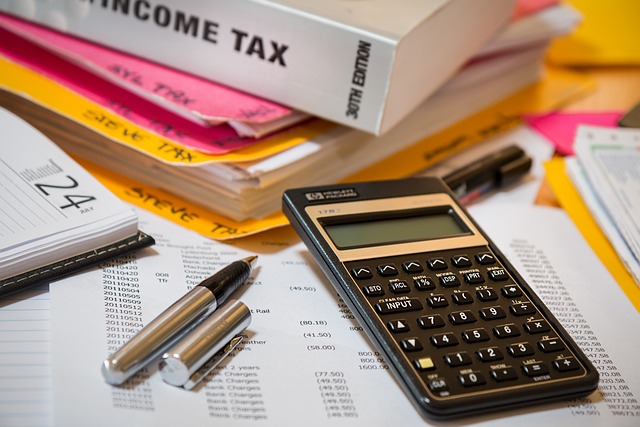

Navigating the complexities of tax season can be a source of stress for many individuals and self-employed professionals alike. However, with the advent of online income tax e-filing solutions, the process has been transformed into an accessible and efficient endeavor. This article serves as your comprehensive guide to easy tax filing, offering insights into how you can leverage digital platforms to streamline your tax return experience. Whether you’re looking for user-friendly online tax forms or seeking to maximize your tax refund with the aid of calculators and planning tools, these resources are designed to simplify your financial obligations. Furthermore, we’ll explore how secure online tax filing not only protects your sensitive information but also accelerates the submission process. Additionally, self-employed individuals will discover how e-filing platforms provide tailored support. With real-time tax filing assistance readily available at your fingertips, you can approach this season with confidence and ease.

- Streamlining Your Tax Return with Income Tax E-Filing: A Guide to Easy Tax Filing

- Navigating Online Tax Forms: Simplifying Your Tax Filing Process

- Maximizing Your Tax Refund with Online Tax Calculators and Planning Tools

- Enhancing Security and Efficiency in Self-Employed Tax Filing through E-Filing Platforms

- Real-Time Tax Filing Assistance: Support at Your Fingertips for a Stress-Free Season

Streamlining Your Tax Return with Income Tax E-Filing: A Guide to Easy Tax Filing

Engaging in income tax e-filing streamlines the process of submitting your taxes, making it a more manageable and efficient task. With user-friendly online tax forms, individuals can navigate through their tax returns with ease, reducing the complexity associated with traditional paper filings. The digital platforms that facilitate this process are designed to guide users step by step, ensuring that every necessary form and deduction is accounted for. For those who are self-employed or have more complex financial situations, these online tools provide additional support and clarity. Moreover, many of the reputable tax filing services offer free online tax filing options for certain income brackets, democratizing access to tax preparation resources. These platforms also feature tax refund tracking, allowing you to monitor the status of your refund with real-time updates, providing peace of mind during the processing period.

The security measures in place for secure online tax filing are robust, safeguarding your sensitive financial data against unauthorized access. E-filing not only offers a more secure method of submission but also accelerates the process, as your return is transmitted directly to the appropriate tax authorities. Additionally, tax filing assistance is readily available through these digital channels, should you encounter any challenges or have questions about your tax obligations. This support often includes virtual customer service representatives and extensive online help centers, ensuring that you are never left to navigate the tax system alone. By leveraging these advanced online tax filing solutions, you can complete your tax return with confidence and precision, freeing up valuable time and reducing the stress typically associated with tax season.

Navigating Online Tax Forms: Simplifying Your Tax Filing Process

Navigating the complexities of income tax e-filing can be made effortless with the advent of user-friendly online tax forms. These digital tools are designed to simplify your tax filing process, catering to a wide array of filers, from the self-employed to those with more conventional sources of income. The easy tax filing options available online remove the traditional hassles associated with paper-based returns, allowing users to input their financial data into a secure platform. This not only streamlines the process but also minimizes the potential for human error, ensuring that your tax submission is accurate and complete.

Furthermore, online tax forms are equipped with intuitive guides and prompts that walk filers through each required field. For those who have complex financial situations or simply need assistance, additional support is readily available in the form of tax filing assistance. This assistance often includes a step-by-step questionnaire that adapts to your responses, leading you to the correct forms and deductions applicable to your situation. With features such as tax refund tracking, you can monitor the status of your return post-submission, all within the confines of a secure online environment. The peace of mind provided by knowing your sensitive financial information is protected by state-of-the-art cybersecurity measures makes online tax filing a smart choice for taxpayers looking to navigate their tax obligations with ease and confidence.

