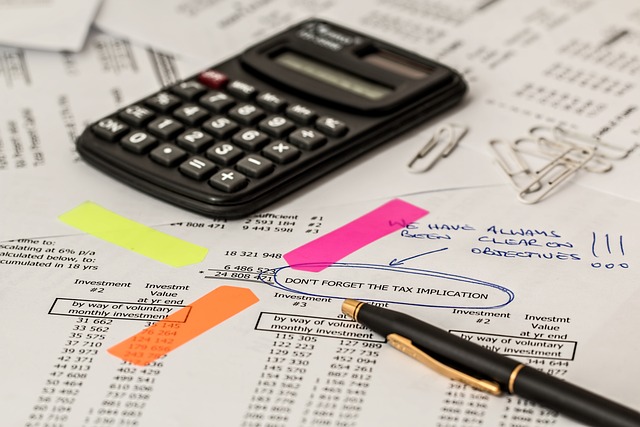

Managing estates and trusts is a complex endeavor, particularly when it comes to the intricate tax landscape that governs wealth transfer. Navigating this space requires not just a passing familiarity with tax laws but a deep understanding of their nuances. This article delves into the pivotal role of income tax advisors in optimizing estate and trust management, offering insights into strategic tax optimization services for retirement planning, and addressing the intricacies of international tax implications for estates and trusts. With a focus on capital gains tax advice and sales tax consulting for estates, this piece underscores the importance of leveraging specialized tax expertise to ensure compliance, preserve wealth, and minimize tax liabilities across generations. Whether you’re self-employed or an individual seeking to plan your retirement with confidence, understanding how to effectively engage with tax optimization services is key to safeguarding your legacy.

- Optimizing Estate and Trust Management with Expert Income Tax Advisor Guidance

- – Overview of estate and trust tax considerations

- – Role of an income tax advisor in estate planning

- – Strategies for efficient wealth transfer using trusts

Optimizing Estate and Trust Management with Expert Income Tax Advisor Guidance

Engaging an Income Tax Advisor with expertise in estate and trust management is a prudent step for individuals looking to optimize their wealth transfer strategies. These professionals offer specialized Tax Optimization Services tailored to each client’s unique situation, ensuring that estates are structured in the most advantageous manner. They delve into Retirement Tax Planning, helping retirees navigate the complexities of income tax implications on retirement savings and distributions. For those with international ties, International Tax Services are indispensable, addressing cross-border estate considerations and minimizing exposure to double taxation. The advisors provide Capital Gains Tax Advice, guiding beneficiaries through the realization of assets within an estate while strategically managing the associated taxes.

In addition to structuring trusts and planning for estate taxes, these tax experts offer Sales Tax Consulting and Payroll Tax Assistance. They ensure that all facets of taxation are accounted for, including those related to the sale of property or the management of a household’s payroll. Self-Employed Tax Help is also within their purview, with advisors offering comprehensive guidance to those who may be managing an estate alongside their own business ventures. This holistic approach to tax planning not only aims to reduce tax liabilities but also seeks to preserve wealth across generations, providing a sense of security and continuity for families. With their deep understanding of the ever-evolving tax landscape, Income Tax Advisors are invaluable partners in achieving effective estate and trust management.

– Overview of estate and trust tax considerations

Navigating the complexities of estate and trust tax considerations is a multifaceted endeavor that demands specialized knowledge in various tax domains. An Income Tax Advisor with expertise in this area can provide indispensable guidance, ensuring that your estate plan aligns with the intricacies of capital gains tax advice, sales tax consulting, and payroll tax assistance. These professionals are adept at crafting strategies for retirement tax planning, which is crucial for self-employed individuals and those with complex financial portfolios. They delve into the nuances of international tax services to address any cross-border implications, ensuring that your wealth transfer plans are optimized for tax efficiency. By leveraging tax optimization services, these advisors help in structuring trusts in a manner that not only complies with current tax laws but also aims to preserve and protect wealth across generations, thereby offering peace of mind to clients. This proactive approach to estate planning is essential for minimizing tax liabilities and securing the legacy you intend to leave behind.

