When safeguarding your assets and well-being against unforeseen events, understanding the roles of accidental injury coverage and property damage insurance is paramount. These critical elements within personal liability protection offer financial security should you inadvertently cause harm or damage to others. Whether it’s a child’s playful mishap leading to a shattered window or an unexpected slip and fall on your premises, these insurance types are designed to cover associated medical and repair expenses, as well as any potential legal implications. As we delve into the nuances of homeowner liability, assessing your needs for a personal umbrella policy becomes essential for comprehensive third-party liability protection. This article will guide you through each facet, culminating in practical examples that underscore the importance of these coverages in everyday situations.

- Understanding Accidental Injury Coverage and Its Role in Personal Liability Protection

- The Essentials of Property Damage Insurance and How It Complements Homeowner Liability

- Navigating Third-Party Liability Claims with a Personal Umbrella Policy

- Assessing Your Homeowner Liability Needs for Accidental Injuries and Property Damage

- Real-Life Scenarios: How Accidental Injury Coverage and Property Damage Insurance Work in Practice

Understanding Accidental Injury Coverage and Its Role in Personal Liability Protection

When it comes to safeguarding your assets and financial well-being, a comprehensive understanding of accidental injury coverage within the context of personal liability protection is paramount. Accidental injury coverage extends beyond mere health concerns; it is a critical component of a robust insurance portfolio that can save you from the unexpected financial burdens associated with causing an injury to a third party. This coverage typically kicks in when your primary home or renters policy limits have been reached, providing additional funds to cover medical expenses and potential legal costs. For example, if a guest slips and falls on your property, the accidental injury coverage aspect of your personal umbrella policy can step in to manage the resulting medical bills and any liability claims that may arise from the incident.

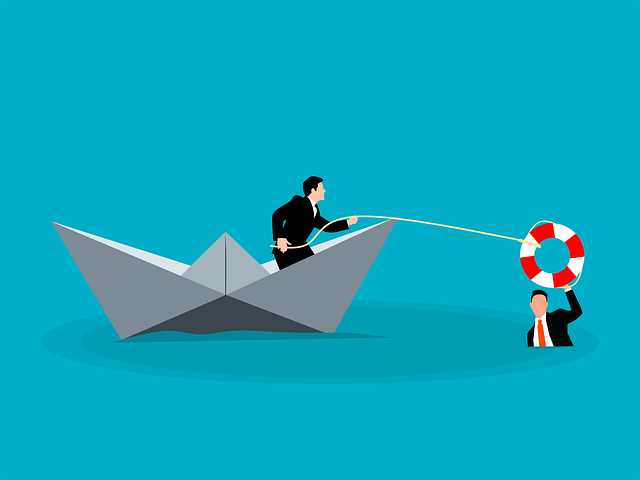

In addition to medical expenses, accidental injury coverage also plays a pivotal role in addressing property damage you may inadvertently cause. Whether it’s a wayward baseball shattering a neighbor’s window or a pet accidentally setting fire to your apartment complex, this insurance serves as a financial buffer against the costs of repair or replacement. A personal umbrella policy is often the additional layer of protection that complements homeowner liability or renters insurance, ensuring that you are not held personally responsible for damages beyond what your primary policies cover. This layer of coverage is crucial in a litigious society where the cost of legal defense alone can be prohibitive even if the lawsuit is without merit. With the right accidental injury coverage and property damage insurance, you can navigate the complexities of third-party liability with greater confidence and peace of mind.

The Essentials of Property Damage Insurance and How It Complements Homeowner Liability

Property damage insurance serves as a vital safeguard against financial losses resulting from accidental injuries or property destruction caused by you or your family members. This type of coverage extends beyond the limitations of standard homeowners insurance, offering broader protection for incidents that occur on or off your property. A key component of comprehensive liability protection, property damage insurance typically covers the cost to repair or replace another person’s belongings if you are held responsible for their destruction. For example, if a tree on your property falls during a storm and damages your neighbor’s car, this policy can cover the repair costs.

Furthermore, personal umbrella policies often complement homeowner liability by providing an additional layer of security above and beyond the limits of your existing home or renters insurance. This means that if the costs to settle a claim exceed your current coverage, the umbrella policy kicks in to cover the excess. It also includes coverage for situations involving third-party liability, such as legal battles arising from lawsuits claiming personal injury or damages. Accidental injury coverage further complements this by specifically addressing medical expenses and potential legal fees if someone is injured on your property due to your negligence. Together, these insurance components form a robust defense against the unforeseen financial implications of accidents, offering peace of mind that you are prepared for unexpected occurrences.

