Effective investment tax planning stands as a cornerstone for investors aiming to enhance returns an…….

Author: Tax planning and filing

Mastering Self-Employment Taxes: Deductions, Retirement Savings, and Compliance Strategies

Self-employment offers a realm of freedom and opportunity, yet it comes with its own set of financi…….

Optimizing Financial Growth: Mastering Tax-Efficient Investment Strategies

Navigating the complexities of investment tax planning is crucial for optimizing returns and safegua…….

Optimizing Investment Portfolios for Tax Efficiency and Maximized Returns

Navigating the complexities of investment tax planning is a critical skill for any investor aiming t…….

Maximize Returns, Minimize Liabilities: A Strategic Guide to Investment Tax Planning

Effective investment tax planning is a cornerstone for enhancing returns and managing liabilities re…….

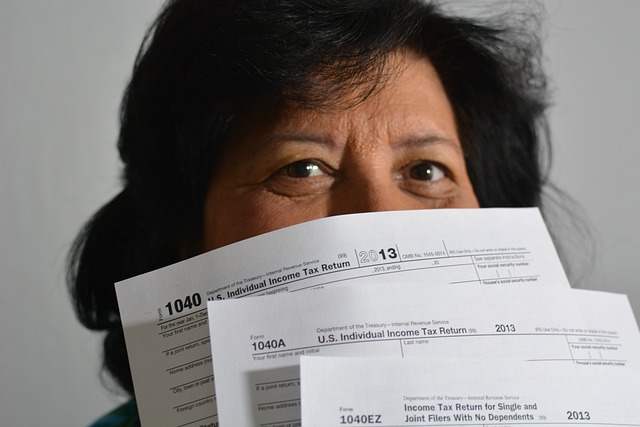

Year-End Tax Planning: Maximizing Savings and Avoiding Penalties Before 2023

2023 year-end tax planning merits careful attention to detail and strategic financial moves. As the …….

Mastering Tax Planning: Strategies for Savings and Compliance

Effective tax planning is a cornerstone of financial health, enabling individuals and businesses to …….

Maximizing Your Financial Health: A Strategic Guide to Tax Planning and Compliance

Managing one’s tax obligations is a cornerstone of sound financial strategy. As the fiscal year pro…….

Optimizing Portfolios: Mastering Investment Tax Planning for Maximum Returns

Navigating the complexities of investment tax planning is a pivotal aspect for savvy investors aimi…….

Strategic Tax Management for Financial Health: A Comprehensive Guide

naviguating the complexities of tax strategies is an integral aspect of a business’s financial heal…….