Considering the robust protection full coverage auto insurance offers, it’s a pivotal decision for drivers to determine if its comprehensive and collision components align with their specific needs. This article delves into the intricacies of full coverage, which encompasses a blend of liability, comprehensive, and collision coverage, providing wide-ranging vehicle protection. While this extensive coverage comes at an additional cost, it’s crucial to weigh this against factors like your vehicle’s age, market value, and personal financial standing. Key aspects such as Rental Car Insurance implications, Commercial Auto Insurance requirements for business vehicles, Classic Car Coverage nuances, and managing deductibles play significant roles in the decision-making process. Additionally, understanding the cost versus benefit ratio of insurance premiums is vital. For tailored advice, consulting with an experienced insurance professional can help navigate these choices effectively.

- Understanding Full Coverage Auto Insurance: Beyond Liability, Comprehensive, and Collision

- Evaluating the Need for Full Coverage: Is It Right for Your Vehicle and Finances?

- Assessing Your Vehicle: Age, Value, and the Decision for Comprehensive Coverage

- Rental Car Insurance and Full Coverage: What You Need to Know When Renting

- Exploring Commercial Auto Insurance: Coverage Options for Business Use Vehicles

- Classic Car Coverage: Full Coverage vs. Specialized Policies for Collectors

- Navigating Car Insurance Deductibles: Balancing Out-of-Pocket Costs and Protection Levels

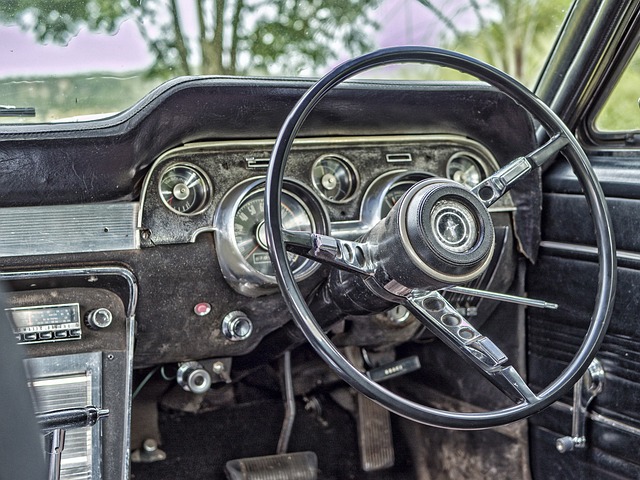

Understanding Full Coverage Auto Insurance: Beyond Liability, Comprehensive, and Collision

Full coverage auto insurance extends beyond the basic liability, comprehensive, and collision components to offer a robust shield for vehicle owners. This encompassing policy includes provisions for rental car insurance, which ensures that you have transportation options if your car is under repair after an accident or theft. Additionally, it often provides commercial auto insurance benefits, catering to those who use their vehicles for business purposes. For classic car enthusiasts, full coverage can be tailored with classic car coverage, offering specialized protection that reflects the unique needs of such vehicles.

When considering full coverage, one must also be aware of the role of car insurance deductibles. These are the amounts you agree to pay out-of-pocket before your insurance kicks in. Choosing higher deductibles can lead to lower insurance premiums, but it’s a balance that should be carefully considered based on your financial situation. High-risk driver coverage is another facet of full coverage, designed for individuals with a history of accidents or traffic violations, ensuring they have access to reliable auto insurance. Furthermore, discounts on car insurance can significantly reduce the overall cost of full coverage. These discounts may be available for a variety of reasons, such as safe driving records, installing safety features in your vehicle, or maintaining multiple policies with the same insurer. It’s advisable to discuss these options and potential savings with an insurance professional to determine if full coverage auto insurance is the most prudent choice for your particular needs and circumstances.

Evaluating the Need for Full Coverage: Is It Right for Your Vehicle and Finances?

When considering full coverage auto insurance, it’s crucial to evaluate how its benefits align with your specific vehicle and financial situation. For instance, if your car is relatively new or has a higher value, comprehensive and collision coverage can protect you against repair costs or replacement in the event of an accident or theft. On the other hand, if you own an older model vehicle with a lower market value, assess whether the potential savings from opting out of full coverage justify the risk of paying for repairs or replacement costs out of pocket. Rental car insurance is another aspect to consider; full coverage typically includes rental reimbursement, which can be invaluable if your car is being repaired after an incident.

