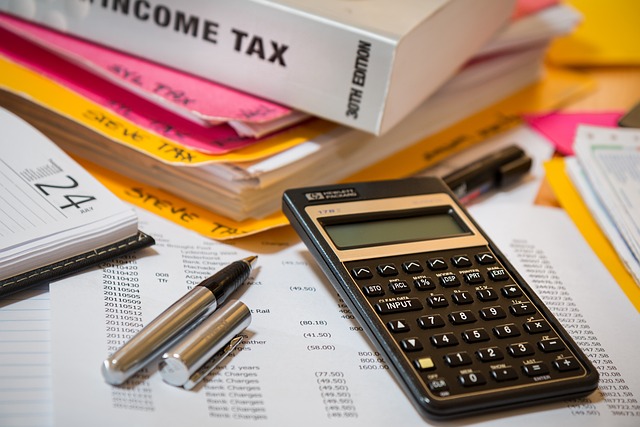

Managing tax obligations can be a complex and daunting task, especially with the ever-evolving landscape of IRS regulations. As tax laws become more intricate, individuals and businesses alike are faced with the challenge of staying compliant and optimizing their tax positions. Our comprehensive guide delves into Year-End Tax Planning for Individuals and Businesses, offering actionable insights to maximize savings. We emphasize the importance of engaging Certified Tax Preparers, whose expertise in navigating the nuances of tax compliance is invaluable. This article will also explore Tax Saving Strategies crafted to align with your unique financial profile, providing a personalized approach to minimizing your tax liabilities. Additionally, we’ll guide you through Income Tax Calculation with expert insights, ensuring clarity and accuracy. For corporate entities, our discussion on Corporate Tax Solutions will highlight ways to streamline your business’s tax obligations effectively. Lastly, we’ll shed light on leveraging Taxpayer Relief Services to alleviate the burden of tax-related issues and maintain good standing with the IRS, all while emphasizing the importance of meeting filing deadlines and avoiding potential penalties with ease.

- Mastering Year-End Tax Planning for Individuals and Businesses

- The Advantage of Engaging Certified Tax Preparers for Your Tax Needs

- Comprehensive Tax Saving Strategies Tailored to Your Financial Profile

- Navigating Income Tax Calculation: A Step-by-Step Guide with Expert Insights

- Corporate Tax Solutions: Streamlining Your Business's Tax Obligations

- Understanding and Utilizing Taxpayer Relief Services to Your Advantage

- Staying Compliant: Meeting IRS Filing Deadlines and Avoiding Penalties with Ease

Mastering Year-End Tax Planning for Individuals and Businesses

As year-end approaches, both individuals and businesses face the critical task of tax planning to optimize their financial position and ensure compliance with tax laws. Mastering Year-End Tax Planning is not a one-size-fits-all endeavor; it requires tailored strategies that consider each entity’s unique financial landscape. Certified Tax Preparers at Taxpayer Relief Services bring a wealth of knowledge to the table, leveraging their expertise in income tax calculation and corporate tax solutions to design individualized tax-saving strategies. These professionals stay abreast of the latest changes in tax regulations, ensuring that clients can navigate complex tax environments with confidence.

Engaging in proactive year-end tax planning with Taxpayer Relief Services means you’re not leaving your financial health to chance. It involves a comprehensive review of the past year’s transactions and a forward-looking analysis to identify opportunities for tax savings. This meticulous process can uncover deductions, credits, and other incentives that might otherwise go unnoticed, potentially reducing your tax liability significantly. With the intricate nature of tax laws, it’s crucial to have a trusted ally in the realm of tax planning. Taxpayer Relief Services’ certified tax preparers stand ready to guide you through every step, ensuring that your year-end tax planning is not only compliant but also strategic, setting you up for a prosperous new fiscal year.

