Online tax preparation has ushered in a new era for individuals managing their tax liabilities. The advent of income tax e-filing streamlines the process, allowing for timely and accurate tax submissions with the aid of user-friendly tax filing software. These digital tools equip taxpayers with easy online tax forms and tax refund calculators, making it simpler than ever to understand and apply for deductions that can maximize their refund potential. As we delve into the intricacies of self-employed tax filing in the digital age, it becomes clear that expert tax filing assistance is just a click away, ensuring real-time tax refund tracking and robust data protection measures. This article explores the multifaceted benefits of online tax return services, offering valuable insights into how you can leverage these resources to optimize your tax strategy efficiently and securely.

- Maximize Your Tax Refund with Income Tax E-Filing

- Simplify Your Tax Filing with Easy Online Tax Forms

- Navigating Self-Employed Tax Filing in the Digital Age

- Expert Tax Filing Assistance at Your Fingertips

- Real-Time Tax Refund Tracking: A Guide for Taxpayers

- Secure Online Tax Filing: Ensuring Data Protection and Compliance

- Leverage Online Tax Calculators to Optimize Your Tax Strategy

Maximize Your Tax Refund with Income Tax E-Filing

Engaging in income tax e-filing is a strategic approach for individuals and self-employed taxpayers looking to maximize their tax refunds. Unlike the traditional paper-based filing process, online tax filing through income tax e-filing systems streamlines the submission of your annual returns with ease. These platforms are designed with user-friendliness in mind, offering a straightforward interface where users can input their financial data using easy tax filing tools. The availability of comprehensive online tax forms means that even the most complex returns can be efficiently processed, ensuring all necessary information is accurately reported and that the correct amount of refund or payment is calculated.

Furthermore, the process of maximizing your tax refund potential becomes more manageable with access to online tax calculators, which help you understand how various deductions and credits may impact your refund. With secure online tax filing, you can trust that your sensitive financial information is protected throughout the process. Once your return is submitted via e-filing, tax refund tracking allows you to monitor the status of your refund in real-time, providing peace of mind as you eagerly await your return. This modern approach not only simplifies and accelerates the filing process but also offers valuable assistance for those who may struggle with self-employed tax filing or are new to managing their own taxes. By leveraging these digital tools and resources, taxpayers can confidently navigate their tax obligations and optimize their refunds with precision and security.

Simplify Your Tax Filing with Easy Online Tax Forms

Navigating the complexities of income tax e-filing can be streamlined with the availability of easy online tax forms. These digital forms are designed to mimic their paper counterparts, offering a familiar interface while simplifying the process for individuals and the self-employed alike. By utilizing these online tax forms, taxpayers can efficiently input their financial data, accurately calculate their tax liabilities, and identify potential deductions that could maximize their refund. The user-friendly nature of these platforms ensures that even those with minimal tax knowledge can file confidently and accurately. Furthermore, the integration of tax refund tracking services allows for real-time updates on the status of one’s refund, providing a sense of control and transparency throughout the process. With robust security measures in place, secure online tax filing becomes an attractive option for those looking to protect their sensitive financial information. These online tax preparation services not only save time but also offer a level of convenience and peace of mind that traditional methods cannot match, making tax season significantly less daunting for all filers.

For the self-employed, the benefits of easy online tax filing are even more pronounced. The ability to organize and categorize income and expenses from the comfort of one’s home or on the go is a game-changer. Online tax preparation software often includes specialized features tailored for freelancers and small business owners, such as scheduling installment payments and estimating quarterly taxes. Additionally, many of these platforms provide comprehensive tax filing assistance, including guidance on navigating complex deductions and credits. This assistance can be invaluable, especially for those who may not have access to a professional accountant. The convenience and efficiency of e-filing, coupled with the availability of such robust tax filing assistance, make managing one’s self-employment taxes a less burdensome task.

