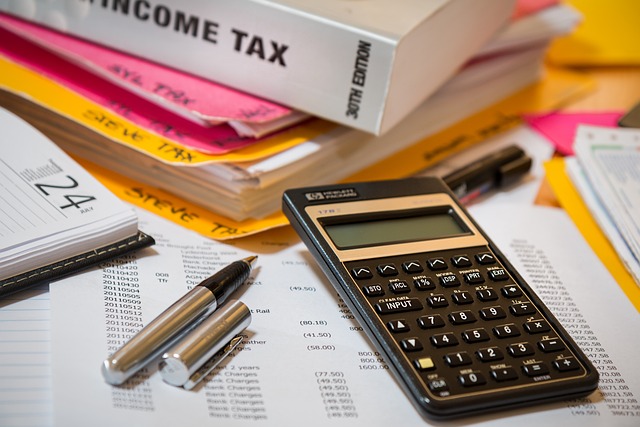

Navigating the complexities of tax season can be a daunting task for many individuals, particularly those who are self-employed. However, the advent of digital tax filing has revolutionized this process, offering simplified and secure means to manage one’s tax obligations. This article delves into how income tax e-filing serves as an invaluable tool for easy tax filing, equipped with user-friendly online tax forms and calculators tailored for self-employed individuals. We’ll guide you through the process of maximizing your return using tax refund tracking and adhering to secure online tax filing best practices. Discover how transitioning to digital tax solutions can lead to a more streamlined, precise, and efficient tax experience, ensuring you stay informed on key deadlines and potential tax deductions available online.

- Simplifying Tax Season with Income Tax E-Filing: A Step-by-Step Guide for Easy Tax Filing

- Leveraging Online Tax Forms and Calculators for Precise Self-Employed Tax Filing Assistance

- Maximizing Your Return: Tax Refund Tracking and Secure Online Tax Filing Best Practices

Simplifying Tax Season with Income Tax E-Filing: A Step-by-Step Guide for Easy Tax Filing

The advent of income tax e-filing has revolutionized the way individuals and businesses approach tax season. With user-friendly online platforms, filing taxes has become a streamlined process, accessible to even those with limited familiarity with tax laws. These platforms offer easy tax filing by providing step-by-step guidance that mirrors the traditional paper form process but with the added benefits of digital tools such as interactive tax calculators and personalized online tax forms. For self-employed individuals, this transition has been particularly impactful, allowing them to accurately report income and expenses, and take advantage of tax deductions in a manner that is both efficient and comprehensible. The ease of use extends beyond the actual filing; it also includes robust tax refund tracking systems, enabling taxpayers to monitor their returns with real-time updates. Furthermore, the security of sensitive personal data is paramount, and secure online tax filing protocols are in place to protect against identity theft and unauthorized access. E-filing not only simplifies the process but also fortifies the integrity of tax submissions, ensuring that every return adheres to the strictest confidentiality standards. With an array of free options available, coupled with comprehensive tax filing assistance, the transition to digital is a testament to the modernization of our tax system, making it more manageable and less daunting for all filers.

Leveraging Online Tax Forms and Calculators for Precise Self-Employed Tax Filing Assistance

For self-employed individuals, the intricacies of tax filing can be particularly daunting, yet leveraging income tax e-filing systems significantly streamlines this process. The availability of comprehensive online tax forms tailored for the self-employed provides a level of precision and personalization that is unmatched by traditional paper-based methods. These digital forms are designed to capture the unique financial activities associated with self-employment, ensuring that every deductible expense and potential income source is accounted for. Additionally, online tax calculators are invaluable tools that help determine the most advantageous ways to file, optimizing for tax refunds and minimizing liabilities. These calculators allow users to input their financial data and receive immediate feedback on their tax situation, enabling informed decisions about deductions and credits.

Easy tax filing is further enhanced by secure online tax filing options, which safeguard sensitive personal and financial information throughout the process. Self-employed tax filers can rest assured that their data is protected by robust cybersecurity measures, reducing the risk of identity theft or data breaches. Furthermore, with tax refund tracking features integrated into these e-filing platforms, self-employed individuals can monitor the status of their returns in real-time, ensuring a transparent and efficient tax season experience. The combination of precise online tax forms, user-friendly calculators, and secure filing processes means that the self-employed no longer need to navigate the complexities of tax season alone; instead, they have access to comprehensive tax filing assistance that simplifies compliance, maximizes savings, and supports their entrepreneurial endeavors.

Maximizing Your Return: Tax Refund Tracking and Secure Online Tax Filing Best Practices

Engaging in income tax e-filing offers a streamlined and efficient approach to maximizing your return. Utilizing online tax forms simplifies the process for self-employed individuals and those with complex financial situations, providing clear instructions and easy tax filing options. These digital tools are designed to guide you through each step, ensuring that all deductions and credits are considered to optimize your refund. Tax refund tracking is another advantage of electronic filing; it allows for real-time updates on the status of your return, offering peace of mind and expedited processing. To ensure secure online tax filing, employ robust security measures such as using encrypted networks and reputable tax preparation software that safeguards your sensitive personal and financial data throughout the e-filing process. Additionally, leveraging tax filing assistance from professionals can further enhance your experience by addressing any unique circumstances or questions you may have, leading to a more accurate and advantageous tax return. This combination of user-friendly technology and expert guidance makes the transition to digital tax filing both convenient and secure for taxpayers seeking to maximize their returns.

The shift towards income tax e-filing has undoubtedly streamlined the tax filing process for countless individuals and self-employed taxpayers. By leveraging easy tax filing tools and online tax forms, filers can navigate their tax obligations with greater precision and less stress. The integration of online tax calculators and refund tracking services ensures that users maximize their returns while adhering to the highest standards of security. As we continue to embrace these advancements in self-employed tax filing assistance, it becomes evident that the digital transformation of tax season benefits all taxpayers. This article has outlined a comprehensive approach to managing your taxes online, from initial preparation to final submission, ensuring that tax season is not only more efficient but also more secure and rewarding. Embracing these digital solutions is a step towards a more informed and financially savvy taxpayer community.