Commercial Vehicle Insurance is non-negotiable for small business fleets, offering tailored Business Auto Insurance Coverage that safeguards against a range of vehicular risks. This specialized insurance ensures economical protection for all company vehicles, from trucks to corporate cars, and can be customized to fit unique operational needs. Fleet Insurance for Small Businesses streamlines policy management, eliminates the need for multiple policies, and provides robust Corporate Vehicle Protection under one cohesive strategy. Key coverage elements include liability, physical damage, medical payments, and protection against uninsured motorists. It's essential for businesses to select commercial car insurance policies that offer adaptability and growth potential to cater to evolving fleets, ensuring business continuity and protecting assets across various locations. This comprehensive approach not only safeguards against financial losses due to accidents or theft but also allows business owners to focus on their core operations without the burden of unexpected vehicle expenses. Truck Insurance for Businesses is particularly important, offering higher liability limits, cargo insurance, and physical damage protection, tailored to mitigate transportation and logistics risks. Investing in a well-rounded Commercial Car Insurance Policy is a strategic move for small businesses, providing Small Business Vehicle Insurance and Business Fleet Insurance Options that are both affordable and comprehensive, ensuring peace of mind and operational resilience on the road.

Managing a fleet of vehicles necessitates careful consideration of commercial vehicle insurance to safeguard your business from unforeseen events on the road. Opting for comprehensive business auto insurance coverage can streamline management and ensure cost-effective protection. Whether your fleet consists of heavy-duty trucks or smaller corporate vehicles, tailored insurance policies are available to meet these diverse needs. By integrating small business vehicle insurance with fleet insurance options, you can achieve both cost efficiency and coverage clarity, vital for maintaining operations. Explore the nuances of commercial vehicle insurance in our detailed guide, where we delve into the specifics of fleet insurance for small businesses and the best practices for selecting a robust commercial car insurance policy that aligns with your company’s unique requirements.

- Navigating Commercial Vehicle Insurance: Understanding Your Options for Small Business Fleet Coverage

- The Advantages of Business Auto Insurance Coverage for Streamlined Fleet Management

- Tailored Truck Insurance for Businesses: Ensuring Robust Protection for Your Heavy-Duty Vehicles

- Comprehensive Corporate Vehicle Protection: Selecting the Right Commercial Car Insurance Policy for Your Small Business Needs

Navigating Commercial Vehicle Insurance: Understanding Your Options for Small Business Fleet Coverage

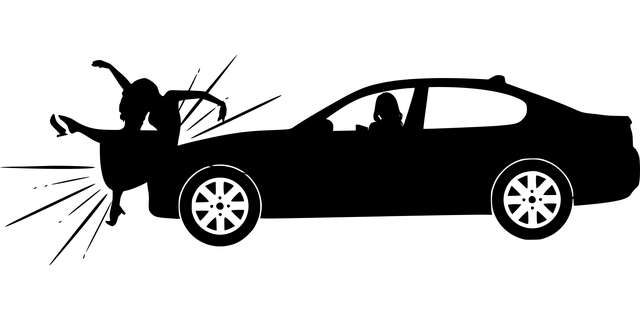

when it comes to safeguarding your small business’s fleet, understanding the nuances of commercial vehicle insurance is paramount. A tailored business auto insurance coverage can offer comprehensive protection for all vehicles under your company’s umbrella. This approach not only streamlines policy management but also ensures that you’re getting cost-effective solutions. With a range of options from truck insurance for businesses to corporate vehicle protection, the right fleet insurance for small businesses can be customized to meet the specific needs and risks associated with your operations. These policies often include coverage for liability, physical damage, medical payments, and uninsured motorists, ensuring that your business is well-protected against a variety of potential incidents on the road.

Moreover, when selecting a commercial car insurance policy, it’s essential to consider small business vehicle insurance options that offer flexibility and scalability as your fleet grows or changes. These policies can be designed to cover all types of vehicles, from company cars to heavy-duty trucks, providing a robust shield against the financial repercussions of accidents, theft, or other vehicular damages. By choosing a comprehensive business fleet insurance option, you’re not only safeguarding your assets but also ensuring the continuity of your operations. This means that whether your vehicles are in transit, at a job site, or parked in your lot, your small business is covered, allowing you to focus on running your business without the added stress of unforeseen vehicle-related expenses.