For commercial auto insurance needs, full coverage is often a necessity due to the higher risk associated with vehicles used for business purposes. Similarly, classic car enthusiasts should look into classic car coverage within full coverage plans, which cater to the unique needs of vintage or collector cars, ensuring they receive appropriate care and valuation. High-risk driver coverage under full coverage can be particularly beneficial, offering tailored protection that addresses the increased likelihood of a claim due to driving history. Remember, when it comes to car insurance premiums, seeking out discounts is always prudent. Many insurers offer reductions for various reasons, such as installing safety features, maintaining a good driving record, or even bundling your policy with other insurance products you may have. It’s important to balance these potential savings against the insurance premiums you pay, ensuring that your coverage remains comprehensive without overextending your budget. Consulting with an insurance professional can provide clarity and guidance on navigating the complexities of full coverage auto insurance options and determining what’s best for your particular needs.

Assessing Your Vehicle: Age, Value, and the Decision for Comprehensive Coverage

When evaluating whether full coverage auto insurance is suitable for your needs, it’s crucial to consider your vehicle’s age and value. Older vehicles may not be worth the cost of comprehensive coverage, especially if high insurance premiums are involved. For classic cars, on the other hand, comprehensive coverage can be invaluable due to their unique value and the potential costs associated with repairs or replacement parts. Rental car insurance is a separate consideration; it’s designed to offer protection when you’re driving a rental vehicle, which might not be covered under your regular policy. If you frequently rent cars, ensuring proper coverage can save you from unexpected financial burdens in case of damage or theft.

In addition to the condition and value of your vehicle, your personal circumstances also impact the decision for comprehensive coverage. If you’re a high-risk driver due to past incidents on the road, your insurance premiums will likely be higher. However, full coverage can provide peace of mind, knowing that collisions and other incidents are covered. Discounts on car insurance can offset some of these costs; they are often available for a variety of reasons, such as safe driving records, completing defensive driving courses, or bundling multiple vehicles under one policy. Assessing your financial situation is key; the higher premiums for full coverage must be justified by the protection it offers and your ability to afford the potential car insurance deductibles should you file a claim. Consulting with an insurance professional can offer clarity on these matters and help tailor a policy that fits both your needs and budget, ensuring that you’re adequately protected without unnecessary financial strain.

Rental Car Insurance and Full Coverage: What You Need to Know When Renting

When renting a vehicle, understanding the intricacies of rental car insurance is crucial to ensure you’re adequately covered and not overpaying for protection that may be redundant. Full coverage auto insurance typically includes comprehensive and collision coverage, which can also extend to rental cars under your policy, depending on your specific plan. It’s important to review your current policy to ascertain the extent of coverage you have when renting a car. For instance, if your full coverage extends to rental vehicles, your personal policy may cover theft, vandalism, or damage due to an accident without the need for additional rental car insurance. However, rental companies often offer supplemental policies such as collision damage waivers (CDW) and loss damage waivers (LDW). These can be beneficial if your personal policy has high deductibles or exclusions that would leave you financially vulnerable.

When considering commercial auto insurance or classic car coverage, the approach to rental car insurance may differ. Commercial policies are tailored for businesses and often come with broader coverage, which might already include rental vehicles as part of the package. On the other hand, classic car insurance is designed with specialized needs in mind, and while it may offer limited rental car coverage, additional options might be necessary when renting a car. Always verify your classic car policy’s terms regarding rental coverage to avoid surprises. High-risk driver coverage can also affect your rental car insurance experience. If you’re classified as a high-risk driver, your rates may be higher, and it’s particularly important to ensure that any additional rental insurance policies are necessary and won’t duplicate the coverage you already have.

To manage costs effectively, explore available discounts on car insurance before renting a vehicle. Many insurers offer discounts for various reasons, such as safe driving records, multi-car policies, or loyalty programs. These savings can sometimes be applied to rental cars, reducing your overall financial exposure. When comparing insurance premiums, don’t forget to consider the terms and conditions of each policy, including the applicability of coverage when renting a car. This due diligence ensures that you’re not paying for overlapping coverages and that you’re fully protected during your rental period. Always consult with an insurance professional to navigate these decisions and tailor your auto insurance coverage to fit your specific needs, whether you’re driving your own vehicle or a rented one.

Exploring Commercial Auto Insurance: Coverage Options for Business Use Vehicles

Commercial auto insurance serves a pivotal role in safeguarding business vehicles, offering tailored coverage options that extend beyond personal auto insurance policies. For enterprises relying on vehicles for operations, it’s imperative to delve into the specifics of commercial auto insurance to ensure comprehensive protection. This type of insurance not only covers liability, comprehensive, and collision, which are also foundational in full coverage personal auto insurance, but it also addresses the nuances of business use. It is designed to address the diverse risks associated with commercial vehicles, which often include higher liabilities and more frequent usage.

