In 2024, rising vehicle repair costs due to technology, materials, and labor shortages make collision coverage in car insurance crucial. New cars, despite advanced features, face high repair bills after accidents. When choosing collision coverage, assess your vehicle's value, financial status, local laws, and driving history to set appropriate limits.

- Understanding Collision Coverage: What It Covers

- Rising Repair Costs in 2024: A Growing Concern

- Why Collision Insurance Matters for New Cars

- Protecting Older Vehicles: The Case for Collision Insurance

- Different Types of Collision Coverage Options

- How to Determine Adequate Collision Coverage

Understanding Collision Coverage: What It Covers

Rising Repair Costs in 2024: A Growing Concern

The year 2024 has brought to light a significant concern among vehicle owners—rising repair costs. This trend is particularly alarming for those involved in accidents, as the financial burden of fixing their vehicles can be substantial. The increase in costs is attributed to several factors, including advancements in technology, higher material prices, and a shortage of skilled labor. Modern cars are equipped with complex systems and materials, making repairs more intricate and expensive than ever before. For instance, replacing a single component in a high-tech vehicle might cost hundreds or even thousands of dollars.

This surge in repair expenses has made collision coverage an increasingly vital aspect of car insurance. As the financial impact of accidents becomes more pronounced, drivers must consider whether their current insurance policies provide sufficient protection against these rising costs. Understanding the value of collision insurance is essential for both new and vintage vehicles, ensuring that owners are not left with overwhelming bills when faced with unforeseen collisions.

Why Collision Insurance Matters for New Cars

New cars, despite their sleek design and advanced features, are highly susceptible to damage from accidents. The initial cost of purchasing a new vehicle is significant, making collision insurance a crucial consideration. In the event of a crash, even minor ones, repairs for new cars can be surprisingly expensive due to the high cost of parts and labor. Collision coverage steps in to protect you by paying for these repairs, minimizing out-of-pocket expenses. This is particularly important as the average repair bill continues to climb each year, making it an invaluable asset for any new car owner.

Additionally, many new cars come with advanced safety features designed to prevent accidents and reduce their impact. However, despite these precautions, accidents can still occur. Collision insurance ensures that you are prepared for such unforeseen events, allowing you to focus on recovery rather than financial strain.

Protecting Older Vehicles: The Case for Collision Insurance

Older vehicles, while cherished for their nostalgia and character, can be more expensive to maintain than newer models. As parts become harder to find and more costly, collision insurance becomes an even more compelling option. In a world where repair bills are rising, having collision coverage ensures that unexpected accidents won’t leave you burdened with astronomical costs. This is especially true for older cars, which may not have the advanced safety features that newer vehicles boast, making them more susceptible to damage in collisions. Collision insurance provides peace of mind, knowing that your classic or vintage vehicle will be repaired, preserving its value and keeping it on the road.

Different Types of Collision Coverage Options

How to Determine Adequate Collision Coverage

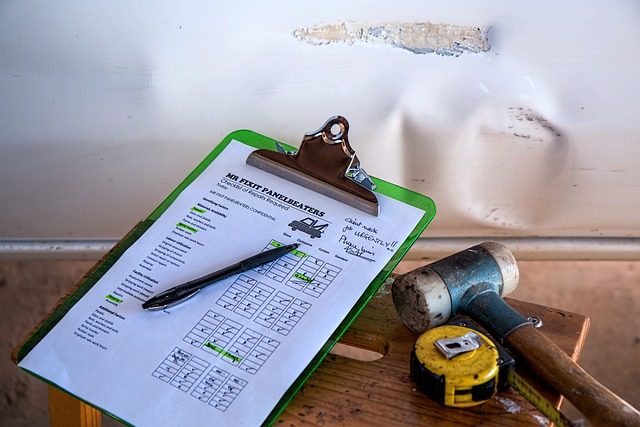

When determining adequate collision coverage, start by assessing your vehicle’s value and considering your financial situation. Older cars, while requiring less coverage than new ones, still merit substantial protection to avoid devastating out-of-pocket expenses in case of an accident. For newer vehicles, opt for limits that match or exceed the manufacturer’s suggested retail price (MSRP).

Research your area’s average repair costs and inflation rates to gauge realistic estimates for future collision repairs. This will help you choose coverage amounts that offer peace of mind while ensuring you’re not paying for excessive protections beyond what’s necessary. Additionally, review your driving history and frequency of accidents; if you’re a safe driver with minimal claims, you may opt for lower limits, but always ensure they align with local legal requirements.

In today’s digital era, where vehicle repair costs continue to rise, collision coverage stands as a crucial component in protecting your financial well-being. By understanding the specifics of collision insurance and its value for both new and older cars, you can make informed decisions. Remember that, while comprehensive insurance covers various non-accident events, collision coverage is tailored to post-accident repairs, making it an essential consideration for every driver.