When involved in a fender bender, car repair costs can vary widely depending on vehicle type, damage severity, and local labor rates. It's important to consider these potential expenses when evaluating collision insurance coverage. Collision insurance covers repair costs after you pay your deductible, with higher deductibles typically lowering monthly premiums but requiring more out-of-pocket payment upon a claim. Selecting the right deductible and understanding your policy are key to financially preparing for repairs. A comprehensive collision insurance plan can protect you from the high costs of car repairs, often beyond personal savings, and help mitigate the immediate financial impact of accidents whether you're at fault or not. Policyholders must balance affordability with their ability to cover the deductible, and it's advisable to reassess coverage regularly as repair costs increase. Collision insurance is crucial for safeguarding against the significant expenses associated with vehicle repairs post-accident, and careful selection of coverage based on vehicle value, driving habits, state requirements, and personal risk tolerance is essential for financial protection. Always consider customer service reputation when selecting an insurer to ensure a smooth claims process.

When a fender bender strikes on a congested Monday morning, the immediate concern often shifts to the cost of repairs. Without car accident repair coverage, these expenses can be financially burdensome. Collision insurance emerges as a safety net, shielding your finances from unexpected bills. This article delves into the intricacies of collision insurance, particularly focusing on deductibles and their role in managing costs. From budget-friendly to comprehensive plans, understanding your coverage options is pivotal for making an informed choice. As repair expenses ascend, the necessity of robust collision insurance becomes ever more apparent. We’ll navigate the post-accident process, evaluate different plans, and strategize on selecting the most suitable collision insurance tailored to your needs.

- Assessing Fender Bender Repair Costs

- The Role of Collision Coverage Post-Accident

- Collision Insurance Deductibles Explained

- Evaluating Affordable vs Premium Collision Plans

- Understanding the Impact of Rising Repair Costs

- Navigating Car Accident Repair Without Coverage

- Strategies for Choosing the Right Collision Insurance

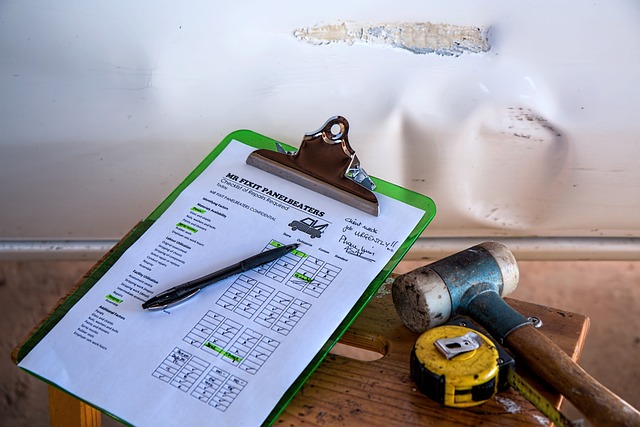

Assessing Fender Bender Repair Costs

When a fender bender occurs, the immediate concern often shifts to the repair costs that will ensue. These costs can vary significantly depending on factors such as the type of vehicle involved, the extent of the damage, and the labor rates in your area. It’s important to assess these costs carefully to understand what you might be facing financially if an accident were to happen. Minor repairs like fixing a headlight or replacing a bumper could still set you back several hundred dollars, while more extensive damage could reach into the thousands. Understanding the potential outlay can help you determine the right level of collision coverage for your needs and budget.

Collision insurance plays a vital role in mitigating these costs. It covers damages to your car when it collides with another object, regardless of who is at fault. With this coverage, you choose a deductible—the amount you agree to pay out-of-pocket before your insurance kicks in. A higher deductible typically leads to lower premiums, but it means you’ll shoulder more of the repair costs should you need to file a claim. Conversely, a lower deductible means your insurer will cover more of the expenses upfront, albeit with higher monthly payments. Assessing the potential costs of fender bender repairs in conjunction with the terms of your collision insurance policy can provide a clearer picture of how much financial protection you need against unexpected vehicle repair bills. This proactive approach ensures that should an accident occur, you are better equipped to handle the situation without undue financial strain.

The Role of Collision Coverage Post-Accident

When involved in a fender bender or more significant collision, having collision coverage can alleviate the immediate financial strain. This type of insurance is specifically designed to cover the cost of repairs to your vehicle after an accident, regardless of who is at fault. It steps in where your pocket would otherwise be left exposed, especially considering that car repair expenses can be substantial, often exceeding the average person’s savings. With collision coverage, policyholders typically face a deductible—a fixed amount they must pay out-of-pocket before their insurance kicks in. The selection of an appropriate deductible balance is crucial; a lower deductible means higher premiums but reduces your financial responsibility post-accident, while a higher deductible can lead to more affordable monthly payments. Ultimately, understanding the ins and outs of collision coverage empowers drivers to make decisions that protect their finances and ensure they are not caught off guard by unexpected repair bills following an accident. It’s a proactive measure that provides peace of mind on the road, where unforeseen events can have significant consequences.

Collision Insurance Deductibles Explained

When considering collision insurance, understanding your deductible is key to grasping how much you will need to pay out of pocket before your insurance coverage kicks in. A deductible is the amount you agree to cover toward repair costs before your insurer contributes to the expenses. Typically, selecting a higher deductible can lower your monthly premium, but this means you’ll owe more in the event of an accident before your insurance coverage becomes active. For instance, if your car sustains $5,000 worth of damage and you have a $1,000 deductible, you would be responsible for paying the first $1,000, while the insurance company would cover the remaining $4,000, minus any additional policy limitations. Conversely, choosing a lower deductible will result in higher premiums but will reduce your financial responsibility after an accident. It’s important to balance the cost of your monthly payments with the amount you can comfortably pay out of pocket in the event of an incident. This choice should align with your overall risk tolerance and financial planning, ensuring that you are neither overburdened by a large deductible nor paying more for insurance than is necessary for your situation.

