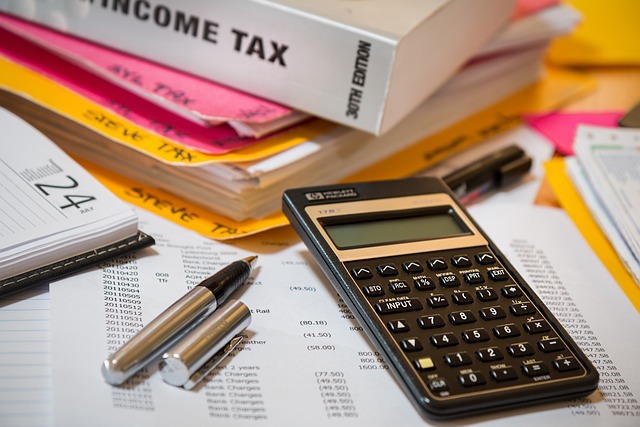

Navigating complex tax laws can be overwhelming. This is where a Certified Tax Advisor (CTA) steps in, offering expert guidance tailored to your unique financial situation. CTAs provide personalized services ranging from strategic planning and compliance assistance to IRS representation. For businesses, they offer specialized corporate tax services and consulting, ensuring adherence to regulations while optimizing financial outcomes. Individuals benefit from advice on estate taxes, investment strategies, and international tax considerations. Engaging a qualified CTA is crucial for effective tax management, optimal income tax optimization, retirement tax planning, and seamless navigation of international tax laws.

- Understanding the Role of a Certified Tax Advisor

- Personalized Tax Services for Individuals and Businesses

- Optimizing Income Tax with Strategic Planning

- Navigating International Tax Laws and Retirement Planning

- Comprehensive Support for Self-Employed Individuals and Sales Tax Management

Understanding the Role of a Certified Tax Advisor

A Certified Tax Advisor (CTA) is a crucial ally in navigating the intricate world of taxation. They are experts who possess specialized knowledge and skills to guide individuals and businesses through their tax obligations, ensuring compliance with laws and regulations. CTAs offer valuable insights into various aspects of taxes, including income tax, retirement tax planning, capital gains tax, sales tax, payroll tax, and more. These professionals tailor their services to specific needs, providing personalized advice that goes beyond mere number-crunching.

By engaging a CTA, individuals and businesses gain access to tax optimization services, which can lead to significant financial savings. For instance, they can assist in developing strategies to minimize capital gains tax, offer guidance on international tax services for expatriates or multinational corporations, and help self-employed individuals navigate complex payroll tax regulations. Retirement planning is another area where these advisors excel, ensuring clients make informed decisions that align with their long-term financial goals while considering the tax implications.

Personalized Tax Services for Individuals and Businesses

Personalized tax services tailored to meet individual and business needs are provided by Certified Tax Advisors. For businesses, specialized corporate tax services include comprehensive compliance assistance, strategic planning, and efficient management of sales tax, payroll tax, and capital gains tax obligations. These services ensure that companies stay on top of ever-changing regulations while optimizing their financial performance.

Individuals can benefit from personalized advice on retirement tax planning, estate and trust taxes, and investment tax strategies. With international tax services, expatriates can navigate complex global tax laws with confidence. Whether it’s maximizing returns, minimizing liabilities, or ensuring compliance, a qualified Income Tax Advisor offers expert guidance to help clients make informed financial decisions and achieve their tax optimization goals.

Optimizing Income Tax with Strategic Planning

Navigating income tax complexities requires strategic planning, where a qualified Income Tax Advisor plays a pivotal role. They offer tailored tax optimization services, helping individuals and businesses minimize their tax burden while ensuring compliance with ever-changing regulations. Through retirement tax planning, capital gains tax advice, and sales tax consulting, these professionals guide clients in making informed decisions that can significantly impact their financial outcomes.

For self-employed individuals and businesses, payroll tax assistance is crucial to navigate the intricate rules surrounding employee and independent contractor taxes. International Tax Services are also provided by Certified Tax Advisors to support expatriates and multinational corporations, ensuring they stay on top of both domestic and international tax laws. This comprehensive approach to tax management enables clients to optimize their financial strategies, from day-to-day operations to long-term retirement planning.

Navigating International Tax Laws and Retirement Planning

Navigating the complex landscape of international tax laws can be daunting for individuals and businesses alike, especially when expanding operations across borders. An Income Tax Advisor offers specialized services to help clients manage their cross-border tax obligations effectively. They provide crucial guidance on matters such as double taxation agreements, foreign earnings exclusion, and treaty benefits, ensuring compliance with both domestic and international tax regulations. This expert support is invaluable for multinational corporations and expatriates, enabling them to optimize their global tax strategies and avoid costly mistakes.

Retirement planning is another critical aspect where a Tax Advisor’s expertise shines. As individuals prepare for their golden years, they face various tax considerations that can impact the overall success of their retirement income. A qualified advisor offers tailored Retirement Tax Planning services, including advice on taxable and nontaxable sources of income, capital gains tax strategies, and the optimization of Social Security benefits. Additionally, for self-employed individuals, payroll tax assistance is provided to ensure accurate reporting and compliance with sales tax regulations. This comprehensive support ensures that clients’ retirement funds are managed efficiently, maximizing after-tax dollars and peace of mind.

Comprehensive Support for Self-Employed Individuals and Sales Tax Management

For self-employed individuals, navigating complex income tax rules and managing various taxes like payroll and sales tax can be overwhelming. Certified Tax Advisors offer comprehensive support tailored to their unique needs. These experts provide crucial guidance on tax optimization services, ensuring that every deduction is maximized and every liability is met. From accurate reporting of capital gains tax advice to meticulous sales tax consulting, they streamline the process, leaving individuals free to focus on their core business activities.

Moreover, as many self-employed folks plan for retirement, engaging an Income Tax Advisor becomes even more vital. They assist in retirement tax planning, helping clients make informed decisions that minimize tax implications while maximizing savings. International tax services are also available for those with global income streams or assets, ensuring adherence to both domestic and foreign regulations. This personalized approach makes it possible for self-employed individuals to manage their finances effectively and plan for the future with confidence.

Navigating complex tax scenarios no longer has to be daunting. By engaging a Certified Tax Advisor, individuals and businesses can access specialized services tailored to their unique needs. From strategic income tax planning to international tax laws and retirement preparation, these experts offer comprehensive guidance. Whether it’s optimizing capital gains, managing sales tax, or providing payroll tax assistance for self-employed individuals, qualified advisors ensure compliance while maximizing financial benefits. Embrace the power of expert tax management and unlock a future of financial stability and growth.