Collision coverage protects policyholders from unexpected financial burdens after vehicular accidents by covering exterior, interior, and mechanical damages. However, it does not extend to non-accident events like natural disasters, theft, vandalism, or normal wear and tear. With rising car repair costs due to technological advancements in 2024, collision insurance is crucial for protecting vehicle investments, especially for older cars and young drivers with higher accident rates. Policies have varying deductibles that balance potential future savings against immediate out-of-pocket expenses; the ideal deductible depends on individual needs and budget considerations. Regular policy reviews ensure coverage continues to meet changing requirements.

In the dynamic realm of automotive insurance, collision coverage stands as a cornerstone of protection against financial strain following accidents. As repair costs escalate in 2024, understanding this specific policy becomes paramount for all drivers, regardless of vehicle age. This article delves into the intricacies of collision coverage, clarifying what it encompasses and how it differs from comprehensive insurance. We explore the escalating costs of car repairs and their impact on personal finances. Furthermore, we dissect why collision insurance is a prudent investment for both new and used vehicles, providing insights to help drivers make informed decisions tailored to their needs.

- Collision Coverage Explained: What It Covers and Doesn't

- The Rising Costs of Car Repairs in 2024

- Why Collision Insurance Matters for New and Older Cars

- Understanding Deductibles and How They Affect Savings

- Protecting Your Wallet: Tips for Choosing the Right Coverage

Collision Coverage Explained: What It Covers and Doesn't

Collision coverage is designed to protect policyholders from the financial burden of vehicle repairs after a collision, regardless of fault. When you have collision insurance, your policy will help cover the costs of fixing or replacing your vehicle if it’s damaged in an accident. This includes damages to both the exterior and interior of your car, as well as mechanical parts. However, it’s important to note that collision coverage does not include damage caused by non-accident related events like natural disasters, theft, vandalism, or wear and tear. It also typically excludes any losses incurred while your vehicle is being driven without your permission or while it’s being transported unless you’ve added specific endorsements. Understanding these exclusions can help ensure you’re getting the right level of protection for your needs.

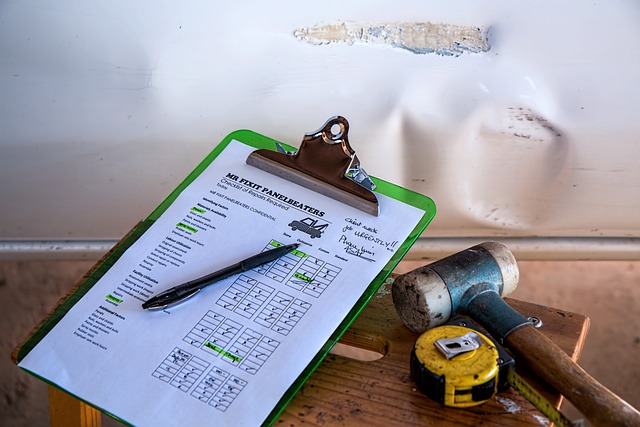

The Rising Costs of Car Repairs in 2024

In recent years, the cost of car repairs has been on a steady upward trend, with 2024 proving no exception. This surge in expenses is attributed to several factors, primarily technological advancements that drive up the price of parts and labor. Modern vehicles are equipped with sophisticated electronic systems, advanced safety features, and complex mechanisms, all of which require specialized tools and expertise for repair. Additionally, the increasing prevalence of premium materials and lightweight components used in car manufacturing contributes to higher replacement costs. These factors combine to make collision repairs more expensive than ever before, making collision coverage an increasingly vital component of any comprehensive insurance policy.

Why Collision Insurance Matters for New and Older Cars

Collision insurance plays a pivotal role in protecting your investment, whether your car is new or several years old. For newer vehicles, collision coverage can be especially crucial as they often come with a higher cost of repair due to advanced technology and complex design features. In 2024, rising material costs and labor rates further exacerbate the financial burden of collision repairs, making comprehensive insurance even more valuable for ensuring you’re not left with a substantial bill after an accident.

For older cars, while they might be less expensive to insure overall, collision coverage remains essential. As vehicles age, their repair costs can increase significantly due to wear and tear and the potential need for specialized parts. Collision insurance provides peace of mind, assuring policyholders that unexpected accidents won’t turn into financial hardships, allowing them to focus on getting back on the road safely and affordably.

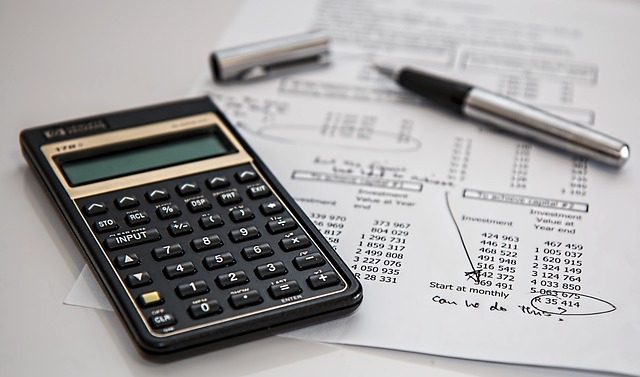

Understanding Deductibles and How They Affect Savings

Collision insurance policies come with deductibles, an amount you must pay out-of-pocket before your insurer covers the rest of the repair costs. These deductibles can significantly impact how much you save on collision coverage. If a policy has a high deductible, it means you’ll need to cover a larger portion of the repair expenses initially. However, this could result in substantial savings if you don’t have frequent accidents. Conversely, policies with lower deductibles provide more immediate financial relief after an accident but may come at a slightly higher premium cost. It’s a balance between potential future savings and short-term out-of-pocket expenses that determines whether a particular deductible aligns with your needs and budget.

Protecting Your Wallet: Tips for Choosing the Right Coverage

Protecting your wallet starts with understanding your car insurance needs. When considering collision coverage, assess your driving habits and vehicle age. For older cars, repair costs might be higher due to their vintage parts availability and technological complexity. In such cases, opting for collision insurance can safeguard you from overwhelming bills. Young drivers, too, should not underestimate this coverage, as accidents are more frequent in the early years of driving.

When choosing the right coverage, compare quotes from different providers. Look beyond the premium price; assess deductibles and understand what’s covered. Opting for higher deductibles can reduce premiums but ensure you have the financial capacity to pay out-of-pocket when needed. Regularly review your policy to ensure it aligns with your changing needs, especially as your vehicle ages or your driving habits evolve.

In today’s world, where accident costs are on the rise, collision coverage is no longer an optional add-on but a necessity. By understanding what this type of insurance covers and how it differs from comprehensive, you can make informed decisions to protect your financial well-being. The article has provided insights into the evolving landscape of car insurance, highlighting why collision coverage is a smart choice for all drivers, regardless of vehicle age. Remember that being prepared financially after an accident is crucial, and the right insurance policy can be a valuable asset in these situations.