Evaluating Affordable vs Premium Collision Plans

When evaluating affordable versus premium collision plans, it’s essential to consider the coverage limits and policy terms associated with each option. Affordable collision plans typically come with higher deductibles, meaning you will pay more out of pocket before your insurance kicks in. This can make them a more budget-friendly choice on a monthly basis, but you need to be prepared for greater expenses if you’re involved in an accident. On the other hand, premium plans often have lower deductibles, offering broader coverage and potentially more protection. They usually come with a higher monthly cost, but they can provide peace of mind knowing that you won’t face as large a financial burden if your car requires extensive repairs.

Another factor to consider when comparing these two types of plans is the choice of repair shop. Some affordable collision plans may limit your options to certain repair facilities, which could impact the quality and cost of repairs. In contrast, premium plans might offer greater flexibility in selecting a repair shop, allowing you to choose one with a reputation for high-quality work that may not be the most cost-effective but ensures your vehicle is repaired to a satisfactory standard. Ultimately, the decision between an affordable or premium collision plan depends on your financial situation, risk tolerance, and expectations for service quality and repair shop choice. It’s important to carefully assess your needs and budget to determine which collision insurance option aligns best with your priorities.

Understanding the Impact of Rising Repair Costs

As repair costs continue to escalate, the importance of having collision coverage becomes ever more evident. The rise in costs is attributed to various factors, including advancements in vehicle technology that necessitate specialized parts and labor, as well as increasing material costs. This trend means that even a minor accident can result in significant expenses. Without adequate insurance, drivers are exposed to financial burdens that could strain their budgets or even lead to financial distress. Collision coverage serves as a safety net, mitigating the impact of these rising costs by covering repair expenses up to the limits of your policy after you fulfill your deductible. Understanding your deductible—the amount you agree to pay out-of-pocket before your insurance kicks in—is key to managing potential financial risks. By carefully considering your coverage options and choosing a deductible that aligns with your financial situation, you can ensure that unexpected repair costs won’t derail your finances during an already stressful time following an accident. It’s essential to regularly review and adjust your policy as needed to keep pace with the ever-changing landscape of vehicle repair costs.

Navigating Car Accident Repair Without Coverage

When a fender bender occurs, especially on a busy day like Monday morning, the immediate aftermath can be chaotic and stressful. Without collision coverage, the financial implications of such an incident can be particularly daunting. The costs associated with car accident repairs can be unexpectedly high, encompassing everything from the labor of mechanics to the parts required for the fix. These expenses are not limited to the essential repairs; they may also include rental car fees during the time your vehicle is being mended. In such scenarios, the lack of collision insurance means these costs fall squarely on the driver’s shoulders. It underscores the importance of considering collision coverage as part of one’s auto insurance policy. This type of coverage helps mitigate the financial impact by covering the repair costs after an accident, regardless of who is at fault. Understanding your deductible amount—the fixed sum you agree to pay out-of-pocket before your insurance kicks in—is key to assessing the true cost of the coverage and its value in protecting your finances during these challenging times. Navigating car accident repairs without collision coverage can lead to significant financial strain, highlighting the prudence of evaluating your insurance options carefully to ensure adequate protection.

Strategies for Choosing the Right Collision Insurance

When selecting the right collision insurance, it’s important to consider several factors to ensure adequate coverage without unnecessary financial strain. Firstly, assess your vehicle’s value and the cost of repairs relative to your insurance premiums. A newer or more expensive car might require a higher level of coverage to cover potential repair costs effectively. Secondly, evaluate your state’s legal requirements for car insurance as they set the minimum levels of coverage you must have. Beyond this baseline, consider additional factors such as the frequency and nature of your driving, your car’s safety features, and your personal risk tolerance.

Another key aspect to consider is the deductible amount. A higher deductible can lead to lower premiums, but be mindful that you will need to pay this amount out-of-pocket if you file a claim. Conversely, a lower deductible means less financial responsibility in the event of an accident but will typically result in higher premiums. It’s a balancing act between monthly costs and the level of protection you desire. Additionally, shopping around for quotes from multiple insurers can yield significant differences in pricing for identical or similar coverage levels. Lastly, consider the reputation and customer service record of the insurance provider. A smooth claims process and reliable customer support can be invaluable when dealing with the stress of an accident. By carefully evaluating these aspects, you can make a well-informed decision that aligns with your financial situation and risk profile.

When encountering the unexpected, such as a fender bender on a crowded street, the repercussions extend beyond immediate safety concerns to the financial realm. The article has outlined the critical importance of collision coverage in mitigating the high costs associated with accident repairs. From grasping deductibles to comparing affordable and premium plans, the insights provided aim to equip you with the knowledge necessary to make a prudent choice for your automotive insurance needs. As repair expenses continue to rise, the value of comprehensive collision insurance becomes increasingly evident. In light of this, it is advisable to review your current coverage and consider any adjustments to ensure you are adequately protected in the event of an incident. Being prepared not only safeguards your finances but also offers peace of mind on the road.