Commercial auto coverage provides tailored protection for businesses using vehicles, offering comprehensive liability and specialized coverage for custom parts, equipment, and varying fleet sizes. It's essential for diverse industries, safeguarding against accidents, theft, and operational disruptions, especially with modern business demands and evolving vehicle technologies. Regular policy reassessments are recommended to ensure optimal coverage and cost efficiency based on changing operational and industry landscapes.

In the dynamic landscape of business, where every vehicle on the road represents a mobile asset, commercial auto coverage emerges as an indispensable partner. From fleet operators to solopreneurs delivering goods, understanding and leveraging this specialized insurance is crucial for seamless operations and financial protection. This article guides you through the intricate benefits, from comprehensive parts coverage to tailored policies, that make commercial auto insurance a strategic necessity in today’s market, where flexibility meets peace of mind.

- Understanding Commercial Auto Coverage: Benefits for Every Business

- Fleet Vehicles to Delivery Vans: Who Needs It and Why

- Custom Parts and Equipment: Ununique Advantages of This Insurance

- Market Insights: The Growing Demand for Flexible Business Policies

- When to Revisit Your Auto Insurance: Ensuring Smooth Operations

Understanding Commercial Auto Coverage: Benefits for Every Business

Commercial auto coverage is tailored to meet the unique needs of businesses operating on the road. Unlike standard personal vehicle insurance, it offers comprehensive protection for a range of commercial vehicles, from trucks and vans to specialized equipment. One of its key advantages lies in the ability to cover custom parts and equipment, which are often integral to a business’s operations and added value to their fleet.

This type of insurance provides peace of mind by ensuring that if your business vehicle is damaged or stolen, you’re protected. It also includes liability coverage, safeguarding your business against claims arising from accidents involving your vehicles. With the increasing demand for flexible policies, commercial auto coverage allows businesses to customize their plans according to specific needs, offering a range of options to suit different industries and fleet sizes.

Fleet Vehicles to Delivery Vans: Who Needs It and Why

Commercial auto coverage is not just for large fleet operators; it’s a vital tool for businesses of all sizes, from solo entrepreneurs to established companies. Whether you’re transporting goods, equipment, or your valued team members, this specialized insurance provides protection tailored to your unique needs.

For instance, if you own a delivery van, this policy ensures that in case of an accident or theft, your valuable cargo and vehicle are covered. It also includes liability protection, shielding you from potential claims arising from accidents involving other vehicles or individuals. This is especially crucial as delivery services become increasingly common, with businesses relying on efficient transportation to meet customer demands.

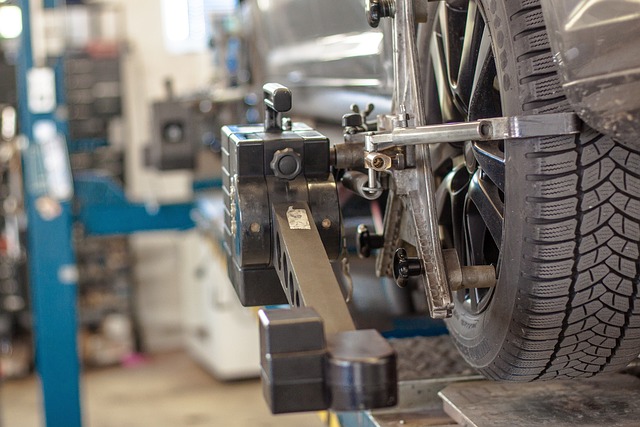

Custom Parts and Equipment: Ununique Advantages of This Insurance

Commercial auto coverage offers a unique advantage in its ability to safeguard custom parts and equipment installed in your vehicles. For businesses that rely on specialized machinery or aftermarket enhancements, this is particularly crucial. It means that if your fleet vehicle or delivery van suffers damage—whether due to an accident or other risks—your insurance will cover the cost of repairing or replacing these unique components. This is especially beneficial for small businesses and entrepreneurs who may have invested heavily in custom setups tailored to their specific operational needs, ensuring their business runs smoothly without unexpected financial setbacks.

Moreover, this coverage extends beyond merely fixing damage; it can also include the replacement value of the custom parts and equipment if they are stolen or lost. This comprehensive protection is a game-changer for businesses operating with specialized vehicles, as it safeguards their unique configurations, keeps operations running seamlessly, and mitigates potential financial losses from unforeseen circumstances.

Market Insights: The Growing Demand for Flexible Business Policies

In today’s dynamic business landscape, market insights reveal a significant shift in demand for flexible and tailored auto insurance policies. The traditional one-size-fits-all approach no longer caters to the diverse needs of modern businesses, especially those operating various types of commercial vehicles. Entrepreneurs and fleet managers are increasingly recognizing the value of insurance that understands their unique challenges. This shift is driven by several factors: the rise of remote work, which expands the operational radius of businesses; the growing complexity of vehicle technology, requiring specialized coverage for advanced parts and systems; and the need for cost-effective solutions without compromising on protection. As a result, insurers are responding with innovative policies that offer customized options, catering to specific business requirements, be it a small delivery service or a large trucking operation.

When to Revisit Your Auto Insurance: Ensuring Smooth Operations

As a business owner, your operations are constantly evolving, and so should your insurance coverage. It’s wise to revisit your auto insurance policy at regular intervals, especially when significant changes occur in your business or the market. For instance, expanding your fleet or introducing new types of vehicles into your operation? These changes could impact your risk profile, potentially leading to higher premiums or uncovered areas.

Similarly, keep an eye on industry trends and regulatory updates related to commercial auto insurance. New laws or technological advancements might introduce specific coverage requirements or offer more flexible options that better suit your business needs. Regularly reviewing your policy ensures you stay protected, save costs, and maintain seamless operations on the road.

Commercial auto coverage is not just a consideration; it’s an essential tool for businesses navigating the road ahead. By understanding its unique benefits, from protecting valuable equipment to offering flexible solutions, business owners can ensure their operations remain seamless and resilient. With market trends indicating a growing demand for tailored policies, revisiting your insurance strategy now could prove to be a game-changer, keeping your business moving smoothly into the future.