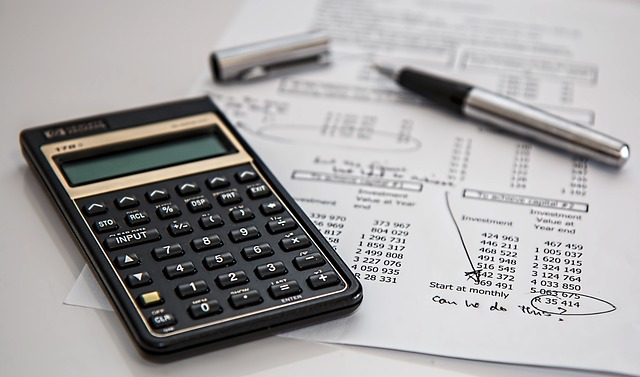

Navigating the complexities of professional practice, notaries must prioritize both financial stability and robust legal protection. This article delves into the intricacies of securing Affordable Notary Insurance that meets the unique needs of the profession. We explore how to strike an optimal balance between cost and coverage, ensuring notaries can operate with confidence. From examining Notary Legal Protection options to strategic risk management, our focus is on providing Financial Security for Notaries through tailored Insurance Policies, enabling a sustainable and trustworthy practice in today’s ever-changing legal landscape.

- Balancing Cost and Coverage: Affordable Notary Legal Protection for Your Practice

- Navigating Insurance Options: Finding the Right Policy for Mobile Notaries

Balancing Cost and Coverage: Affordable Notary Legal Protection for Your Practice

For mobile notaries, securing notary legal protection through affordable notary insurance is a prudent step in risk management and achieving financial security. The landscape for insurance policies for notaries is designed to offer tailored coverage that aligns with both the notary’s practice needs and budget constraints. Finding the right balance between cost and comprehensive coverage is essential for notaries who operate in diverse environments, often requiring flexibility to accommodate different types of transactions and potential exposures. An affordable notary insurance plan should provide robust liability protection, covering a wide array of scenarios that could arise during the course of professional duties, such as document errors, fraudulent acts, or breach of duty claims. This ensures that notaries are equipped to manage legal challenges without incurring overwhelming financial strain. Notaries must evaluate insurance providers carefully, considering the scope of their services and the liability limits offered to determine the most suitable and cost-effective policy for their practice. With the right insurance for mobile notaries, professionals can navigate their responsibilities with confidence, knowing that they are safeguarded against unforeseen events that could potentially jeopardize their business and reputation. It’s an investment in the sustainability and trustworthiness of their professional practice, offering peace of mind that allows them to focus on serving their clients effectively.

For notaries public, securing affordable notary legal protection is a prudent step in their professional practice. An Insurance for Mobile Notaries should be tailored to address the unique challenges they face, whether they operate from an office or on the go. Affordable Notary Insurance acts as a shield, offering financial security for notaries against potential errors or omissions that could lead to legal disputes. These insurance policies are designed to cater to the specific needs of notaries, providing comprehensive coverage without straining their budgets. The right policy can offer notary risk management solutions, ensuring that professionals are safeguarded against unforeseen claims and liability issues. With a range of options available, notaries can select an Insurance Policy for Notaries that strikes the ideal balance between cost and coverage, allowing them to operate with confidence and peace of mind, knowing they are well-protected in their essential role. It’s important for notaries to evaluate different insurance providers to find the most suitable plan that aligns with their practice’s specific requirements and the scope of their services. This strategic approach to Notary Liability Protection ensures that notaries can manage their risks effectively, fostering a sustainable and trustworthy practice in an increasingly complex legal landscape.

Navigating Insurance Options: Finding the Right Policy for Mobile Notaries

When mobile notaries venture out to offer their services, they encounter a unique set of challenges that necessitate tailored Notary Legal Protection and Financial Security for Notaries. As these professionals operate across various locations and encounters diverse clientele, the risks they face can be as dynamic as the environments in which they work. An Insurance Policy for Notaries designed with mobile service providers in mind will account for the potential for errors or oversights to occur in a multitude of settings. It’s imperative that such a policy includes robust Notary Risk Management and Notary Liability Protection to safeguard their operations from unforeseen claims. Affordable Notary Insurance packages that cater to mobile notaries should offer comprehensive coverage without breaking the bank, allowing these professionals to conduct their necessary travel with the assurance of financial security against any legal pitfalls they may encounter.

In the pursuit of finding the right policy, mobile notaries must consider the scope of their services and the liability limits that best align with their practice. The best Affordable Notary Insurance options will offer a balance between cost and coverage, providing peace of mind without overextending the budget. It’s essential to evaluate various insurance providers to determine which offers the most suitable Insurance for Mobile Notaries, considering factors such as the frequency of travel, the types of documents they notarize, and their past experiences with client interactions. By carefully selecting an insurance policy that meets all these criteria, mobile notaries can navigate their professional responsibilities with confidence, knowing they are protected by a comprehensive and cost-effective insurance plan.

In conclusion, notaries play a vital role in the official process, and with the increasing complexity of legal documentation, securing robust yet affordable Notary Legal Protection is paramount. This article has outlined key considerations for notaries seeking Insurance for Mobile Notaries, emphasizing the importance of Financial Security for Notaries through comprehensive coverage that caters to their unique needs. By carefully evaluating Notary Risk Management and Liability Protection options, notaries can safeguard their professional practices effectively. Choosing an Insurance Policy for Notaries that balances cost with coverage allows these professionals to operate with confidence, knowing they are prepared for any claims against them. With the right insurance in place, notaries can focus on serving their clients, confident in their ability to manage risks and maintain a trustworthy practice.