we outline effective strategies to Preventing Notary Liability, thereby maintaining a robust professional reputation within the industry. Understanding these aspects is crucial for notaries seeking to operate with confidence and due diligence in their professional capacity.

- Navigating Notary Public Risk Protection: Understanding Notary Legal Liability

- Ensuring Financial Security for Notaries through Professional Liability Insurance

- The Role of Notary Business Insurance in Mitigating Errors and Omissions Risks

- Strategies for Preventing Notary Liability and Maintaining a Robust Professional Reputation

Navigating Notary Public Risk Protection: Understanding Notary Legal Liability

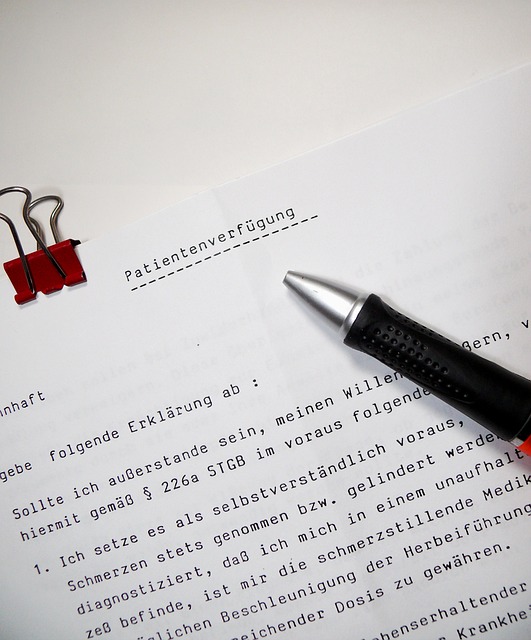

Notaries public play a critical role in the official record-keeping process, and as such, they are exposed to various risks associated with their duties. Notary Public Risk Protection is a specialized form of insurance designed to mitigate these risks by providing coverage for legal expenses and damages that may arise from claims of negligence or errors in notarial acts. Understanding Notary Legal Liability is essential for notaries to appreciate the full scope of protection this insurance offers. It safeguards against financial losses a client might suffer due to alleged notarial mistakes, ensuring their personal assets remain secure and their professional standing intact.

Financial Security for Notaries is paramount in an era where legal actions can be costly and damaging to a notary’s reputation and livelihood. Notary Business Insurance, encompassing the umbrella of Notary Public Risk Protection, is tailored to address the unique liabilities inherent in the role. This insurance serves as a shield against claims that may arise from document fraud, misrepresentation, or breach of duty. By securing this comprehensive coverage, notaries can navigate the complexities of their profession with greater confidence and peace of mind, knowing they have a robust defense against potential liability claims.

Ensuring Financial Security for Notaries through Professional Liability Insurance

Notaries play a critical role in the legal process by witnessing and certifying the validity of documents and transactions. As such, they are inherently exposed to professional risks that can lead to significant financial repercussions if a claim of negligence, error, or omission is made against them. Notary Legal Liability insurance serves as a safeguard, providing a robust shield for notaries against such claims. This specialized coverage extends beyond the scope of general liability insurance, addressing unique risks in the notarial field. It ensures that notaries are not personally liable for financial losses resulting from alleged mistakes or oversights in their professional duties. With Notary Public Risk Protection, notaries can rest assured that their business operations are protected, allowing them to conduct their services with confidence and peace of mind. This protection is not just about mitigating potential legal costs; it’s a fundamental aspect of Financial Security for Notaries. It safeguards their personal assets and reputation in the event of unfounded or frivolous claims, ensuring that their professional practice remains resilient against any financial fallout from their notarial activities.

Investing in Notary Business Insurance is a prudent step for any notary who wishes to maintain a successful and secure practice. This insurance acts as a safety net, offering coverage for legal defense costs and potential damages that could otherwise deplete a notary’s personal savings or assets. By preventing Notary Liability, this insurance not only protects the financial stability of individual notaries but also contributes to the overall integrity of the profession. It is an indispensable tool in managing risk and maintaining the trust of clients who rely on the precision and reliability of notarial services. With the right coverage, notaries can focus on serving their clients with professionalism and without undue concern for unforeseen legal challenges that could arise from routine notarial acts.

The Role of Notary Business Insurance in Mitigating Errors and Omissions Risks

Notary legal liability insurance plays a pivotal role in safeguarding notaries public from the risks inherent in their profession. This specialized form of coverage, often referred to as notary public risk protection, is tailored to address the unique exposures that notaries may face when executing their duties. It encompasses financial security for notaries by providing a safety net against claims arising from alleged negligence, errors, or omissions during notarial acts. This includes scenarios where a notary’s failure to perform a service with due care and diligence results in financial losses for the client. With notary business insurance, notaries can rest assured that their personal assets are shielded from potential legal judgments, thereby preserving their hard-earned professional standing. The coverage extends to various facets of a notary’s work, including document authentication, administration of oaths, and handling of sensitive information, ensuring comprehensive risk protection. In the event of a claim, this insurance offers defense costs and any settlements or judgments, allowing notaries to continue their practice without undue financial strain or damage to their reputation. Consequently, investing in notary business insurance is an essential step for professionals seeking to maintain both their financial security and the integrity of their service offerings in the face of unforeseen errors or omissions.

Strategies for Preventing Notary Liability and Maintaining a Robust Professional Reputation

To mitigate notary public risk and safeguard against notary legal liability, it is imperative for notaries to implement a comprehensive set of strategies that encompass both proactive measures and adherence to best practices. Firstly, staying abreast of the latest laws and regulations governing notarial acts is crucial. This includes understanding the specific jurisdictional rules that apply to their practice, as these can vary significantly. Notaries should also maintain meticulous records for each notarization performed, ensuring that all procedures are thoroughly documented. This not only aids in maintaining transparency but also provides a clear reference in case of any disputes or claims.

Secondly, investing in notary business insurance, specifically tailored professional liability insurance, is a prudent step towards financial security for notaries. This coverage shields notaries from the potential financial fallout of errors or omissions during the course of their duties. By having such a policy in place, notaries can protect personal assets from being jeopardized by legal claims. Additionally, maintaining a robust professional reputation hinges on the delivery of consistent, competent service. Notaries should continuously seek to enhance their skills and knowledge through ongoing education and training. Engaging with professional associations and networks can also provide valuable resources for staying informed about risk management practices. By prioritizing these efforts, notaries can effectively prevent notary liability and maintain a reputation that inspires trust and confidence among clients.

In conclusion, notaries play a pivotal role in the officialdom of society, and with such responsibility comes inherent risk. Understanding Notary Public Risk Protection is essential for notaries to grasp their exposure to legal liability. By securing comprehensive Notary Business Insurance tailored for Notary Legal Liability, notaries can ensure significant Financial Security for Notaries against claims of negligence, errors, or omissions. This insurance serves as a critical shield, protecting personal assets and upholding the professional reputation that is paramount to their practice. Implementing strategies to Preventing Notary Liability is not only prudent but a testament to a commitment to excellence and trustworthiness within their profession. As such, notaries should consider this insurance as an integral component of their business operations, safeguarding them against unforeseen events and ensuring continued service with integrity.