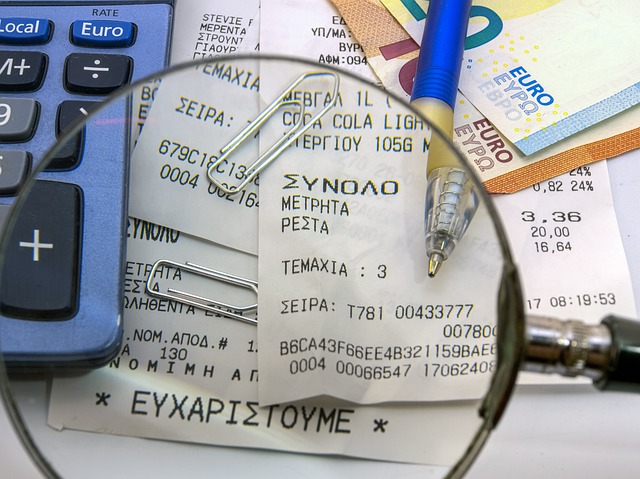

In today’s digital era, the ease and efficiency of managing finances have been revolutionized, particularly in the realm of income tax e-filing. This article delves into how easy tax filing through online platforms has become a cornerstone for many individuals and businesses alike, offering a seamless approach to fulfilling tax obligations. From tax preparation online to submitting your online tax return, these digital solutions are designed with user convenience in mind, integrating comprehensive services that simplify the entire process. With intuitive online tax forms and robust tax calculators, users can effortlessly estimate their liabilities and potential refunds, ensuring they make informed decisions. Moreover, with free online tax filing services available, taxpayers have access to tailored tax filing assistance that aligns with their financial circumstances. As we explore the benefits of this digital transformation in tax management, it becomes clear that not only does e-filing streamline the process but also provides a secure and reliable method for handling one’s taxes. Whether you’re self-employed or an individual taxpayer, understanding how to navigate these online tools can optimize your tax experience and contribute to peace of mind during tax season.

- Leveraging Income Tax E-filing for Streamlined Tax Management

- The Advantages of Easy Tax Filing with Online Platforms

- Navigating Online Tax Forms and Utilizing Tax Calculators

- Tracking Your Tax Refund with Secure Online Systems

- Tailored Tax Filing Assistance for Self-Employed Individuals

Leveraging Income Tax E-filing for Streamlined Tax Management

Incorporating income tax e-filing into your annual financial routine can significantly streamline tax management. The advent of user-friendly online platforms has made it easier than ever for individuals to file their taxes with precision and efficiency. These platforms offer a suite of services, including the availability of easy tax filing options through online tax forms tailored to various financial situations. For the self-employed, in particular, e-filing provides a flexible and manageable solution to fulfill their tax obligations. The process is designed to be intuitive, guiding users through each step of tax preparation online, from categorizing income sources to claiming deductions. Moreover, with tax refund tracking features, taxpayers can monitor the status of their returns in real-time, ensuring a transparent and timely experience.

The security measures implemented in secure online tax filing systems ensure that sensitive financial information is protected throughout the e-filing process. These platforms use advanced encryption and authentication protocols to safeguard data, providing peace of mind for users who are concerned about privacy and fraud. Additionally, tax filing assistance is readily available online, offering guidance to those who may not be familiar with the complexities of self-employment taxes or who wish to optimize their tax strategy to maximize refunds. By leveraging these comprehensive e-filing tools, individuals can save time, reduce stress, and navigate the tax system with greater confidence and control.

The Advantages of Easy Tax Filing with Online Platforms

Income tax e-filing has revolutionized the way self-employed individuals and the general public manage their annual tax obligations. Easy tax filing through online platforms not only streamlines the process but also provides a user-friendly interface that simplifies the complexities of tax preparation online. These robust digital tools enable users to navigate online tax forms with ease, ensuring accuracy and completeness in their submissions. With a single digital submission, taxpayers can access a suite of services, including comprehensive tax filing assistance. This assistance often includes step-by-step guidance through the tax preparation process, online tax calculators that estimate liabilities and potential refunds, and real-time updates on tax refund tracking. The convenience of these services is further underscored by the availability of free online tax filing options, which cater to various financial scenarios, making it an accessible solution for many.

