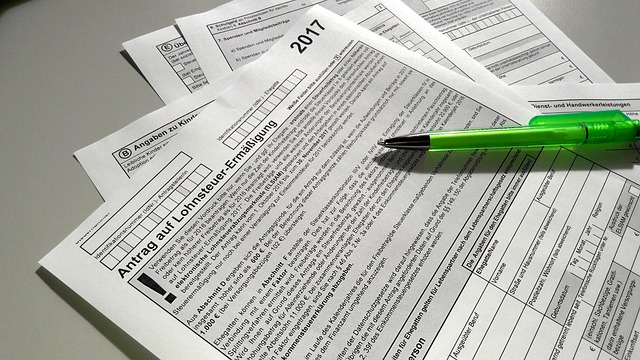

As the year draws to a close, tax planning is crucial. By reviewing your financial activities and im…….

Category: Tax planning and filing

Year-End Tax Planning: Save Money, Stay Compliant with Last-Minute Strategies

As the year closes, engaging in strategic year-end tax planning is crucial. Reviewing financial acti…….

Maximizing Tax Deductions: Strategies for Self-Employed Success and IRS Compliance

Self-employed individuals face unique tax challenges but also have opportunities to maximize deducti…….

Maximizing Tax Deductions and Credits for Self-Employed: Navigating IRS Deadlines and Nonprofit Filing

Tax Exemption Eligibility for Self-Employed Individuals: Understanding Crucial Deductions – Home o…….

Maximize Tax Savings for Self-Employed: Deductions, Strategies, and Deadlines

Self-employed individuals face unique tax challenges but also have opportunities to maximize deducti…….

Mastering Tax Planning: Strategies for Financial Well-being and Compliance

Navigating the intricate world of tax planning and filing is paramount for achieving financial well-…….

Mastering Tax Strategies: Compliance, Planning, and Savings for Businesses

Tax Exemption Eligibility: Unlocking Potential Savings for Businesses and NonprofitsUnderstanding IR…….

Maximize Returns, Minimize Liabilities: Strategic Investment Tax Planning

Investment tax planning is a strategic approach to maximizing returns while minimizing liabilities……..

Maximizing Returns: Strategic Tax Planning for Investments & Nonprofits

Investment tax planning is a strategic approach to maximizing returns and minimizing liabilities. Un…….

Mastering Taxes for Self-Employed: Deductions, Credits, Deadlines & Strategies

Self-employed individuals face unique tax challenges but also have opportunities to maximize deducti…….