The Advantage of Engaging Certified Tax Preparers for Your Tax Needs

Engaging certified tax preparers is a strategic advantage for individuals and businesses alike when it comes to managing year-end tax planning. These professionals are adept at navigating the intricate web of tax laws and regulations, ensuring that your financial situation is optimized to maximize tax savings. With their expertise in income tax calculation and understanding of complex corporate tax solutions, they can identify and implement effective strategies tailored to your unique tax scenario. Their knowledge extends beyond mere compliance; it encompasses a proactive approach to taxpayer relief services, where they actively seek opportunities for you to reduce your tax liability and potentially increase your financial returns. By leveraging their skills, you not only safeguard against the potential pitfalls of an audit but also position yourself to take full advantage of legal deductions and credits. This level of professional guidance is invaluable, especially given the ever-evolving tax code, which can be daunting for the uninitiated. With their assistance, you can rest assured that your tax return filing will be completed accurately and on time, thus helping you to avoid penalties and maintain a positive standing with the IRS. The peace of mind gained from knowing that an expert is handling your taxes is immeasurable, allowing you to focus on what you do best, whether it’s running your business or enjoying your personal life, confident that your tax matters are in capable hands.

Comprehensive Tax Saving Strategies Tailored to Your Financial Profile

navigating the complexities of tax law can be daunting, especially with the ever-evolving landscape of year-end tax planning. Our IRS tax help services are designed to offer personalized tax saving strategies that align with your unique financial profile. Our team of certified tax preparers delves into your fiscal situation to identify opportunities for significant tax savings. By leveraging their deep understanding of income tax calculation and the latest corporate tax solutions, they tailor a strategic approach that not only maximizes your financial efficiency but also ensures compliance with current IRS regulations.

Understanding the nuances of tax law is critical for effective year-end tax planning and maintaining good standing with the IRS. Our taxpayer relief services are here to assist you through every step of the process, from meticulous filing to sophisticated strategy implementation. We stay abreast of the latest changes in tax compliance and filing requirements, ensuring that our clients benefit from the most current and advantageous tax saving strategies. Whether it’s navigating complex income tax calculations or finding relief from audits, our expertise allows you to approach your tax obligations with confidence, knowing that you are supported by professionals who understand the intricacies of the tax system.

Navigating Income Tax Calculation: A Step-by-Step Guide with Expert Insights

As the tax landscape becomes increasingly complex, individuals and businesses alike seek expert guidance to navigate income tax calculation effectively. Year-End Tax Planning is a pivotal process that enables taxpayers to proactively manage their finances in anticipation of the upcoming fiscal year. Certified Tax Preparers play a crucial role here, offering insights that align with each taxpayer’s unique financial situation. These professionals are adept at identifying opportunities for tax savings through strategic planning and the utilization of legitimate tax-saving vehicles.

Engaging with Taxpayer Relief Services can provide relief and clarity when faced with the intricacies of income tax calculation. Their expertise in corporate tax solutions is instrumental in ensuring that businesses optimize their tax positions, adhering to the ever-evolving regulations set forth by the IRS. By staying abreast of the latest changes to tax compliance and filing requirements, these services help taxpayers meet critical deadlines and avoid potential penalties. The guidance provided by these experts not only aids in reducing the tax burden but also keeps businesses in good standing with the IRS. With a comprehensive approach that includes meticulous income tax calculation and strategic planning, Tax Saving Strategies are within reach for those who seek professional assistance.

Corporate Tax Solutions: Streamlining Your Business's Tax Obligations

Navigating the complex landscape of corporate tax obligations can be a daunting task for businesses. The intricacies of year-end tax planning require meticulous attention to detail and an understanding of the ever-evolving tax code. Certified tax preparers with expertise in corporate tax solutions stand as beacons for businesses looking to manage their tax liabilities effectively. These professionals are adept at income tax calculation and leverage their knowledge to implement strategic measures that not only comply with regulations but also optimize financial outcomes. By engaging with these experts, companies can ensure that they take full advantage of tax-saving opportunities, thereby strengthening their bottom line. Furthermore, in the event of audits or filing issues, these taxpayer relief services offer invaluable support, helping businesses maintain good standing with the IRS and avoid unnecessary penalties. With the recent changes to tax compliance and filing requirements, relying on professional tax planning has become more critical than ever for corporations aiming to streamline their tax obligations efficiently and effectively. Tax saving strategies are tailored to each business’s unique situation, ensuring that every dollar is accounted for and maximized in accordance with current laws and regulations. By entrusting your corporate tax solutions to seasoned professionals, your business can navigate the complexities of tax law with confidence, securing its financial health for years to come.

