When the unexpected occurs on the road, liability coverage stands as a critical safeguard against financial repercussions from accidents involving injury or property damage. This essential component of car insurance is not merely a legal requirement but a smart choice for drivers who value security and asset protection. Our comprehensive article delves into the nuances of liability coverage, guiding you through understanding its role, navigating state-specific mandates, and tailoring your policy to fit various vehicle types, including rental cars, commercial vehicles, and classic car collections. We also address managing deductibles and high-risk driver coverage, offering practical strategies for your financial planning. Additionally, we explore how to capitalize on discounts and the implications of insurance premiums on your liability coverage. With this knowledge, you’ll be equipped to make informed decisions about your car insurance, ensuring you have the right level of protection at the right price.

- Understanding Liability Coverage in Car Insurance: Your Shield Against Accidental Damages

- Navigating Liability Limits and State Requirements: What You Need to Know

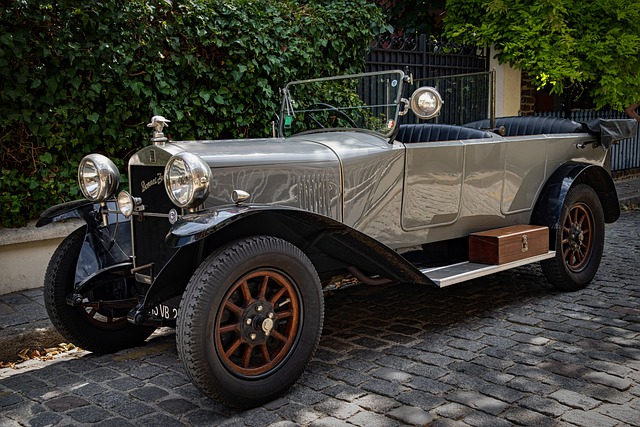

- Tailoring Your Liability Coverage for Different Vehicle Types: Rental Cars, Commercial Vehicles, and Classics

- Managing Car Insurance Deductibles and High-Risk Driver Coverage: Strategies for Effective Financial Planning

- Exploring Discounts on Car Insurance and the Impact of Insurance Premiums on Liability Coverage

Understanding Liability Coverage in Car Insurance: Your Shield Against Accidental Damages

Understanding liability coverage within the context of car insurance is crucial for anyone who drives. This type of coverage is designed to offer financial protection against claims and lawsuits for bodily injury and property damage that you, as the driver, are legally obligated to pay following an accident where you are at fault. It’s a comprehensive shield that acts as a safety net, ensuring that your personal assets remain secure in the event of unintended accidents. For those who use rental cars frequently, rental car insurance can be tailored to include liability coverage, providing similar protection as your personal auto insurance policy. Similarly, commercial auto insurance and classic car coverage often come with liability options specifically tailored to the risks associated with business use or the unique nature of classic vehicles.

When assessing your liability coverage, it’s important to consider car insurance deductibles—the amount you agree to pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically leads to lower insurance premiums, but it also means greater out-of-pocket expenses in the event of an accident. High-risk driver coverage is another aspect that requires attention; if you’ve been identified as a high-risk driver due to traffic violations or accidents, you’ll need to explore options that can provide adequate coverage at a reasonable cost. Discounts on car insurance are available for various reasons, such as maintaining a clean driving record, completing defensive driving courses, or even bundling your policies with the same insurance provider. Regularly reviewing and updating your liability coverage limits is essential, especially as your financial situation, driving habits, or vehicle changes over time. This diligence ensures that you maintain adequate protection and can adapt to new circumstances, all while keeping insurance premiums within a manageable range.

Navigating Liability Limits and State Requirements: What You Need to Know

When considering liability limits for your car insurance, it’s crucial to understand both state requirements and the nuances of various coverage types. Each state has its own mandated minimum levels of liability coverage, which typically include bodily injury and property damage. While these minimums offer a legal safety net, they may not be sufficient to fully protect you in the event of a serious accident. For instance, if you’re involved in an incident with significant injuries or extensive property damage, the costs could easily exceed the minimum coverage limits, potentially leaving you financially liable for the remainder. Therefore, it’s prudent to evaluate your personal risk factors and consider whether higher liability limits are necessary. This is particularly important for those who have assets that could be at risk in a lawsuit following an accident.

Rental Car Insurance, Commercial Auto Insurance, Classic Car Coverage, and policies designed for High-Risk Driver Coverage often come with different liability coverage requirements and options. Rental car insurance, for example, may offer temporary liability coverage that aligns with your personal auto policy. Similarly, commercial and classic car policies can have specialized liability coverage to address the unique risks associated with these vehicle types. For high-risk drivers, it’s essential to find a policy that not only meets state requirements but also adequately protects you given your risk profile. It’s also worth exploring Discounts on Car Insurance to offset the cost of increasing your liability limits or switching to a provider offering more comprehensive coverage. Keep in mind that higher Insurance Premiums can be a trade-off for greater peace of mind and protection against unforeseen events. Regularly reviewing and updating your liability coverage is not just a legal obligation but also a financial strategy to safeguard your assets and ensure you have the appropriate level of coverage. As your circumstances change, so too should your insurance policy to reflect any new risks or coverage needs.

