Commercial auto coverage is a vital tool for businesses using vehicles in operations, offering comprehensive protection including liability against accidents, and swift replacement of custom parts and specialized equipment to minimize downtime. No longer limited to large fleets, it's accessible to small businesses with even a single vehicle, crucial for industries relying on mobile assets like logistics and construction. Market trends driven by remote work, dynamic models, expansion, and tech advancements have led to more flexible policies, emphasizing the need to align insurance with specific operational needs to safeguard against financial disruptions.

As a business owner, navigating the road ahead with confidence is crucial. Commercial auto coverage emerges as your steadfast companion, offering tailored protection for fleet vehicles, delivery vans, and everything in between. This specialized insurance goes beyond standard protections by safeguarding valuable custom parts and equipment, addressing the unique needs of modern businesses. With recent market insights highlighting a surge in demand for flexible policies, now is the ideal time to reassess your auto insurance strategy and ensure uninterrupted operations for your team. Let’s explore how commercial auto coverage can provide the smoothest ride yet.

- Understanding Commercial Auto Coverage: Benefits for Business Owners

- Fleet Vehicles to Delivery Vans: Who Needs It?

- Custom Parts and Equipment Coverage: Protecting Your Investments

- Market Insights: The Growing Demand for Flexible Policies

- Revisit Your Policy: Ensuring Seamless Business Operations

Understanding Commercial Auto Coverage: Benefits for Business Owners

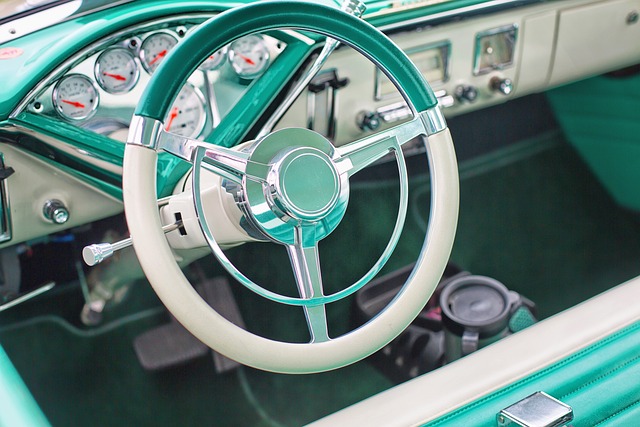

Commercial auto coverage is tailored to meet the unique needs of businesses operating on the road. Unlike standard personal vehicle insurance, it offers comprehensive protection for a variety of business vehicles, from trucks and vans to specialized equipment. One of its key advantages is the ability to cover custom parts and fixtures that are often integral to a business’s operations. This ensures that if these valuable assets are damaged or stolen, they can be replaced promptly, minimizing downtime and potential losses.

Moreover, commercial auto insurance provides liability protection against claims arising from accidents involving your vehicles. This includes coverage for property damage and bodily injury, safeguarding your business from significant financial burdens. By understanding and leveraging these benefits, business owners can navigate the road with peace of mind, knowing their assets and operations are secure.

Fleet Vehicles to Delivery Vans: Who Needs It?

Commercial auto coverage is no longer just for large fleet operators. In today’s dynamic business landscape, even small businesses with a single delivery van or a couple of company vehicles can benefit from this specialized insurance. It’s designed to protect not just the vehicle itself but also its unique parts and equipment, which are often crucial to the day-to-day operations of many businesses.

Whether you’re in logistics, construction, or any other industry relying on mobile assets, having commercial auto coverage ensures that unexpected events like accidents, theft, or damage don’t disrupt your workflow. It provides peace of mind, allowing business owners to focus on growth and success rather than dealing with the hassle and cost of repairs or replacement parts.

Custom Parts and Equipment Coverage: Protecting Your Investments

Custom parts and equipment coverage is a critical component of commercial auto insurance, especially for businesses that rely heavily on specialized vehicles or unique fixtures. This type of coverage ensures that if your vehicle is damaged or stolen, replacement parts and essential equipment are accounted for, minimizing downtime and financial loss. It’s particularly beneficial for fleets that include custom-fitted vans, trucks with specialized tools, or vehicles equipped with proprietary technology.

Such protection goes beyond standard insurance policies by recognizing the value and uniqueness of business assets. It offers peace of mind, knowing that your investments in customized parts and equipment are protected, which can be crucial for maintaining smooth operations and customer satisfaction.

Market Insights: The Growing Demand for Flexible Policies

In recent years, market trends indicate a noticeable shift in the insurance landscape, particularly within the commercial auto sector. Business owners are increasingly seeking flexible and tailored policies that cater to their unique operational needs. This demand is driven by several factors. Firstly, the rise of remote work and dynamic business models means that traditional, one-size-fits-all insurance plans no longer meet the requirements of modern enterprises. Secondly, with businesses expanding into new territories and adopting innovative technologies, there’s a growing need for coverage options that can keep pace with these changes.

Moreover, the global pandemic has further accelerated this trend, as companies have had to adapt quickly to changing market conditions and consumer behaviors. As a result, insurance providers are responding by offering more adaptable policies, recognizing the importance of providing tailored solutions to keep business owners ahead of the curve and confident on the road ahead.

Revisit Your Policy: Ensuring Seamless Business Operations

As a business owner, your vehicle is more than just a means of transportation; it’s a crucial asset that keeps your operations running smoothly. That’s why revisiting your auto insurance policy is essential. Commercial auto coverage goes beyond standard insurance by recognizing the unique risks faced by businesses on the road. It offers tailored protection for various types of commercial vehicles, ensuring that unexpected incidents don’t disrupt your workflow.

By regularly reviewing your policy, you can ensure it aligns with your business’s evolving needs. This includes understanding the scope of coverage for custom parts and equipment, which is especially vital if your operations depend on specialized tools or modifications. A well-adapted policy will provide peace of mind, allowing you to focus on growing your business without constant worry about potential financial setbacks due to vehicle-related issues.

In today’s dynamic business landscape, commercial auto coverage is not just an option—it’s a strategic decision. By understanding the unique benefits tailored to fleet vehicles, delivery vans, and custom equipment, business owners can safeguard their operations and investments. With market insights highlighting the increasing demand for flexible policies, revisiting your auto insurance now could prove invaluable. Embrace the road ahead with confidence, knowing that the right coverage enables uninterrupted growth and success.