Understanding and Utilizing Taxpayer Relief Services to Your Advantage

Engaging with year-end tax planning is a pivotal step in optimizing your financial position and maximizing tax savings. As the fiscal year draws to a close, it becomes imperative to strategize effectively to minimize tax liabilities. Certified Tax Preparers with expertise in income tax calculation can provide valuable insights and guidance tailored to your unique financial situation. These professionals are adept at navigating complex tax codes and regulations, ensuring that every deduction and credit you’re entitled to is accounted for. Their role is crucial in crafting a comprehensive plan that aligns with your individual or corporate tax needs.

Taxpayer Relief Services extend beyond mere compliance; they offer a lifeline for those facing the intricacies of tax disputes, complex return filings, and the ever-evolving landscape of IRS regulations. By utilizing these services, taxpayers can alleviate the stress associated with audits and other tax-related issues. Corporate Tax Solutions, provided by these experts, are designed to address the multifaceted challenges businesses encounter, from multistate taxation to international tax considerations. Leveraging these services not only positions you for compliance but also empowers you with the knowledge and tools necessary to make informed decisions regarding your tax strategy, ensuring that you remain in good standing with the IRS and capitalize on opportunities for tax savings throughout the year.

Staying Compliant: Meeting IRS Filing Deadlines and Avoiding Penalties with Ease

With the intricate web of tax regulations and the ever-evolving landscape of IRS requirements, staying compliant can be a daunting task for even the most diligent taxpayers. The complexity of year-end tax planning often necessitates professional expertise to navigate effectively. Our IRS tax help services are designed to guide individuals through the process, ensuring that all filing deadlines are met without incurring unnecessary penalties. By leveraging the knowledge of certified tax preparers, we provide tailored strategies that align with your financial situation and optimize your tax-saving opportunities. These professionals are adept at income tax calculation and adeptly apply their skills to offer taxpayer relief services for those facing audits or complex filing issues. Our aim is to simplify the process for you, allowing you to focus on what matters most while we handle the technicalities of your tax compliance.

In today’s fast-paced business environment, staying compliant with corporate tax solutions is not just about adherence but also about strategic planning. The recent changes in tax laws and regulations can have a significant impact on your bottom line. Our services are equipped to offer comprehensive support, ensuring that your business remains in good standing with the IRS. We understand the critical importance of timely filing and accurate income tax calculation for businesses. Our team’s expertise in corporate tax solutions is instrumental in developing strategies that not only help you stay compliant but also potentially reduce your tax liability. With our assistance, you can navigate the complexities of tax compliance with ease, ensuring peace of mind and allowing you to concentrate on driving your business forward.

Navigating the complexities of tax compliance can be a daunting task for individuals and businesses alike. The intricacies of Year-End Tax Planning, the strategic use of Certified Tax Preparers, and the implementation of Tax Saving Strategies tailored to your unique financial profile are crucial steps in maintaining fiscal health. Our comprehensive suite of services, including expert guidance on Income Tax Calculation and specialized Corporate Tax Solutions, empowers you to manage your tax obligations effectively. Moreover, understanding and utilizing Taxpayer Relief Services can alleviate the stress associated with IRS interactions. By leveraging our expertise, you can confidently meet filing deadlines, minimize penalties, and maintain good standing with the IRS. Rest assured, with our assistance, you’re well-equipped to face the tax landscape with clarity and confidence.