Navigating Self-Employed Tax Filing in the Digital Age

In the digital age, self-employed individuals face unique challenges when it comes to income tax e-filing. The process of managing one’s financial transactions and calculating taxes due can be complex, with a myriad of deductions and credits available that cater to their specific circumstances. However, the advent of online tax filing platforms has made this task easier than ever. These services offer easy tax filing solutions by providing comprehensive online tax forms tailored for self-employed individuals. With intuitive interfaces and step-by-step guidance, these tools simplify the process of reporting business income, expenses, and self-employment taxes. The integration of easy tax filing features with access to up-to-date tax laws ensures that users can accurately prepare their returns without the need for extensive knowledge of tax code. Furthermore, these platforms are designed to help users understand and maximize their tax refund potential by identifying relevant deductions and credits that apply to their situation.

For those who require additional assistance, many online tax filing services offer support from tax professionals. This ensures that even the most intricate tax situations are handled with care and precision. The security of sensitive financial information is paramount in the digital realm, and these services employ state-of-the-art encryption and secure login protocols to protect user data. Additionally, tax refund tracking is a feature that allows self-employed filers to monitor the status of their refund with real-time updates, providing peace of mind as they await their return. By leveraging these advanced online tax filing systems, self-employed individuals can navigate their tax obligations with confidence, efficiency, and security, making the digital age a boon for managing one’s financial responsibilities.

Expert Tax Filing Assistance at Your Fingertips

Online tax filing has transformed the complex and often daunting task of preparing income tax returns into a streamlined process accessible at your fingertips. With expert tax filing assistance readily available, self-employed individuals and those with intricate financial situations no longer need to navigate the convoluted world of tax forms and regulations alone. Advanced e-filing platforms offer a suite of user-friendly tools designed to simplify easy tax filing. These include comprehensive online tax forms tailored to your specific financial situation, detailed guides on how to claim all eligible tax deductions, and sophisticated tax calculators that estimate your refund potential with precision. The convenience extends beyond preparation; these services also provide real-time tax refund tracking, allowing you to monitor the status of your refund without the usual wait times or the need for repetitive phone calls. What’s more, the security measures implemented in secure online tax filing ensure that your sensitive financial information is protected throughout the process. This not only expedites the overall tax filing experience but also provides peace of mind, knowing that your data is encrypted and your return is filed accurately and on time. With expert support integrated into these platforms, you can confidently tackle your tax obligations with the assurance of professional guidance every step of the way.

Real-Time Tax Refund Tracking: A Guide for Taxpayers

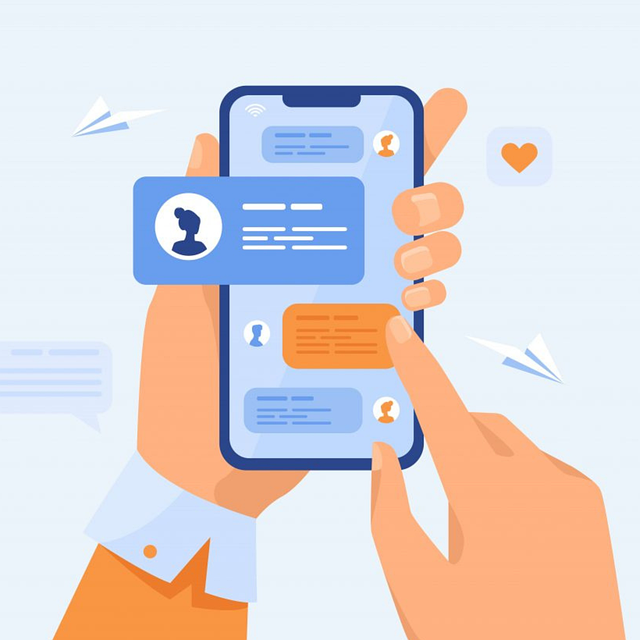

Engaging in income tax e-filing through online platforms offers a seamless and user-friendly experience for taxpayers, particularly those who are self-employed or have complex tax situations. These platforms streamline the process by providing easy tax filing access to comprehensive online tax forms. With just a few clicks, individuals can submit their returns accurately and efficiently, avoiding the common pitfalls of manual filings. The convenience extends beyond mere submission; it includes real-time tax refund tracking, which allows taxpayers to monitor their refund status throughout the processing period. This feature is invaluable for those eager to know the status of their returns, providing a sense of control and transparency that was previously unattainable.

