- Notary Responsibilities and Legal Implications

- – Explaining notarial acts and their significance

- – Risks associated with negligence in notarial duties

- The Role of Liability Insurance for Notaries

Notary Responsibilities and Legal Implications

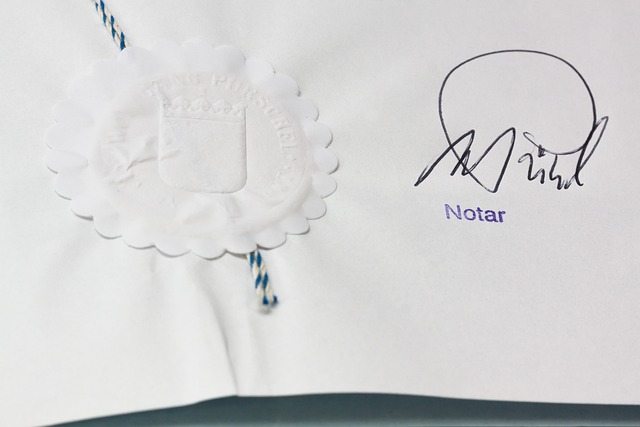

Notaries have a multifaceted role in legal and official document processes, ensuring the authenticity and integrity of signatures. Their responsibilities encompass verifying the identity of signers, witnessing and affirming the voluntariness of signatures, and certifying documents as required by law. Notarial acts demand meticulous attention to detail as any oversight or negligence can result in severe legal implications.

Failure to adhere to notary duties, such as failing to obtain proper identification, improperly administering oaths, or misrepresenting document content, may lead to claims of notarial misconduct and malpractice. Consequently, notaries must be well-versed in notary law and ethics to mitigate risks and avoid potential liabilities. Liability insurance, including Errors and Omissions (E&O) coverage, plays a pivotal role in protecting notaries from financial loss resulting from such claims.

– Explaining notarial acts and their significance

Notarial acts are crucial components in legal and official document certification processes. Notaries public have specific duties and responsibilities as outlined by local notary laws. They witness and authenticate signatures, ensuring the authenticity and integrity of documents, which is of utmost importance for legal validity. Every act requires meticulous attention to detail due to the significant impact it can have on individuals’ rights and legal proceedings. Any negligence or oversight on the part of a notary can lead to serious consequences, including legal liability and potential claims of malpractice.

The significance of notarial acts cannot be overstated, especially in an era where documents are increasingly digital. Notaries play a vital role in safeguarding against fraud and ensuring that signed documents are genuine. To protect themselves and their clients from financial loss and reputational damage, it is highly recommended that notaries secure liability insurance, commonly known as Errors and Omissions (E&O) insurance. This coverage protects against claims arising from alleged notarial misconduct or errors in judgment during document certification processes. Additionally, maintaining a notary bond further underscores the notary’s commitment to ethical practices and provides an additional financial guarantee.

– Risks associated with negligence in notarial duties

Negligence in notarial duties can have severe repercussions, as it directly impacts the integrity and legal validity of documents. Notaries are entrusted with certifying important legal documents, such as wills, contracts, or powers of attorney, which require precise attention to detail. Any oversight or mistake could lead to significant consequences for all parties involved. For instance, a missed signature or an incorrect date might render a document null and void, causing delays, additional costs, and potential disputes.

Moreover, negligence can result in legal liability and financial loss for the notary. If a certified document is found to be inaccurate or fraudulent due to the notary’s oversight, they may face substantial claims from clients or third parties. Liability insurance, such as Errors and Omissions (E&O) coverage, serves as a crucial shield against these risks. It protects notaries from financial loss resulting from claims of malpractice, ensuring that they can uphold their professional responsibilities without undue concern for personal liability.

The Role of Liability Insurance for Notaries

Liability insurance plays a pivotal role in safeguarding notaries from potential financial and reputational risks associated with their duties. As notarial acts require meticulous attention to detail, any oversight or negligence can lead to legal implications and notary claims. Errors and Omissions (E&O) insurance, also known as professional liability insurance, is designed to protect notaries against claims of malpractice or misconduct. This coverage becomes especially vital when considering the sensitivity and legal weight of document certification processes.

By securing E&O insurance, notaries can ensure that they are financially protected in the event of a claim. This insurance helps cover the costs associated with legal defense and potential settlements, safeguarding the notary’s personal assets. Moreover, it reinforces the importance of adhering to notary ethics and duties, as insured notaries have an added incentive to maintain high standards of professionalism to minimize risks and protect their liability coverage.