In today’s fast-paced digital era, income tax e-filing has revolutionized the way individuals and businesses manage their tax obligations. The convenience and efficiency of easy tax filing through online platforms have made it a preferred choice for many. These user-friendly interfaces offer comprehensive services, including tax preparation online, submission of online tax returns, and integration of online tax calculators to estimate liabilities and potential refunds. With the advent of free online tax filing services, taxpayers, especially self-employed individuals, can find tailored solutions that align with their financial situations. This article delves into the benefits of e-filing, provides essential tips for navigating tax season, and offers valuable assistance to ensure your self-employed tax filing is as smooth as possible. Embracing secure online tax filing not only simplifies the process but also fortifies your financial data against unauthorized access. Discover how to optimize your tax experience by leveraging the full potential of digital tools designed for income tax e-filing, and stay informed on the latest in easy tax filing practices.

- Maximize Your Tax Efficiency with Income Tax E-Filing

- Streamlining Tax Season for Easy Tax Filing with Online Tools

- Essential Tips and Assistance for Self-Employed Tax Filing Online

Maximize Your Tax Efficiency with Income Tax E-Filing

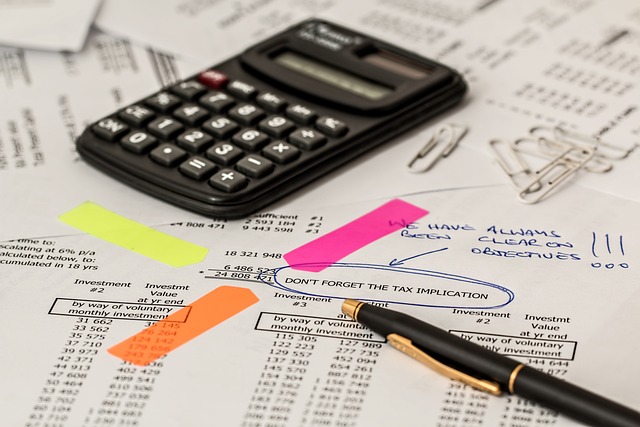

Engaging in income tax e-filing presents a plethora of advantages for taxpayers seeking to maximize their tax efficiency. Online platforms facilitate easy tax filing by providing intuitive interfaces and simple steps to complete your tax returns. These platforms are equipped with robust online tax forms tailored to individuals, self-employed professionals, and businesses alike. The convenience of digital submission is further enhanced by the integration of tax refund tracking tools, allowing you to monitor the status of your return with ease. This feature not only streamlines the process but also provides peace of mind as you await your potential refund.

Moreover, the security measures implemented in secure online tax filing ensure that sensitive financial data is protected throughout the entire e-filing process. The platforms employ encryption and other cybersecurity protocols to safeguard your information from unauthorized access. With professional tax filing assistance readily available online, you can confidently navigate complex tax codes and deductions. This level of support is invaluable for those who wish to optimize their tax experience, ensure compliance with tax laws, and take advantage of all the legal benefits available to them. By leveraging income tax e-filing, you can efficiently manage your tax obligations, freeing up time to focus on other important aspects of your life or business.

Streamlining Tax Season for Easy Tax Filing with Online Tools

Navigating tax season no longer has to be a daunting task with the advent of income tax e-filing systems. These user-friendly online platforms streamline the entire process, transforming the once arduous task into easy tax filing for individuals and self-employed taxpayers alike. The digital transformation of tax forms means that filers can access and submit their returns directly from a computer or mobile device, ensuring convenience and efficiency. For those who have historically found tax season to be complex and time-consuming, online tools offer a straightforward approach to tax preparation online. These platforms are equipped with intuitive interfaces and step-by-step guides that simplify the process, allowing users to effortlessly input their financial data and calculate their liabilities or potential tax refunds using online tax calculators.

Furthermore, the security measures implemented in secure online tax filing systems provide peace of mind for taxpayers concerned about the confidentiality of their personal and financial information. With end-to-end encryption and compliance with tax authorities’ standards, these platforms ensure that your data is protected throughout the e-filing process. Additionally, tax filing assistance is readily available online for those who may require help navigating complex tax laws or understanding their options for deductions and credits. Tax refund tracking services are also integrated into many of these systems, enabling taxpayers to monitor the status of their returns post-submission. This level of accessibility and support means that managing your self-employed tax filing has never been easier, as the digital tools designed to optimize your tax experience are at your fingertips throughout the tax season.

Essential Tips and Assistance for Self-Employed Tax Filing Online

For self-employed individuals navigating the complexities of income tax e-filing, leveraging easy tax filing solutions is paramount. Online platforms offer a suite of tools designed to streamline the process, including comprehensive online tax forms tailored for various business structures. To maximize efficiency and accuracy, it’s crucial to utilize these services to their fullest potential. Start by gathering all necessary financial documentation, such as income statements and receipts, to accurately complete your tax return. The platform’s intuitive interface will guide you through each step, from categorizing business expenses to calculating deductions that can significantly reduce your tax liability.

Furthermore, the ease of use is complemented by the added benefit of secure online tax filing. With robust encryption and privacy safeguards, your sensitive financial information is protected throughout the process. Additionally, self-employed tax filers have access to real-time tax refund tracking, allowing for better cash flow management post-filing. Tax filing assistance is also available through these platforms, offering support for any questions or complexities you may encounter. This support ensures that even if you’re new to the process or your tax situation is intricate, you can confidently file your taxes online, optimizing both your time and resources. Utilize the full range of tools and assistance provided by online tax filing platforms to make self-employed tax filing as smooth and stress-free as possible.

In today’s digital era, income tax e-filing stands as a testament to technological advancements simplifying the tax landscape for individuals and self-employed filers alike. The transition from traditional paper-based tax submissions to easy tax filing online has been a transformative journey, marking a significant stride towards convenience and efficiency in managing financial obligations. With robust online platforms that offer comprehensive tax services, including intuitive online tax forms, tax refund tracking, and secure online tax filing, the process is not only streamlined but also fortified with data protection measures. As we continue to navigate the complexities of tax laws, leveraging the insights provided by tax calculators and filing assistance ensures that filers maximize their tax efficiency while adhering to deadlines. Embracing digital solutions for self-employed tax filing optimizes the experience, making tax season less daunting. The future of tax filing is undoubtedly digital, and it invites us all to engage with the system confidently, knowing that each click brings us closer to fulfilling our fiscal responsibilities with precision and ease.