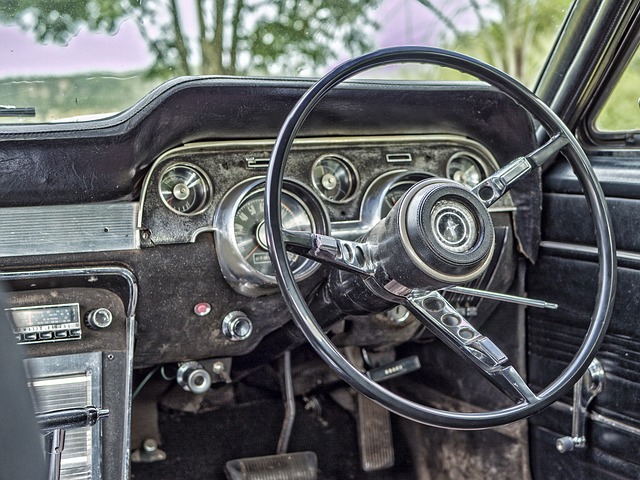

When a vehicle is reconstructed and assigned a rebuilt title, navigating the subsequent insurance process can be complex. Unlike their counterparts with clean titles, cars that have been rebuilt due to significant damage require careful handling when securing insurance coverage. This article delves into the nuances of insuring a rebuilt car, offering clear guidance on how to transfer a rebuilt title effectively, and the critical paperwork involved. It also provides insightful best practices for selling such vehicles, with a focus on the specifics of transferring a salvage-to-rebuilt title. Furthermore, understanding the stringent inspection requirements for rebuilt titles is essential for ensuring that your vehicle meets insurers’ standards. With expert advice on each step, from obtaining a comprehensive vehicle history report to acing the rebuilt title inspection, this article equips you with the knowledge to confidently manage your rebuilt car’s insurance and title transfer process.

Navigating Insurance for Rebuilt Titles: Ensuring Full Coverage

When a vehicle with a rebuilt title is back on the road, securing adequate insurance coverage is a critical step for both the owner’s peace of mind and legal compliance. Unlike vehicles with clean titles, those with rebuilt titles may face additional scrutiny from insurance companies due to their history. A car that has been declared a total loss and later rebuilt may carry a stigma that can affect insurability. To navigate this complex process, it’s imperative to understand the paperwork involved in transferring a rebuilt title. The rebuilt title transfer paperwork requires meticulous documentation, including proof of ownership, a salvage title, evidence of repair completion, and often a rebuilt title inspection report. This inspection, which verifies that the vehicle has been restored to a condition that meets safety and performance standards, is crucial for insurers to assess the risk associated with the car.

Sellers looking to transfer a rebuilt title must ensure all paperwork is in order and that the vehicle’s restoration adheres to state regulations. Buyers should be aware of the title transfer for salvage-to-rebuilt cars process and its implications on insurance options. Insurance policies for rebuilt titles may range from limited coverage, which typically includes liability insurance, to full coverage that might be more challenging to secure. To improve insurability, it’s advisable to ensure that all repairs are performed by certified professionals and meet industry standards. This due diligence can help in obtaining comprehensive vehicle history reports, which provide assurance to both the owner and potential insurers about the car’s condition and past. Understanding the nuances of a rebuilt title inspection requirements is essential for ensuring full coverage for this type of vehicle. Engaging with knowledgeable insurance agents who specialize in such cases can further streamline the process, leading to more favorable insurance terms for owners of rebuilt-title cars.

Comprehensive Guide to Transferring a Rebuilt Title: Paperwork and Processes

When navigating the process of transferring a rebuilt title, it’s imperative to be well-versed in the specific paperwork and procedures required. The journey begins with gathering the necessary documentation. This includes the completed application for a certificate of title, which varies by state but often requires submission of a rebuilt title affidavit or similar form acknowledging the vehicle’s history. Additionally, proof of ownership, such as a salvage title, must be provided along with a bill of sale reflecting the transaction details.

Furthermore, a rebuilt title inspection is a critical step in the transfer process. This assessment ensures the vehicle meets safety and legal standards post-repair. The requirements for this inspection can differ by state; however, it generally involves a thorough examination by an authorized inspector who checks for proper part replacement, vehicle identification number (VIN) integrity, and overall compliance with state regulations. Once the vehicle passes this inspection and all paperwork is in order, the state’s department of motor vehicles (DMV) will issue the new rebuilt title. It’s advisable to consult the specific guidelines for your state, as the exact requirements for selling a car with a rebuilt title can vary, including the necessary documentation and proof of repairs. Understanding these steps and adhering to the title transfer for salvage-to-rebuilt cars process is essential for a smooth transition and legal compliance.

Best Practices for Selling a Car with a Rebuilt Title and Title Transfer Insights for Salvage-to-Rebuilt Cars

When selling a car with a rebuilt title, transparency and thorough documentation are key to facilitating a smooth transaction. Potential buyers will be more confident in their purchase if they can see all the paperwork associated with the rebuilt title transfer process. It’s essential to have all the rebuilt title transfer paperwork in order, including the title certificate that reflects the rebuilt status, proof of insurance, and a detailed vehicle history report. The latter should explicitly mention the car was rebuilt and the reasons for its salvage title. Additionally, providing evidence that all repairs were carried out according to industry standards can significantly enhance the vehicle’s marketability. To ensure a seamless transfer, the seller must disclose the car’s history and provide any relevant documentation, such as a bill of sale or repair receipts, to the buyer.

For title transfer insights specific to salvage-to-rebuilt cars, it’s imperative to adhere to state regulations, as they vary widely across the United States. The process typically involves submitting rebuilt title transfer paperwork to the appropriate state department of motor vehicles (DMV). This paperwork often includes a completed application for a certificate of title, proof of ownership, and a rebuilt title affidavit or similar declaration. The rebuilt title inspection requirements must be met; these inspections verify that the vehicle has been restored to safe operating conditions. The DMV will then issue a rebuilt title upon successful completion of the inspection and approval of all submitted documentation. It’s advisable to initiate this process well in advance of the sale to avoid any delays that could jeopardize the transaction. Understanding and fulfilling these requirements is not only critical for legal compliance but also for establishing trust with potential buyers.

When navigating the process of insuring and transferring a rebuilt title, it’s imperative to be well-informed. This article has provided a comprehensive overview, detailing the necessary steps for securing insurance for your rebuilt vehicle, understanding the intricacies of transferring a rebuilt title, and preparing for a rebuilt title inspection. By following the best practices outlined in sections like “Navigating Insurance for Rebuilt Titles” and “Comprehensive Guide to Transferring a Rebuilt Title,” and keeping abreast of the latest requirements for selling a car with a rebuilt title, as discussed in “Best Practices for Selling a Car with a Rebuilt Title” and insights on title transfer for salvage-to-rebuilt cars, you can effectively manage these processes. It’s advisable to leverage the resources available to obtain a thorough vehicle history report and ensure all repairs meet industry standards, which in turn will enhance your ability to secure comprehensive coverage. Remember, due diligence is key when dealing with rebuilt titles, and this article serves as a guide to help you through each step of the journey.