Implementing robust tax strategies is paramount for businesses aiming to thrive financially. Effecti…….

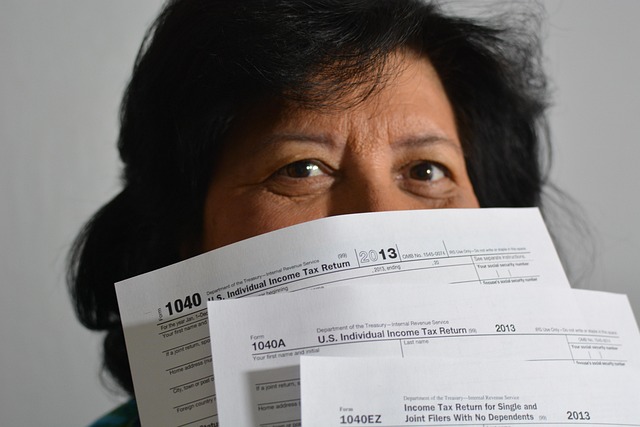

Category: Tax planning and filing

Year-End Tax Planning: Maximize Deductions, Minimize Taxes with Proactive Strategies

As the year winds down, it’s time to focus on year-end tax planning. By reviewing your financial act…….

Year-End Tax Planning: Strategies for Savings & Compliance

As the year winds down, it’s time to focus on year-end tax planning. By reviewing your financial act…….

Maximize Returns, Minimize Taxes: Strategic Investment Tax Planning for Success

Investment tax planning is a strategic must for maximizing returns and minimizing liabilities. Under…….

Mastering Tax Planning: Strategies for Savings, Compliance, and Maximized Returns

Navigating complex tax planning and filing is crucial for achieving financial well-being. Effective…….

Master Tax Planning: Strategies for Savings, Compliance, and Optimization

Navigating the complexities of tax planning and filing is essential for financial well-being. Effect…….

Maximize Self-Employed Tax Deductions, Avoid IRS Penalties, and Boost Exemption Eligibility

Self-employed individuals face unique tax challenges but also have opportunities to maximize deducti…….

Year-End Tax Planning: Maximize Savings, Minimize IRS Penalties

As the year winds down, it’s time to shift gears from holiday cheer to year-end tax planning. Maximi…….

Master Tax Planning: Strategies for Exemptions, Deadlines & Optimal Returns

Understanding Tax Deductions and Credits: Unlocking Tax Exemption EligibilityIRS Filing Deadlines: A…….

Master Tax Planning: Strategies for Savings and Compliance

Navigating tax planning and filing complexities is crucial for achieving financial well-being. Effec…….