The Advantages of Business Auto Insurance Coverage for Streamlined Fleet Management

Implementing business auto insurance coverage is a strategic move for small businesses managing fleets. It consolidates all vehicles under a single, comprehensive policy, which not only simplifies the administrative process but also optimizes costs. This approach to fleet insurance ensures that every vehicle in your inventory, from commercial trucks to smaller corporate cars, is adequately protected under one cohesive plan. The advantage of this streamlined coverage is multifaceted: it eliminates the need for multiple policies and providers, reduces the complexity of managing various expiry dates and renewal terms, and provides a unified approach to risk management. Moreover, tailored business fleet insurance options can be customized to address the specific needs of your fleet, ensuring that every vehicle is covered according to its use, size, and value. This bespoke coverage facilitates seamless operations by minimizing disruptions caused by unexpected events that could otherwise impede the smooth functioning of your fleet. By securing small business vehicle insurance through a commercial car insurance policy, businesses can operate with confidence, knowing that their investment in vehicles is protected, and that their fleet remains operational even in the face of unforeseen incidents.

Tailored Truck Insurance for Businesses: Ensuring Robust Protection for Your Heavy-Duty Vehicles

When it comes to safeguarding your heavy-duty vehicles, tailored truck insurance for businesses is a critical component of robust protection. As a small business owner with a fleet of commercial vehicles, securing comprehensive coverage is essential to mitigate risks associated with transportation and logistics operations. A specialized commercial vehicle insurance policy can be tailored to address the unique exposures that heavy-duty trucks face, such as higher liability limits due to the potential for more significant damage in the event of an accident. Business auto insurance coverage extends beyond basic protection, offering additional options like cargo insurance, on-hook coverage, and physical damage protection to ensure your trucks are well-protected against a variety of risks.

Choosing the right fleet insurance for small businesses is not just about selecting the most affordable option; it’s about finding corporate vehicle protection that aligns with your business’s specific needs. Business fleet insurance options provide a streamlined approach to insuring all your vehicles under one policy, which simplifies management and can be more cost-effective than insuring each vehicle individually. Whether you manage a small group of delivery vans or a large fleet of trucks, these insurance packages are designed to offer the flexibility needed to customize coverage for each type of commercial vehicle in your inventory. By tailoring truck insurance for businesses with a comprehensive car insurance policy, you can ensure that your fleet is protected against unforeseen events, allowing your business to operate without undue worry about potential losses due to accidents or thefts.

Comprehensive Corporate Vehicle Protection: Selecting the Right Commercial Car Insurance Policy for Your Small Business Needs

When it comes to safeguarding your small business’s fleet, comprehensive corporate vehicle protection is paramount. Selecting the right commercial car insurance policy tailored to your needs is a strategic decision that can significantly impact your operations. Business auto insurance coverage encompasses a wide range of options designed to address the specific risks associated with operating a fleet. These policies are crafted to cater to various types of vehicles, from trucks to smaller cars, ensuring that each asset under your company’s umbrella is adequately protected. Opting for fleet insurance for small businesses offers the convenience of managing all your vehicle insurances under one cohesive policy, which streamlines administration and helps maintain budgetary control. By choosing a commercial car insurance policy that aligns with your business’s unique requirements, you can enjoy peace of mind, knowing that your vehicles are covered against potential accidents, damages, or liabilities. This not only safeguards your investment but also ensures the uninterrupted operation of your business.

Moreover, truck insurance for businesses is a specialized aspect within commercial vehicle insurance. It’s crucial to consider the distinct demands and exposures that come with operating trucks, such as heavy-duty liability coverage, which addresses the higher risk these vehicles present. With the right insurance in place, your small business can navigate the road with confidence, knowing that comprehensive corporate vehicle protection is your ally against unforeseen events. The coverage options for truck insurance for businesses are robust and tailor-made to meet the heavy responsibilities of long-haul operations or local deliveries. By carefully selecting the appropriate fleet insurance for small businesses, you can mitigate risks, maintain compliance with legal requirements, and foster a safe driving culture within your organization. This strategic approach to commercial vehicle insurance ensures that your business remains agile, resilient, and prepared for whatever lies ahead on the road.

In conclusion, effectively managing a fleet necessitates robust Commercial Vehicle Insurance tailored to the diverse needs of your small business. Opting for a comprehensive Business Auto Insurance Coverage not only simplifies the administration process but also ensures that all vehicles under your command are adequately protected. Whether your operations include Truck Insurance for Businesses or require a more nuanced Corporate Vehicle Protection plan, the key is to select a Commercial Car Insurance Policy that aligns with your specific small business vehicle insurance requirements. By choosing the right Fleet Insurance for Small Business, you can safeguard your investments and ensure your vehicles remain operational, contributing to the seamless operation of your enterprise.