Moreover, secure online tax filing ensures that sensitive financial information is protected throughout the process, providing peace of mind to taxpayers. The integration of advanced encryption and security protocols means that individuals can confidently submit their income tax e-filing without fear of data breaches or unauthorized access. The efficiency and security of online tax filing platforms empower users to meet tax filing deadlines with ample time to spare, while also staying abreast of changes in tax laws and understanding the full scope of available tax deductions online. This digital shift not only optimizes the tax experience but also fosters a more informed taxpayer population, ready to take advantage of every legitimate benefit available to them.

Navigating Online Tax Forms and Utilizing Tax Calculators

Navigating online tax forms has become an intuitive process for many individuals and businesses alike, thanks to the advancements in income tax e-filing systems. These platforms are designed to streamline the tax filing experience, offering easy tax filing options for a variety of tax situations. For the self-employed or those with complex financial portfolios, these online tax forms can be particularly beneficial, as they often provide customizable forms and sections that cater to unique income sources and deductions. The platforms are equipped with user-friendly interfaces that guide users through each step of the tax filing process, ensuring accuracy and completeness. Moreover, taxpayers can utilize robust online tax calculators to estimate their liabilities and potential refunds, which is an invaluable tool for financial planning and budgeting. These calculators are integrated into the e-filing systems, allowing users to input their relevant income, deductions, and credits to receive a personalized assessment of their tax obligations. With secure online tax filing, individuals can trust that their sensitive financial information is protected throughout the process. Additionally, tax refund tracking features enable taxpayers to monitor the status of their returns post-submission, providing peace of mind and a sense of control over their tax outcomes. This blend of convenience, efficiency, and security makes e-filing an indispensable tool for anyone looking to simplify their self-employed tax filing or personal income tax e-filing experience.

Tracking Your Tax Refund with Secure Online Systems

Income tax e-filing has revolutionized the way taxpayers, including self-employed individuals, manage their annual tax obligations. The ease and efficiency of filing taxes online are unparalleled, with numerous platforms offering intuitive online tax forms tailored to diverse financial situations. These platforms not only facilitate easy tax filing but also provide tax filing assistance to ensure accuracy and compliance with the latest tax laws. One of the most beneficial aspects of e-filing is the ability to track your tax refund securely online. Once your return has been submitted, these systems enable you to monitor the status of your refund in real time. This feature offers taxpayers peace of mind, as they can stay informed about their refund’s progress without the need for repeated phone calls or visits to tax authorities. The secure online tax filing process ensures that sensitive financial information is protected throughout the submission and refund tracking stages. With a few clicks, taxpayers can access their personal tax account, view their submitted tax forms, and keep tabs on their refund status until it’s safely deposited into their bank account or mailed to their address. This level of transparency and ease is a testament to the advancements in online tax systems, making the process of tracking your tax refund as straightforward as the initial filing itself.

Tailored Tax Filing Assistance for Self-Employed Individuals

For self-employed individuals, navigating the complexities of income tax e-filing can be a daunting task, but with the advent of tailored tax filing assistance designed specifically for this demographic, the process is streamlined and simplified. Online platforms offer a suite of tools that cater to the unique financial situations of freelancers, independent contractors, and small business owners. These platforms are equipped with user-friendly interfaces that guide users through the completion of easy tax filing, utilizing online tax forms that reflect their self-employed status. The platforms feature specialized sections for deductions and credits commonly associated with self-employment, ensuring accuracy and optimizing potential tax savings.

Furthermore, the secure online tax filing process is bolstered by robust security measures, providing peace of mind for those transmitting sensitive financial information. Self-employed tax filing becomes a more manageable endeavor when supported by these advanced e-filing systems, which also include tax refund tracking features. Taxpayers can monitor their returns with real-time updates, reducing uncertainty and wait times. The availability of free online tax filing services for the self-employed further democratizes access to tax expertise, allowing individuals to focus on running their businesses rather than managing complex tax code requirements. With this level of support, the often-intimidating task of tax preparation online is transformed into a straightforward and efficient process.

In conclusion, income tax e-filing stands as a testament to the modernization of financial management. The advantages of easy tax filing with online platforms have made navigating online tax forms and utilizing tax calculators a seamless experience for individuals and self-employed taxpayers alike. These tools empower users to track their tax refunds through secure online systems, ensuring both efficiency and accuracy in managing tax obligations. With tailored tax filing assistance readily available, the process is not only simplified but also accessible to those with diverse financial needs. As we continue to embrace digital solutions for self-employed tax filing, it is clear that e-filing represents a significant stride forward in personal finance management, offering a secure and user-friendly approach to fulfilling our tax responsibilities.