Navigating Third-Party Liability Claims with a Personal Umbrella Policy

A personal umbrella policy serves as an invaluable addition to your existing home and auto insurance policies, offering extended coverage that goes beyond the limitations of traditional homeowner liability and property damage insurance. This policy steps in when the liability limits of your primary policies are exhausted, providing a financial buffer against third-party liability claims. For example, if an incident on your property results in significant injury to a guest, the medical costs may quickly surpass the coverage provided by your standard homeowner’s policy. In such scenarios, the personal umbrella policy kicks in to cover the excess amounts, including any legal fees should the injured party pursue litigation. Accidental injury coverage and property damage insurance are integral parts of this comprehensive protection. They address claims resulting from unintentional events like a pet accidentally injuring someone or your child causing costly damage to a neighbor’s property. With a personal umbrella policy, homeowner liability is not just limited to the confines of your residence; it extends to anywhere in the world where you are held responsible for bodily injury or property damage, offering robust and far-reaching protection against unforeseen events.

Assessing Your Homeowner Liability Needs for Accidental Injuries and Property Damage

When considering the comprehensive protection of your assets and well-being against accidental injuries and property damage, it’s prudent to assess your homeowner liability needs. Homeowner liability coverage is a critical component of standard homeowners insurance policies, yet it typically offers limited protection. This is where a personal umbrella policy comes into play, serving as an additional layer of security that extends beyond the limits of your primary home and auto policies. An umbrella policy can provide substantial coverage for claims or legal proceedings that arise from incidents on your property or from activities engaged in by the members of your household.

For example, if a guest slips and falls in your home due to a wet floor, accidental injury coverage within your personal umbrella policy can safeguard you against high medical costs, lost income, and legal fees should the injured party decide to pursue litigation. Similarly, should your child or pet accidentally damage a neighbor’s property, property damage insurance under an umbrella policy can cover the cost of repairs or replacement, thus shielding you from the financial repercussions of such accidents. The higher liability limits provided by an umbrella policy are essential for those with significant assets to protect or who engage in higher-risk activities. It’s important to regularly review your coverage needs, as third-party liability risks can evolve over time with changes in lifestyle, family size, and community dynamics. This assessment ensures that you remain adequately covered against the unpredictable nature of accidents.

Real-Life Scenarios: How Accidental Injury Coverage and Property Damage Insurance Work in Practice

When considering the safety net that protects against financial ruin due to accidental injuries or property damages, a personal umbrella policy serves as a critical layer of protection beyond the limits of your homeowner’s insurance. In practice, this comprehensive coverage extends your liability coverage and can be invaluable when an incident occurs. For example, if a guest slips and falls on your property, sustaining injuries, accidental injury coverage under a personal umbrella policy can cover the resulting medical expenses. This is particularly important because these incidents can result in significant costs, including ongoing care or legal liabilities should the injured party seek compensation for their losses.

Similarly, if an event beyond your control leads to unintentional property damage, such as your child’s ball accidentally breaking a neighbor’s window, property damage insurance within a personal umbrella policy can cover the repair costs. This ensures that you are not left financially responsible for another person’s property repairs. The breadth of coverage afforded by a personal umbrella policy is essential because it addresses third-party liability claims, providing peace of mind whether you are at home or away. It’s this comprehensive approach to liability protection that underlines the importance of understanding and securing both accidental injury coverage and property damage insurance as part of your overall financial security plan.

When considering the safeguards necessary for personal liability protection, it’s crucial to understand the roles of accidental injury coverage and property damage insurance within your overall risk management strategy. These coverages are essential in shielding you from the financial repercussions of unintended accidents involving others. A real-life incident where a child’s playful antics result in a neighbor’s window being broken, or a visitor slipping on your steps and incurring injuries, can lead to unexpected expenses. Having a robust personal umbrella policy extends beyond the basic homeowner liability, providing an additional layer of security against third-party liability claims. It is advisable to assess your specific needs for accidental injury coverage and property damage insurance to ensure comprehensive protection. By doing so, you can rest assured that you are prepared should such incidents occur, thereby maintaining peace of mind in your personal and financial well-being.