When considering commercial auto insurance, it’s crucial to evaluate your specific needs, such as whether you frequently rent vehicles or own classic cars that require specialized coverage like classic car coverage. Businesses with vehicles at risk of damage due to frequent travel should also consider the implications of car insurance deductibles, which can significantly impact the financial outcome of an accident or incident. High-risk driver coverage is another aspect to consider if your drivers have a history of accidents or violations. On the flip side, exploring discounts on car insurance for maintaining a safe driving record or implementing fleet management practices can offset the cost of higher insurance premiums. It’s advisable to engage with an insurance professional who can navigate the complexities of commercial auto insurance and help you find the best coverage for your business at the most favorable rates. By carefully analyzing your options, you can make an informed decision that aligns with your budget while ensuring that your business assets are adequately protected.

Classic Car Coverage: Full Coverage vs. Specialized Policies for Collectors

When evaluating your auto insurance needs, distinguishing between full coverage and specialized policies such as classic car coverage is crucial. Full coverage auto insurance typically includes liability, comprehensive, and collision coverage, providing a broad spectrum of protection for various eventualities. This comprehensive approach can be particularly beneficial for everyday vehicles, ensuring peace of mind on the road. However, for classic car enthusiasts, a standard full coverage policy might not suffice. Classic cars are unique assets that often require specialized insurance policies tailored to their distinct needs. These specialized policies can offer agreed value coverage, which ensures that in the event of a total loss, you receive the amount insured minus any deductible, reflecting the car’s true value. This is particularly important for classic cars whose market value can fluctuate significantly.

Additionally, when considering classic car coverage versus full coverage, it’s essential to factor in the frequency of use. Classic cars are typically driven less frequently than standard vehicles, which can influence both your eligibility for certain policies and the insurance premiums you pay. Owners of classic cars may also be eligible for various discounts on car insurance, reflecting the reduced risk of accident or theft due to limited mileage. For high-risk drivers, it’s vital to explore coverage options that address their specific situation, which might include higher insurance premiums. In contrast, rental car insurance and commercial auto insurance cater to different needs entirely, each with its own set of coverages and deductibles tailored to the nature of use. Whether you’re a collector, a business owner, or a driver with a less-than-stellar driving record, understanding the nuances between these policies can lead to more informed decisions and potentially lower insurance premiums, ensuring that your vehicle is adequately protected while aligning with your financial circumstances.

Navigating Car Insurance Deductibles: Balancing Out-of-Pocket Costs and Protection Levels

Navigating car insurance deductibles is a critical aspect of balancing out-of-pocket costs with the level of protection you desire. A deductible represents the amount you agree to pay out of pocket before your insurance coverage kicks in during an incident. Selecting an appropriate deductible involves weighing potential savings against the financial burden you’d face in the event of an accident or theft. For instance, someone with a newer vehicle might opt for a lower deductible under full coverage auto insurance to mitigate the risk of high repair costs. Conversely, drivers with older vehicles might choose a higher deductible to offset more affordable comprehensive and collision coverage.

When considering rental car insurance as part of your policy, it’s important to evaluate if the additional cost aligns with your usage patterns. Rental car coverage can offer peace of mind when traveling or commuting, ensuring you’re not left without transportation in the event your vehicle is in the shop. Similarly, commercial auto insurance requires careful deductible selection, as vehicles used for business purposes may be on the road more frequently, necessitating a balance between protection and cost. For classic car enthusiasts, classic car coverage often comes with agreed value options and possibly lower compulsory and collision deductibles, reflecting the specialized nature of this niche market. High-risk driver coverage can also be tailored with deductible levels that accommodate the higher premiums associated with this category of drivers, while still providing necessary protection. In all cases, leveraging discounts on car insurance is a smart strategy to reduce insurance premiums, which can then be allocated towards a more favorable deductible structure. It’s advisable to regularly review your policy and consult with an insurance professional to ensure your deductibles and coverage types are aligned with your current needs and financial situation.

When considering the purchase of full coverage auto insurance, it’s crucial to weigh the benefits against the costs, especially when evaluating your vehicle’s specific needs. This article has illuminated various aspects of full coverage, including its combination of liability, comprehensive, and collision protection, and how it can be tailored through products like Rental Car Insurance, Commercial Auto Insurance for business vehicles, Classic Car Coverage for collectors, and managing deductibles to suit a high-risk driver’s or any driver’s financial situation. As you navigate these options, remember that discounts and understanding insurance premiums are key factors in making an informed decision. Ultimately, the choice should align with your vehicle’s value, age, and your personal risk tolerance. For tailored advice, consulting with a knowledgeable insurance professional can demystify the process and ensure you select the most appropriate coverage for your unique circumstances.