When navigating the complex landscape of auto insurance, distinguishing between comprehensive and collision coverage is paramount. This article delves into the essential differences between these two types of coverage, guiding you through the selection process for policies that align with your vehicle’s value and risk profile. We will explore the benefits of full coverage, which marries comprehensive and collision protection, and its suitability for various vehicle types, including rental cars, commercial fleets, and classic vehicles. Additionally, we will provide insights on optimizing your policy through strategic use of discounts, thoughtful management of deductibles, and navigating the unique challenges posed by high-risk driver coverage. Understanding how personal circumstances influence insurance premiums completes the picture, ensuring you are well-equipped to make informed decisions about your auto insurance needs.

- Navigating Auto Insurance Options: Understanding Comprehensive and Collision Coverage

- Full Coverage Explained: The Synergy of Comprehensive and Collision Policies

- Evaluating Your Vehicle and Risk: Making Informed Decisions on Coverage Levels

- Tailored Protection: Special Considerations for Rental Car Insurance, Commercial Auto Insurance, and Classic Car Coverage

- Strategizing Your Policy: Utilizing Discounts, Managing Deductibles, and Dealing with High-Risk Driver Coverage

Navigating Auto Insurance Options: Understanding Comprehensive and Collision Coverage

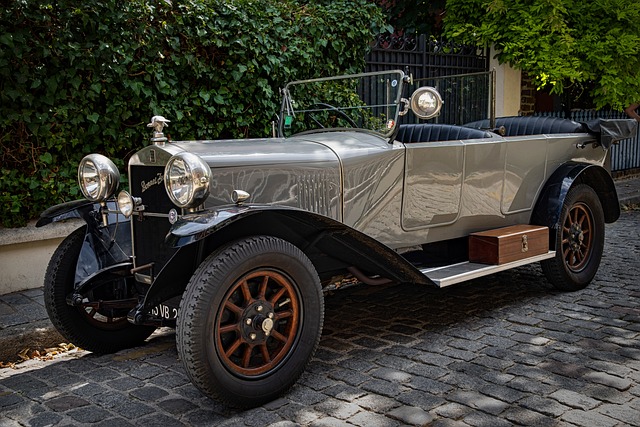

When considering your auto insurance options, it’s crucial to differentiate between comprehensive and collision coverage. Comprehensive coverage safeguards your vehicle against a range of non-collision events such as theft, vandalism, fire, or natural disasters like floods or hail storms. This type of coverage is particularly relevant for those with a vehicle at risk of these perils, including owners of classic cars who may rely on comprehensive coverage to protect their investment from unexpected damage or loss. On the other hand, collision insurance is designed to cover repairs or replacement costs when your car is involved in an accident with another vehicle or object. This aspect of auto insurance is critical for those leasing or financing a car, as it’s often mandatory to ensure the lender’s interests are protected.

Choosing between rental car insurance, commercial auto insurance, and classic car coverage involves understanding your specific needs and the extent of protection you require. For instance, if you frequently rent vehicles, additional rental car insurance may be prudent. Conversely, those operating fleets of cars for business purposes will benefit from commercial auto insurance. Classic car aficionados must explore specialized policies that not only offer comprehensive coverage but also account for the unique nature and value of these vehicles. When selecting your policy, consider factors such as car insurance deductibles—the amount you agree to pay out-of-pocket before your insurance kicks in. A higher deductible can lower your insurance premiums, but ensure that the chosen deductible is manageable within your budget. High-risk driver coverage can also affect your premiums; drivers with a history of accidents or traffic violations may face higher rates, making it essential to shop around for the best rates and discounts on car insurance available. These discounts can be based on various factors such as safe driving records, vehicle safety features, or loyalty to an insurance provider. Always assess your coverage needs in light of your vehicle’s value and your personal risk tolerance to ensure you have the right balance of protection and affordability.

Full Coverage Explained: The Synergy of Comprehensive and Collision Policies

When considering the synergy of comprehensive and collision policies within full coverage auto insurance, it’s essential to understand how this comprehensive approach can benefit you. Full coverage combines comprehensive and collision policies, offering a robust shield against a wide array of potential mishaps. Comprehensive coverage steps in when your vehicle encounters perils not involving another vehicle, such as falling objects, fire, theft, or vandalism. On the other hand, collision coverage is critical when your car is involved in an accident with a fixed object like a tree or another vehicle, regardless of fault. Together, these policies provide a comprehensive safety net that can include rental car insurance, a valuable addition if your car is under repair. This holistic approach to auto insurance is particularly beneficial for those with commercial auto insurance needs or classic car coverage enthusiasts who want to safeguard their investment against the unexpected.

Incorporating both types of coverage into full coverage auto insurance can also be advantageous for high-risk drivers. It ensures that even if you’re deemed a higher risk due to past incidents, your vehicle is protected. Moreover, full coverage can come with discounts on car insurance, which can significantly lower insurance premiums when you qualify. These discounts often reward safe driving habits or the installation of advanced safety features in your vehicle. Assessing your specific circumstances, such as the value of your car and your personal risk tolerance, will guide you to determine the most suitable level of coverage for your needs. It’s advisable to consult with an insurance agent to tailor a policy that fits your situation perfectly, ensuring you have the right balance of protection and affordability.

Evaluating Your Vehicle and Risk: Making Informed Decisions on Coverage Levels

When evaluating your vehicle and risk, it’s essential to consider various factors that influence the type and level of auto insurance coverage you should have. For instance, if you drive a classic car, specialty coverage like Classic Car Coverage is often necessary due to its unique value and the specific needs of such vehicles. This specialized policy can offer agreed value or stated value, which regular car insurance policies might not provide. On the other hand, if you rely on your vehicle for business purposes, Commercial Auto Insurance is a must to ensure compliance with legal requirements and adequate protection for both your asset and potential liabilities associated with commercial use.