Tailoring Your Liability Coverage for Different Vehicle Types: Rental Cars, Commercial Vehicles, and Classics

When considering liability coverage for different vehicle types, it’s essential to tailor your policy to each vehicle’s unique use case and risk factors. For rental car insurance, drivers often opt for the provided coverage, which typically comes with higher deductibles. It’s wise to weigh the cost of the premium against the value of the rental vehicle and your comfort level with self-insuring a portion of the risk. Commercial auto insurance, on the other hand, necessitates more comprehensive coverage due to the higher likelihood of regular use and the potential for greater liability. Businesses must ensure they have adequate liability coverage to protect against claims resulting from employee driving, as well as the higher value of commercial vehicles.

Classic car enthusiasts should look into classic car coverage, which often provides agreed value coverage rather than actual cash value in the event of a total loss. This type of coverage recognizes the sentimental and potentially appreciable value of classic cars, ensuring owners are adequately compensated. High-risk driver coverage is another consideration; it’s tailored for individuals with poor driving records or who have had their licenses suspended. Such policies may come with higher insurance premiums but offer the necessary protection to cover potential damages, allowing high-risk drivers to legally and safely return to the road. Discounts on car insurance can be a boon for all vehicle types; drivers should inquire about available discounts that could lower their insurance premiums, such as those for safe driving, multi-car policies, or completing defensive driving courses. Regularly reviewing and updating liability coverage limits is not just a matter of meeting state-mandated minimums but also of ensuring that your assets are protected against unforeseen events on the road.

Managing Car Insurance Deductibles and High-Risk Driver Coverage: Strategies for Effective Financial Planning

When it comes to car insurance, managing deductibles and securing coverage as a high-risk driver are critical components of effective financial planning. For drivers who opt for rental car insurance when their personal vehicle is out of commission, understanding deductibles becomes particularly important. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in during a claim. Choosing an appropriate deductible can be a delicate balance; a higher deductible typically leads to lower insurance premiums, but it also means you’ll shoulder more of the initial cost in the event of a claim. Therefore, it’s essential to consider your financial situation and how much you can reasonably afford to pay in the event of an incident.

For high-risk drivers, obtaining coverage can be more challenging due to factors like a history of accidents or violations. These individuals may find that commercial auto insurance and classic car coverage have different requirements and costs. It’s crucial for high-risk drivers to explore options such as specialized policies designed for their situation. Additionally, they should investigate discounts on car insurance that may apply to them, such as those for taking defensive driving courses or installing safety devices in their vehicles. Regularly reviewing your coverage and shop around for the best rates can also help ensure that you’re not overpaying for your policy. By carefully considering your choices regarding deductibles and seeking out high-risk driver coverage solutions, you can create a tailored insurance plan that protects your finances without unnecessary burden.

Exploring Discounts on Car Insurance and the Impact of Insurance Premiums on Liability Coverage

When considering liability coverage in your car insurance policy, it’s prudent to explore various avenues for discounts that can alleviate the burden of insurance premiums. Rental Car Insurance often provides opportunities for savings; bundling this with your primary auto insurance policy can lead to substantial reductions, as insurers reward customers who cover multiple vehicle types. For those operating commercial vehicles, Commercial Auto Insurance typically offers a range of discounts based on factors like driving record, vehicle usage, and the number of drivers covered under the policy. Similarly, Classic Car Coverage enthusiasts can benefit from reduced premiums by participating in driver safety programs or storing their vehicles in secure locations.

Car Insurance Deductibles play a crucial role in determining your out-of-pocket expenses before coverage kicks in, and selecting a higher deductible can significantly lower your insurance premiums. However, it’s important to balance this with the financial resources you have available to cover the deductible in the event of an accident. For high-risk drivers, securing High-Risk Driver Coverage involves a different set of considerations; these policies are designed for individuals who have a history of accidents or violations, and they often come with higher premiums reflective of the increased risk. Nonetheless, by maintaining a clean driving record and utilizing available discounts—such as those for completing defensive driving courses or installing vehicle safety technology—high-risk drivers can work towards lowering their insurance costs over time. It’s advisable to regularly review your liability coverage limits in light of these factors to ensure you maintain adequate protection without overpaying for your car insurance.

When it comes to car insurance, liability coverage stands as a critical safeguard, particularly in the event of an accident involving injury or property damage. This article has outlined the importance of understanding your liability coverage, tailoring it to fit various vehicle types such as rental cars, commercial vehicles, and classics, and managing deductibles and high-risk driver coverage with smart financial planning. It’s clear that maintaining appropriate liability limits not only aligns with state requirements but also offers a robust defense against potential financial burdens. Additionally, exploring available discounts and being mindful of how insurance premiums affect your liability coverage can lead to more cost-effective policies without compromising on essential protection. For rental car insurance, commercial auto insurance, and classic car coverage, it’s imperative to ensure your policy is comprehensive and up-to-date. In summary, a well-informed approach to liability coverage ensures that you are prepared for unexpected events on the road, providing both legal and financial security.