When shopping for auto insurance, understanding the distinction between comprehensive and collision coverage is paramount. Comprehensive insurance shields your vehicle from non-collision perils like theft, vandalism, or natural calamities, while collision coverage kicks in during accidents with other vehicles or objects. Opting for full coverage, encompassing both, offers unparalleled protection.

This article guides you through the nuances of these coverages, helping you make informed choices. We’ll explore how to evaluate your vehicle’s value and risk profile to determine optimal coverage, plus delve into additional types like rental car, commercial auto, and classic car coverage, along with tips on deductibles and discounts to lower insurance premiums.

- Understanding Comprehensive vs. Collision Coverage: Protections for Different Scenarios

- Evaluating Your Vehicle and Risk Profile to Determine Optimal Coverage

- Navigating Additional Types of Auto Insurance and Their Benefits

Understanding Comprehensive vs. Collision Coverage: Protections for Different Scenarios

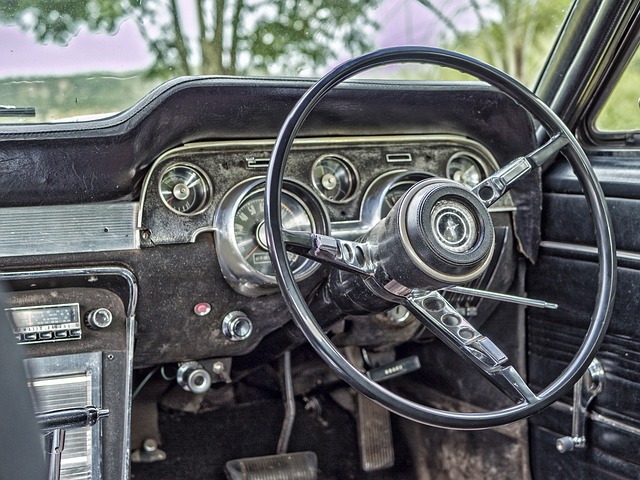

When comparing auto insurance policies, comprehending the distinctions between comprehensive and collision coverage is paramount. Comprehensive insurance offers protection against a wide range of non-collision events, such as theft, vandalism, and natural calamities. This type of coverage is invaluable for owners of valuable vehicles, including classics or collectibles, where the replacement cost could be substantial. On the other hand, collision coverage specializes in mitigating damages arising from accidents with other vehicles or fixed objects. It repairs or replaces your car, up to its actual cash value, after a collision.

For instance, if you’re renting a car and it’s damaged due to an accident, collision coverage within your rental car insurance would typically cover the repairs. Similarly, for commercial auto insurance policies, comprehensive and collision protections are essential to safeguard business assets. High-risk drivers may also require specialized coverage that combines comprehensive and collision, along with increased liability limits, to address higher insurance premiums. Discounts on car insurance can be availed by understanding these coverages and choosing the right balance of protection tailored to your vehicle’s value and personal risk profile.

Evaluating Your Vehicle and Risk Profile to Determine Optimal Coverage

Evaluating your vehicle’s value and understanding your risk profile are crucial steps in determining the optimal insurance coverage for your automotive needs. When it comes to rental cars, commercial vehicles, or even classic cars with sentimental value, assessing their worth is essential. Insurance companies often base their premiums on the replacement cost of the vehicle, so accurately gauging its market value will impact your insurance expenses.

Additionally, considering your risk profile as a driver is vital. Factors like your driving history, claims experience, and personal lifestyle can influence premium rates. High-risk drivers, for instance, might face higher premiums due to increased claims potential. Conversely, safe driving habits and a clean record may lead to discounts on car insurance. By analyzing these aspects, you can tailor your coverage choices, ensuring you’re appropriately insured without overspending, especially when considering options like Commercial Auto Insurance or Classic Car Coverage with specific Rental Car Insurance clauses to fit diverse vehicle ownership scenarios.

Navigating Additional Types of Auto Insurance and Their Benefits

When it comes to protecting your vehicle beyond the basics, several specialized insurance options cater to different needs. For instance, Rental Car Insurance is valuable if you frequently rent vehicles, ensuring coverage during those periods. Commercial Auto Insurance is tailored for business owners with company cars, providing liability protection and covering business-related incidents. If you own a classic car, Classic Car Coverage offers specialized care to preserve its historical value.

Understanding Car Insurance Deductibles is crucial; they represent the out-of-pocket expense you agree to pay when filing a claim. Lower deductibles mean higher premiums but offer peace of mind. Conversely, higher deductibles can reduce insurance premiums significantly. Additionally, High-Risk Driver Coverage caters to drivers with poor credit or a history of accidents, helping them access insurance despite increased risk. Many insurance providers also offer Discounts on Car Insurance for safe driving, good students, and bundling policies, potentially lowering your overall Insurance Premiums.

When choosing auto insurance, understanding the nuances between comprehensive and collision coverage is key to ensuring adequate protection. Comprehensive coverage provides a safety net for unforeseen events like theft or natural calamities, while collision coverage repairs damage from accidents. Opting for full coverage combines both, offering peace of mind and safeguarding your vehicle’s value. By evaluating your risk profile and vehicle importance, you can select the right balance between these coverages. Remember, the right auto insurance policy should adapt to your unique needs, whether it’s for a rental car, commercial fleet, or classic vehicle, potentially saving you on premiums while ensuring access to necessary coverage when needed.