In addition to their expertise in domestic tax matters, Income Tax Advisors are well-versed in the intricacies of international tax considerations. They ensure that your estate plan takes into account the various tax regimes and legal frameworks across different countries, should your beneficiaries be globally dispersed. This global perspective is particularly valuable for individuals with assets or heirs located abroad, as it can significantly reduce the risk of inadvertently exposing your estate to double taxation or other unfavorable international tax consequences. With their comprehensive understanding of the various taxes that may be applicable, these advisors provide tailored solutions that align with your unique financial situation and objectives, ensuring that your estate and trust arrangements are both legally sound and fiscally responsible.

– Role of an income tax advisor in estate planning

An Income Tax Advisor plays a pivotal role in the intricate process of estate planning by offering tailored tax optimization services. Their expertise is instrumental in structuring estates in a manner that aligns with an individual’s financial goals and minimizes potential tax burdens. This includes comprehensive retirement tax planning, ensuring that assets are managed effectively to provide for the estate owner during their lifetime and beyond. The advisor’s role extends beyond domestic concerns; they often provide international tax services, which are crucial for individuals with cross-border assets or beneficiaries. Capital gains tax advice is another area where an Income Tax Advisor’s knowledge proves indispensable, particularly when dealing with the valuation and transfer of appreciating assets. Sales tax consulting is also part of their skill set, as it can impact the estate’s value and the distribution of its assets. Additionally, payroll tax assistance is essential for any estate that employs staff or has been involved in business ventures. For self-employed clients, these advisors offer specialized help to navigate the complexities of self-employed tax issues, ensuring that all aspects of an individual’s financial situation are harmonized with their estate plan, thereby maximizing the wealth preservation potential across generations and optimizing overall tax liabilities.

– Strategies for efficient wealth transfer using trusts

Engaging an Income Tax Advisor with expertise in trusts and estate planning is a prudent step for those looking to facilitate efficient wealth transfer. These professionals are adept at devising strategies that leverage trust structures to mitigate estate taxes, ensuring that the intended beneficiaries receive the maximum benefit of the assets transferred. By meticulously analyzing individual financial situations and objectives, these advisors can tailor tax optimization services to align with retirement tax planning needs, thereby safeguarding a legacy for future generations. Their comprehensive approach encompasses understanding the nuances of international tax services, which is particularly beneficial for those with cross-border assets or beneficiaries.

In addition to structuring trusts, these tax advisors offer capital gains tax advice that is critical when transferring highly appreciated assets. They assist in navigating the complexities of sales tax consulting and ensure compliance with payroll tax assistance regulations to avoid any potential pitfalls. Their services are indispensable for the self-employed, providing them with tax help specifically designed to address the unique challenges associated with their income streams. By leveraging these advisors’ knowledge, clients can enjoy peace of mind, knowing that their wealth transfer plans are optimized for tax efficiency and structured to withstand the test of time.

In conclusion, the prudent management of estates and trusts is a multifaceted endeavor that hinges on the nuanced understanding of tax laws. Engaging an Income Tax Advisor with expertise in Tax Optimization Services is indispensable for those looking to execute effective retirement tax planning and preserve their legacy across generations. With a comprehensive grasp of international tax services, these professionals adeptly structure trusts, strategize for estate taxes, and ensure compliance with the complex legal framework governing inheritance. Their guidance not only facilitates the efficient transfer of wealth but also actively works to minimize tax liabilities. For individuals and families seeking to optimize their financial standing, the assistance of such experts is a critical investment, offering peace of mind through thoughtful retirement planning and capital gains tax advice. Additionally, their expertise extends to providing comprehensive payroll tax assistance and self-employed tax help, ensuring a holistic approach to one’s fiscal wellbeing.