Claims management is a critical component of insurance operations, directly influencing underwriting decisions. A robust claims management system provides valuable data on claim frequencies and severities, empowering underwriters to refine risk assessments and policy evaluations. Through actuarial analysis and precise risk classification, insurers can accurately calculate premiums and improve coverage offerings. This seamless integration between claims management and underwriting enhances risk mitigation, ensures fair insurance premiums, and ultimately boosts policyholder satisfaction through efficient policy issuance and transparent claim handling.

- Understanding Claims Management: The Cornerstone of Insurance Operations

- Data-Driven Insights: How Claims Information Influences Underwriting Decisions

- Actuarial Analysis and Risk Classification: Unlocking Precision in Policy Evaluations

- The Impact on Premium Calculation: Ensuring Fairness and Accuracy

- Streamlining Policy Issuance: Efficient Processes for Enhanced Customer Experience

- Building Trust through Transparent Claim Handling and Policy Management

Understanding Claims Management: The Cornerstone of Insurance Operations

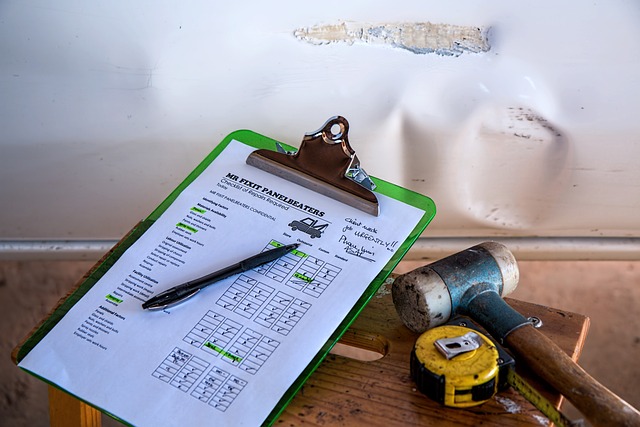

Claims management is a critical process in the insurance industry that forms the very foundation of efficient operations. It involves the systematic handling and processing of insurance claims, from initial report to final settlement. This robust system captures and analyzes data related to claim frequencies, severities, and patterns, offering invaluable insights for both claims adjusters and underwriters. By understanding the nuances of claims management, insurers can optimize their processes, ensuring a seamless experience for policyholders while maintaining financial stability.

For underwriters, claims management serves as a powerful tool for actuarial analysis. It enables them to study historical data on claims trends, enabling more precise risk classification. This information directly influences the determination of insurance premiums and policy issuance criteria. Through effective claims management, insurers can anticipate potential risks, adjust their pricing strategies, and offer tailored coverage options, ultimately enhancing the entire insurance lifecycle.

Data-Driven Insights: How Claims Information Influences Underwriting Decisions

Claims management plays a pivotal role in providing data-driven insights that directly influence underwriting decisions. By meticulously tracking and analyzing claim frequencies and severities, insurers gain valuable information about risk profiles. This actuarial analysis allows underwriters to refine their risk classification methods, ensuring more accurate assessments of future risks. For instance, identifying patterns in specific types of claims can lead to adjustments in policy coverage and exclusions, better reflecting the actual risk associated with particular activities or demographics.

The integration of robust claims management systems into underwriting processes enhances the overall precision of insurance premium calculations. Accurate risk classification feeds into policy issuance decisions, ensuring that each policy is tailored to reflect the unique needs and risks of individual policyholders. This not only improves coverage determination but also fosters higher policyholder satisfaction by providing policies that align with their actual risk profiles, ultimately contributing to a more stable and sustainable insurance market.

Actuarial Analysis and Risk Classification: Unlocking Precision in Policy Evaluations

Claims management is a critical component that drives accurate actuarial analysis and risk classification within the insurance industry. By efficiently managing claims, insurers gain access to valuable data on claim frequencies and severities across different policy types and demographics. This data-driven approach enables actuaries to delve into intricate patterns and trends, facilitating more precise risk assessments. Through sophisticated statistical methods and models, they can identify high-risk areas or populations and incorporate these insights into their risk classification frameworks.

Such granular analysis powers the entire insurance lifecycle, from policy issuance to premium calculation. Actuaries can employ this data to refine their risk classification methods, ensuring that policy premiums accurately reflect the underlying risks. This precision translates to better coverage determination, where policies are tailored to meet specific needs while maintaining financial viability for both insurers and policyholders. Ultimately, robust claims management acts as a catalyst for enhanced actuarial analysis, leading to more accurate risk classification and improved insurance policy issuance.

The Impact on Premium Calculation: Ensuring Fairness and Accuracy

Effective claims management plays a pivotal role in refining insurance premium calculation processes. By gathering and analyzing historical claim data, insurers can identify patterns and trends that directly influence risk assessment. This actuarial analysis involves scrutinizing claim frequencies—how often policies are engaged—and severities, or the financial burden of each claim. Such insights empower underwriters to adjust their risk classification methods accordingly.

Accurate risk classification is paramount for ensuring fairness in premium determination. Through rigorous claims management, insurers can anticipate potential risks associated with specific demographics, locations, or policy types. This allows for more precise calculations, preventing overcharging or underpricing policyholders based on legitimate risk factors. Consequently, robust claims management contributes to transparent insurance practices, fostering trust between insurers and policyholders.

Streamlining Policy Issuance: Efficient Processes for Enhanced Customer Experience

Efficient claims management significantly streamlines policy issuance, leading to enhanced customer experiences. By automating and digitizing claim processing, insurance providers can reduce manual effort and errors, expediting the entire workflow. This efficiency is particularly crucial during peak seasons or in response to natural disasters, where rapid policy issuance can mean the difference between providing timely coverage or losing potential clients to competitors.

Moreover, seamless claims management integrates actuarial analysis into policy issuance. Underwriters can leverage historical data from processed claims to refine risk classification models, ensuring more accurate insurance premiums. This proactive approach enables insurers to offer tailored coverage options that accurately reflect the risks associated with individual policyholders, thereby fostering trust and long-term satisfaction among customers.

Building Trust through Transparent Claim Handling and Policy Management

Building trust is paramount in the insurance industry, and a key pillar of this is transparent claims management. When policyholders file a claim, they expect a fair, efficient, and open process. A robust claims management system ensures that every step of the claim handling process is well-documented and accessible, from initial reporting to final settlement. This transparency not only facilitates quicker claim resolution but also strengthens the relationship between insurers and their clients. Policyholders who experience transparent claims management are more likely to view their insurer as reliable and trustworthy, fostering a sense of loyalty.

This trust extends beyond individual interactions; it influences overall policy management. Actuarial analysis, heavily reliant on historical claims data, benefits from this transparency. Insurers can leverage these insights for accurate risk classification, informed policy issuance, and precise insurance premium calculations. By embracing transparent claim handling practices, insurers demonstrate their commitment to ethical business operations, setting the stage for long-term success in a competitive market while enhancing policyholder satisfaction.

Claims management is not just a process; it’s a dynamic force driving the insurance industry forward. By integrating robust claims data into underwriting decisions through actuarial analysis and risk classification, insurers can significantly enhance their premium calculations, policy evaluations, and overall customer experience during policy issuance. This holistic approach, where claims management and underwriting collaborate harmoniously, ultimately fosters trust, ensures fairness in pricing, and promotes a seamless interaction with policyholders, solidifying the foundation for a thriving insurance business.