Another key aspect to consider is the coverage level that aligns with your risk tolerance and financial situation. High-Risk Driver Coverage can be a consideration for individuals who have had multiple violations or accidents, which may raise their insurance premiums. In such cases, it’s crucial to explore options that can lead to Discounts on Car Insurance, such as completing defensive driving courses or installing safety devices. Understanding your car insurance deductible options is also vital; a higher deductible can lower your insurance premiums but will require you to pay more out of pocket if you file a claim. Balancing the cost of insurance premiums with the need for adequate coverage can be complex, but making informed decisions is pivotal in ensuring that you are not underinsured or overpaying for your policy. Rental Car Insurance is an additional coverage that can offer peace of mind if your vehicle is in the shop due to an insured incident. Weighing these factors and exploring all available options will enable you to select the most suitable auto insurance policy for your specific needs, mitigating potential financial burdens should an incident occur.

Tailored Protection: Special Considerations for Rental Car Insurance, Commercial Auto Insurance, and Classic Car Coverage

When considering auto insurance tailored to different needs, it’s important to evaluate the specific coverage options available for rental cars, commercial vehicles, and classic cars. Rental Car Insurance often offers temporary coverage that aligns with your existing policy, ensuring continuity of protection while you’re behind the wheel of a hire car. This temporary coverage can include collision damage waivers (CDW) or loss damage waivers (LDW), which can safeguard renters from financial responsibility should their rental vehicle be damaged or stolen. It’s advisable to carefully review your personal policy and understand what is covered, as some rental car agreements may require additional insurance.

For those operating commercial vehicles, Commercial Auto Insurance is a necessity rather than an option. These policies are designed to address the higher risks associated with business use, such as higher mileage, multiple drivers, and cargo liability. They often come with higher insurance premiums due to these increased exposure factors but offer comprehensive protection against both collision and comprehensive losses. Classic Car Coverage, on the other hand, is tailored for car enthusiasts and owners of vintage or collector vehicles. These policies may offer agreed value coverage, which ensures that you receive the full insured value in the event of a total loss, and typically come with specialized provisions to account for the vehicle’s unique features and potential use in exhibitions or parades.

Understanding Car Insurance Deductibles is another critical aspect of selecting the right insurance plan. A deductible is the amount you agree to pay out-of-pocket before your insurance kicks in. Choosing a higher deductible can lower your insurance premiums, but it also means you’ll bear more of the cost if an incident occurs. Conversely, opting for a lower deductible will result in higher premiums but may provide greater financial relief when claiming. High-Risk Driver Coverage is designed for individuals who have had their driving privileges suspended or restricted due to violations or accidents. This type of coverage can be more expensive and may include stipulations like installing a monitoring device in the vehicle. Lastly, don’t overlook the potential for Discounts on Car Insurance, which can be applied for various reasons, such as completing a defensive driving course, maintaining a good driving record, or bundling multiple policies with the same insurer. By carefully considering these factors and tailoring your coverage to your specific needs, you can ensure that you have the right protection in place at the best possible rate.

Strategizing Your Policy: Utilizing Discounts, Managing Deductibles, and Dealing with High-Risk Driver Coverage

When strategizing your auto insurance policy, it’s advantageous to explore various options that can reduce costs while maintaining adequate coverage. One such strategy is to take advantage of discounts offered by insurers. These can include everything from multi-car policies for families with multiple vehicles to discounts for drivers who have completed defensive driving courses or those who bundle their auto insurance with other types of insurance, such as homeowners or renters insurance. Rental Car Insurance is another aspect to consider; if you frequently rent vehicles, ensure your policy includes rental car coverage to avoid additional charges should you need a replacement car due to an accident or theft. For those with classic cars, specialized Classic Car Coverage tailored to the unique needs of these vehicles can provide peace of mind without breaking the bank.

Managing car insurance deductibles is another key element in customizing your policy. A higher deductible can lead to lower insurance premiums, but it’s important to choose a deductible amount that you can comfortably afford in the event of an accident. This balance between out-of-pocket costs and overall coverage can significantly impact your financial well-being post-incident. For high-risk drivers, securing High-Risk Driver Coverage is crucial. This type of policy takes into account a driver’s history and provides the necessary protection at a fair rate. It’s essential to be transparent with your insurer about your driving record to avoid gaps in coverage or future complications. Discounts on car insurance for high-risk drivers can sometimes be found through defensive driving courses, usage-based programs that monitor driving habits, or through commercial auto insurance policies if the vehicle is used for business purposes. By carefully considering these aspects of your auto insurance policy and utilizing available discounts, you can tailor a plan that offers comprehensive coverage at a price that suits your budget.

When selecting the right auto insurance policy, it’s essential to differentiate between comprehensive and collision coverage. This article has delved into the nuances of these coverages, highlighting their distinct roles in safeguarding your vehicle against various risks. Full coverage auto insurance, which combines both comprehensive and collision coverage, offers the most comprehensive protection. As you consider your options, weighing your vehicle’s worth and personal risk tolerance is key to making an informed decision. Additionally, this exploration has underscored the importance of understanding specialty insurance types like Rental Car Insurance, Commercial Auto Insurance, and Classic Car Coverage, ensuring tailored protection suited to diverse needs. Strategies such as leveraging discounts, managing car insurance deductibles, and navigating high-risk driver coverage options can also play a significant role in optimizing your policy while keeping insurance premiums manageable. In conclusion, by carefully evaluating these factors and the specific auto insurance options available to you, you can choose a policy that aligns with your vehicle’s value, risk tolerance, and unique circumstances.