Furthermore, online tax filing services are designed with security at their core, ensuring that sensitive personal and financial information is protected during transmission. The secure online tax filing process not only safeguards your data but also facilitates access to digital tax forms, which can be overwhelming for many taxpayers. By harnessing the power of these platforms, individuals can maximize their tax refund potential by understanding and utilizing available deductions. Additionally, should one require tax filing assistance, online services often provide guidance and support throughout the process, making complex tax situations more manageable. This guide to real-time tax refund tracking is a testament to the strides made in simplifying and securing the tax filing experience for all taxpayers.

Secure Online Tax Filing: Ensuring Data Protection and Compliance

The advent of secure online tax filing has transformed the landscape for individuals and self-employed taxpayers alike, offering a seamless and efficient means to fulfill income tax e-filing requirements. With the advent of digital platforms, taxpayers can easily access online tax forms, which are up-to-date and simplify the process of claiming deductions. These platforms are designed with robust security measures to protect sensitive financial information, ensuring that data transmission and storage comply with the highest standards of privacy and confidentiality. The encryption of data and secure login processes provide peace of mind, knowing that personal details are safeguarded against unauthorized access while navigating the complexities of tax laws.

Furthermore, the convenience of online tax filing extends beyond the initial submission; it includes the ability to track your tax refund with ease. Tax refund tracking offers real-time updates on the status of your refund, allowing you to plan and manage your finances more effectively. The intuitive design of these platforms means that even those who are less tech-savvy can utilize them without difficulty. For self-employed individuals, the benefits of online tax filing are particularly profound, as it streamlines the process of categorizing business expenses and income, thereby maximizing refund potential. Additionally, tax filing assistance is readily available through these platforms for those who require help or have questions about their specific tax situation. This comprehensive support system ensures that all taxpayers can confidently engage in self-employed tax filing while enjoying the convenience and security of online tax solutions.

Leverage Online Tax Calculators to Optimize Your Tax Strategy

Income tax e-filing has streamlined the process of preparing and submitting taxes, providing individuals with an easy tax filing experience. Online tax calculators are a cornerstone of this modern approach, enabling taxpayers to optimize their tax strategies by accurately estimating their tax liabilities and identifying potential deductions. These sophisticated tools analyze your financial situation, considering income sources, allowable expenses, and changes in tax laws, thus ensuring that self-employed tax filers can effectively manage their fiscal responsibilities. By inputting relevant data into the tax calculator, users receive real-time calculations of their tax obligations, which helps in planning ahead and making informed decisions to maximize refunds. Furthermore, these platforms offer access to a wide array of online tax forms, which are continually updated to reflect the latest tax regulations. This means that individuals no longer need to navigate through complex paper forms or guess at the correct forms needed; they can simply select from a digital repository. Additionally, the ease of use and convenience of these tools extend beyond filing to include tax refund tracking. Taxpayers can monitor the status of their refunds with secure online tax filing systems, receiving timely updates and ensuring that their refunds are processed accurately and efficiently. The security protocols in place for online tax filings are robust, protecting sensitive financial information with encryption and other cybersecurity measures. This allows users to file their taxes confidently, knowing that their personal data is safeguarded throughout the e-filing process. With the advent of user-friendly interfaces and comprehensive tax filing assistance available online, individuals can approach their tax obligations with greater confidence and less stress. Whether you are self-employed or an ordinary wage earner, leveraging these digital tools ensures that your tax return is not only compliant but also optimized for your financial situation.

In conclusion, the digital transformation in income tax e-filing has reshaped the way individuals manage their annual tax obligations. By utilizing easy tax filing resources and online tax forms, taxpayers, including those who are self-employed, can navigate the complexities of tax season with greater ease and precision. The integration of expert tax filing assistance at one’s fingertips ensures that even the most intricate tax scenarios are addressed. Furthermore, the ability to track tax refunds in real-time provides a level of transparency and convenience previously unattainable. With robust security measures in place for secure online tax filing, individuals can trust that their sensitive financial information is protected throughout the process. Embracing these advanced e-filing solutions not only simplifies tax preparation but also empowers taxpayers to optimize their tax strategies and maximize their refund potential, making the most of the digital age’s offerings in managing income tax obligations.