Tax planning is a cornerstone of smart financial management. As the year comes to a close, Year-End Tax Planning becomes crucial for maximizing deductions and achieving your financial goals. Our comprehensive services, led by certified tax preparers, offer tailored advice and IRS tax help, empowering you with insights into tax-saving strategies and ensuring compliance. Whether self-employed or running a business, we design customized tax plans to minimize liabilities while optimizing income tax calculation. Unlock significant taxpayer relief services and discover creative tax saving strategies for businesses, transforming your financial landscape.

- Understanding Year-End Tax Planning: Why It Matters and When to Start

- The Role of Certified Tax Preparers in Optimizing Your Taxes

- Unlocking Taxpayer Relief Services: Strategies for Significant Savings

- Creative Tax Saving Strategies: What Every Business Owner Should Know

- Corporate Tax Solutions: Streamlining Income Tax Calculation for Businesses

Understanding Year-End Tax Planning: Why It Matters and When to Start

Year-end tax planning is a crucial aspect of financial management that often gets overlooked until it’s almost too late. It involves strategic preparation to optimize your taxes, taking advantage of deductions and credits while ensuring compliance with IRS regulations. By engaging certified tax preparers early in the process, you can leverage their expertise to identify potential savings and navigate complex tax laws effectively. This proactive approach is especially vital for business owners and self-employed individuals who face unique tax considerations.

Starting your year-end tax planning as early as possible offers several benefits. It allows ample time to review financial records, analyze income and deductions, and implement strategies that align with your goals. Additionally, it helps you stay ahead of deadlines, avoid last-minute stress, and potentially secure taxpayer relief services through efficient tax calculations and planning. Early preparation ensures a smoother process, reduces errors, and may even lead to significant tax savings, providing a valuable advantage in managing your corporate tax solutions or income tax calculation.

The Role of Certified Tax Preparers in Optimizing Your Taxes

In the realm of year-end tax planning, certified tax preparers play a pivotal role in optimizing your taxes and maximizing taxpayer relief services. These professionals bring expertise to bear on complex income tax calculations, ensuring that every deduction and credit is leveraged to minimize liabilities. With their deep knowledge of current tax laws and regulations, they can implement effective tax-saving strategies tailored to individual or corporate tax scenarios.

By engaging certified tax preparers, businesses and individuals alike can navigate the intricate web of tax codes with confidence. These experts provide valuable insights into optimizing business structures, managing expenses, and taking advantage of available deductions. They help in preparing accurate financial statements, ensuring compliance with IRS requirements, and offering peace of mind knowing that one’s taxes are in capable hands.

Unlocking Taxpayer Relief Services: Strategies for Significant Savings

Engaging year-end tax planning strategies with certified tax preparers is key to unlocking significant taxpayer relief services and substantial tax savings. Our experts leverage their deep understanding of complex tax laws to offer tailored advice, ensuring compliance while maximizing deductions for individuals and corporations alike. We go beyond simple income tax calculation by identifying opportunities in corporate tax solutions, enabling clients to navigate the tax code efficiently.

By prioritizing proactive year-end planning, businesses can significantly reduce their tax burden. Our strategies focus on legitimate tax saving methods, helping companies optimize expenses and investments throughout the year. With our assistance, business owners gain control over their financial future, ensuring they stay compliant with IRS regulations while minimizing liabilities.

Creative Tax Saving Strategies: What Every Business Owner Should Know

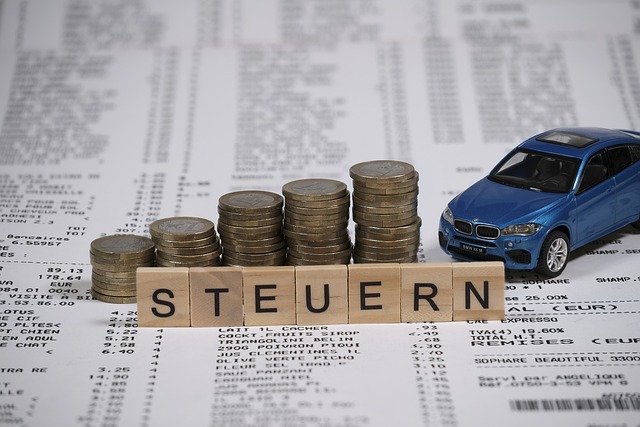

Creative tax-saving strategies are a crucial aspect of year-end tax planning for business owners. By leveraging the expertise of certified tax preparers, entrepreneurs can uncover valuable taxpayer relief services that go beyond traditional deductions. One effective approach is to optimize corporate tax solutions by carefully reviewing income tax calculations and identifying opportunities to minimize liabilities. This may involve structuring expenses strategically, taking advantage of tax credits, or exploring deferred compensation plans.

Business owners should also be aware of the long-term benefits of proactive tax planning. By aligning their financial goals with efficient tax strategies, they can ensure compliance while maximizing returns. From simplifying record-keeping to staying updated on changing tax laws, these practices empower business owners to take control of their finances and make informed decisions that drive success.

Corporate Tax Solutions: Streamlining Income Tax Calculation for Businesses

In today’s complex business landscape, effective year-end tax planning is more crucial than ever for corporations seeking to optimize their financial strategies. Our team of certified tax preparers specializes in providing tailored corporate tax solutions that streamline income tax calculation processes. By leveraging advanced tax laws and taxpayer relief services, we design innovative strategies to minimize liabilities and maximize tax savings for our clients.

We understand the unique challenges faced by businesses, especially owners navigating self-employment or running enterprises. Our expertise lies in helping them structure their operations to align with IRS guidelines while leveraging legal deductions and credits. Through meticulous planning, we ensure our clients remain compliant, avoiding costly penalties, and capitalize on opportunities for taxpayer relief, ultimately fostering a robust financial foundation for their ventures.

Year-end tax planning is a strategic must for anyone seeking smart financial management. By leveraging the expertise of certified tax preparers and exploring taxpayer relief services, individuals and businesses alike can optimize deductions, minimize liabilities, and align their tax strategies with their financial goals. Incorporating creative tax-saving strategies and understanding corporate tax solutions further streamlines income tax calculation processes. Don’t leave your hard-earned money on the table – start planning today for a brighter financial future.