Self-employment offers a realm of autonomy and opportunity, yet it comes with its own set of financ…….

Author: Tax planning and filing

Mastering Tax Strategy: A Comprehensive Guide to Exemptions, Nonprofits, and Investment Optimization

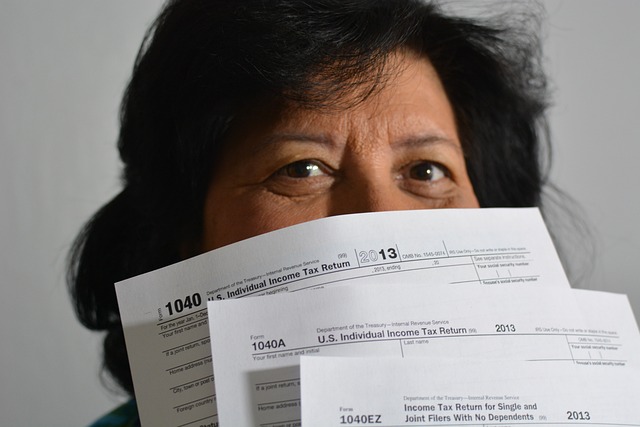

Navigating the complexities of tax planning and filing is a critical aspect of securing your financ…….

20XX Year-End Tax Planning: Maximizing Savings and Avoiding Penalties

2023 year-end tax planning is a strategic move for individuals and nonprofits alike. As the calendar…….

2023 Year-End Tax Planning: Maximize Savings & Avoid IRS Penalties

2023 is winding down, signaling the time to strategically manage your finances for optimal tax outco…….

Optimizing Your Investment Strategy for Maximum Tax Exemption and Efficiency

Effective investment tax planning is indispensable for optimizing returns while mitigating liabiliti…….

Strategic Tax Planning: A Comprehensive Guide for Maximizing Savings and Avoiding Penalties

Effective tax planning and filing are pivotal for securing your financial health. This article delve…….

Strategic Investment Tax Planning: Maximizing Returns with Tax-Efficient Vehicles and Filing Status Optimization

navigating the complexities of investment tax planning is a pivotal strategy for enhancing financial…….

Optimizing Business Tax Strategies: Compliance, Savings, and Financial Efficiency

Navigating the complexities of tax law is a pivotal aspect of business financial management. As busi…….

Maximizing Investment Returns: A Strategic Guide to Tax Exemption Eligibility and Efficient Investments

Navigating the complexities of investment tax planning is a pivotal strategy for investors aiming to…….

2023 Year-End Tax Planning: Maximize Savings & Avoid Penalties

2023 year-end tax planning is a prudent step for individuals aiming to minimize their tax liabilitie…….