Auto insurance has undergone a major transformation, becoming highly customizable to meet diverse driver needs. Newer policies offer:

Wider coverage options: Beyond basic liability, add-ons like Personal Injury Protection (PIP) and Underinsured Motorist Coverage provide enhanced protection.

Personalized pricing: Discounts target safe driving behaviors and teen drivers while pay-per-mile plans charge based on actual mileage for low-usage drivers.

* Technology integration: Insurers leverage data and technology to offer personalized policies, ensuring drivers receive tailored coverage at competitive rates.

- Unlocking Affordable Auto Insurance: New Discounts & Trends

- Safe Drivers Reap Rewards: Customized Insurance Policies

- Beyond Basic Coverage: Enhancing Protection with Add-ons

- PIP & Underinsured Motorist Coverage: Budget-Friendly Security

- Pay-per-Mile Insurance: A Game-Changer for Occasional Drivers

- Navigating Industry Innovations: Car Insurance Redefined

- Customized Protection: Securing Your Journey Today

Unlocking Affordable Auto Insurance: New Discounts & Trends

In recent years, the auto insurance landscape has evolved dramatically, offering drivers more options than ever to balance affordability and coverage. A wave of new discounts tailored for safe driving behaviors and teen motorists has made securing comprehensive protection more accessible. These savings, coupled with innovative policy add-ons and flexible payment plans, signal a significant shift in how individuals approach car insurance.

One notable trend is the emergence of pay-per-mile insurance, designed for drivers who log few miles annually. This progressive concept rewards cautious driving by charging premiums based on actual usage, rather than a fixed rate. As a result, occasional drivers can enjoy substantial cost savings while still gaining access to essential coverage options like PIP and underinsured motorist protection.

Safe Drivers Reap Rewards: Customized Insurance Policies

Safe drivers now have an edge when it comes to auto insurance. With new discounts and customized policies, they can achieve a delicate balance between affordability and comprehensive coverage. Insurers are recognizing the safety benefits of responsible driving, offering rewards in the form of lower premiums. These incentives encourage safe driving habits by making insurance more accessible and affordable for those who maintain a clean record.

By tailoring insurance policies to individual needs, drivers can select specific add-ons that provide extra protection without paying for unnecessary coverage. This personalized approach ensures that safe drivers get rewarded, allowing them to customize their insurance plans and stay within budget.

Beyond Basic Coverage: Enhancing Protection with Add-ons

Auto insurance has evolved far beyond the basic coverage of yesteryear. Today, drivers have a multitude of options to customize their policies and tailor them to their unique needs. Beyond the standard liability and collision coverages, various add-ons offer enhanced protection at competitive rates. Personal Injury Protection (PIP), for instance, provides financial assistance for medical expenses and lost wages in case of an accident, ensuring that policyholders receive comprehensive care regardless of fault.

Similarly, Underinsured Motorist Coverage safeguards against unforeseen circumstances when dealing with drivers who have inadequate or no insurance. These add-ons demonstrate the industry’s commitment to protecting individuals on the road, offering peace of mind without significantly increasing premiums. By selecting these specific coverages, drivers can ensure they are adequately prepared for potential risks while keeping their insurance costs manageable.

PIP & Underinsured Motorist Coverage: Budget-Friendly Security

Personal Injury Protection (PIP) and Underinsured Motorist Coverage are essential add-ons that offer significant budget-friendly security for drivers. PIP covers medical expenses and lost wages in the event of an accident, ensuring financial protection for policyholders and their families, regardless of fault. This is particularly beneficial for those with high healthcare costs or income dependencies.

Underinsured Motorist Coverage, on the other hand, protects against damages when an at-fault driver has inadequate insurance. By providing extra liability coverage, it shields policyholders from facing substantial financial burdens due to the actions of irresponsible drivers. These add-ons are cost-effective and offer peace of mind, ensuring that even unexpected incidents don’t lead to overwhelming expenses.

Pay-per-Mile Insurance: A Game-Changer for Occasional Drivers

Pay-per-mile insurance plans are revolutionizing car insurance, catering specifically to occasional drivers who log fewer miles each year. This innovative approach reverses the traditional model where premiums are based on a fixed rate and an extensive list of factors. Instead, it charges policyholders for every mile driven, offering significant savings for those who use their vehicles sparingly.

For teens or adults with part-time jobs or hobbies that involve limited driving, this option presents a cost-effective solution. By accurately tracking mileage, insurers can provide tailored coverage, eliminating the need to pay for excessive insurance during periods of inactivity. This game-changing concept not only benefits budget-conscious drivers but also encourages more responsible and mindful driving habits.

Navigating Industry Innovations: Car Insurance Redefined

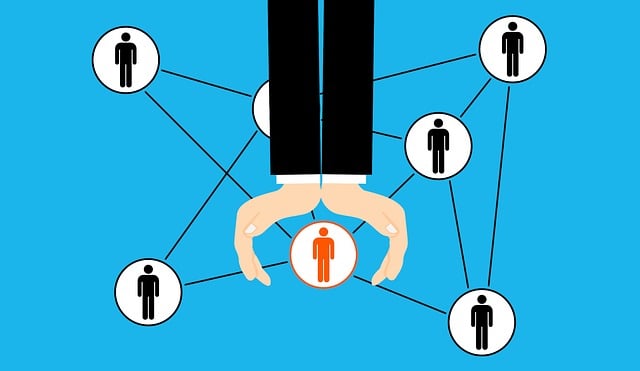

In today’s dynamic insurance landscape, consumers are presented with a growing array of options designed to cater to diverse needs and budgets. Navigating these innovations requires an understanding of emerging trends. One notable development is the integration of technology, such as pay-per-mile plans, which offer flexibility for drivers who log fewer miles, potentially saving them significant premiums. Additionally, personalized discount programs targeting safe drivers and teens are reshaping how insurance companies assess risk.

These advancements not only provide cost savings but also enhance customization, ensuring that policyholders receive tailored coverage. By embracing these industry updates, drivers can secure comprehensive protection while managing their expenses effectively. This refined approach to car insurance promises a more accessible and adaptable future for both individuals and families seeking peace of mind on the road.

Customized Protection: Securing Your Journey Today

In today’s dynamic world, auto insurance is no longer a one-size-fits-all proposition. With cutting-edge technology and evolving consumer preferences, insurance companies are offering highly customized protection tailored to individual needs. This shift empowers drivers to secure their journeys like never before. From driver behavior analytics that reward safe habits to innovative pay-per-mile plans for part-time drivers, the landscape is transforming.

By leveraging data and advanced algorithms, insurers can now offer personalized discounts and coverage options. For instance, teen driver insurance has become more adaptive, taking into account factors like driving history and vehicle usage. Similarly, personal injury protection (PIP) and underinsured motorist coverage can be adjusted to provide just the right amount of security without excessive costs. This level of customization ensures that drivers receive tailored protection, offering peace of mind on the road.