Maximizing Your Tax Refund with Online Tax Calculators and Planning Tools

Utilizing online tax calculators and planning tools can significantly enhance your ability to maximize your tax refund. These digital resources allow for a precise estimation of your tax liability, thereby enabling informed financial decisions. By inputting your income, deductions, and credits into the tax calculator, you can gauge how much you may owe or the potential amount of your refund before the actual filing process begins. This forward-looking approach ensures that self-employed individuals and those with more complex tax situations have a clearer picture of their financial obligations, facilitating easier tax filing and more strategic planning.

The user-friendly nature of these online tools means that the process of estimating your tax refund is straightforward and accessible to all taxpayers. With secure online tax filing platforms, you can confidently input your data knowing that your personal and financial information is protected. These platforms are designed with encryption and other security measures to safeguard against unauthorized access, providing peace of mind. Additionally, the integration of tax refund tracking into these services means you can monitor the status of your refund after submission, ensuring a smoother and more transparent interaction with the tax authorities. By leveraging income tax e-filing systems alongside easy-to-use online tax forms, taxpayers can navigate the tax season with greater ease and confidence, maximizing their tax refunds and streamlining their self-employed tax filing experience.

Enhancing Security and Efficiency in Self-Employed Tax Filing through E-Filing Platforms

For self-employed individuals, managing finances and staying on top of income tax e-filing can be particularly challenging due to the complex nature of their business transactions. However, online tax filing platforms have revolutionized this process, offering a suite of tools that cater specifically to the needs of freelancers, contractors, and small business owners. These platforms streamline the preparation and submission of easy tax filing by providing intuitive online tax forms tailored for self-employed tax filers. They simplify the categorization of income sources and deductible expenses, which can be numerous and complex. With secure online tax filing, these services ensure that sensitive financial information is protected, employing advanced encryption and security protocols to safeguard against unauthorized access. The efficiency of e-filing means that self-employed filers can quickly transmit their returns, avoiding the risk of lost or delayed paper submissions. Furthermore, many of these platforms offer tax filing assistance with real-time guidance and customer support, which is invaluable for those navigating the nuances of self-employment tax laws. Additionally, tax refund tracking features allow users to monitor the status of their returns with ease, providing peace of mind throughout the process. By leveraging these online solutions, self-employed individuals can significantly reduce the stress associated with tax season, ensuring compliance and optimizing their financial position while enjoying the convenience and security of modern e-filing systems.

Real-Time Tax Filing Assistance: Support at Your Fingertips for a Stress-Free Season

The advent of income tax e-filing has revolutionized the way taxpayers interact with their annual obligations. With user-friendly online tax forms, the process of filing taxes is now easier and more accessible than ever before. Taxpayers, including self-employed individuals, can navigate through the complexities of tax season without the need for extensive knowledge of tax laws. The digital platforms providing these services are equipped with real-time tax filing assistance, offering a helping hand to ensure accuracy and compliance every step of the way. This support is not just limited to guidance on filling out forms; it extends to estimating your liabilities and calculating potential tax refunds through intuitive online tax calculators. These tools provide a clear picture of your fiscal situation, enabling informed decision-making and financial planning. Moreover, the security measures in place for secure online tax filing guarantee that sensitive personal information is safeguarded throughout the process. The efficiency and convenience of e-filing also accelerate the tax refund tracking process, allowing for quicker turnaround times and reducing the stress typically associated with tax season. By leveraging the power of technology, you can transform what was once a cumbersome task into a streamlined experience that leaves more time to focus on other important aspects of your life.

Navigating the complexities of tax season is a task that many approach with trepidation. However, with the advent of online tax filing solutions, this daunting process has been transformed into a streamlined and user-friendly experience. Income tax e-filing, through secure and accessible platforms, simplifies the tax return process for all, from those managing their own finances to self-employed individuals. The article has illuminated various facets of online tax preparation, emphasizing the ease with which one can complete online tax forms, maximize tax refunds using calculators and planning tools, and access real-time assistance. By leveraging these digital resources, taxpayers can ensure their returns are accurate, filed on time, and managed with the utmost security. In conclusion, embracing the convenience and efficiency of online tax filing is not just a smart choice but an essential step towards a less stressful and more productive tax season.