Managing a small business necessitates a keen understanding of tax complexities. Our article demystifies the tax landscape for small businesses, emphasizing year-end tax planning strategies and the critical role of certified tax preparers. We delve into income tax calculation nuances, offering insights on how these impact your enterprise. Our comprehensive guide also explores tailored corporate tax solutions for various business needs and highlights the importance of staying abreast of IRS updates to ensure compliance and savings. Furthermore, we examine the benefits of leveraging tax-saving strategies to bolster profitability and introduce taxpayer relief services designed for sustained financial health. Prepare to navigate the intricacies of business taxes with confidence.

- Navigating Year-End Tax Planning for Small Businesses

- The Role of Certified Tax Preparers in Small Business Success

- Understanding Income Tax Calculation and Its Impact on Your Business

- Leveraging Tax Saving Strategies to Enhance Small Business Profitability

- Corporate Tax Solutions: Tailored Approaches for Diverse Business Needs

- The Importance of Staying Current with IRS Updates and Changes

- Exploring Comprehensive Taxpayer Relief Services for Sustained Financial Health

Navigating Year-End Tax Planning for Small Businesses

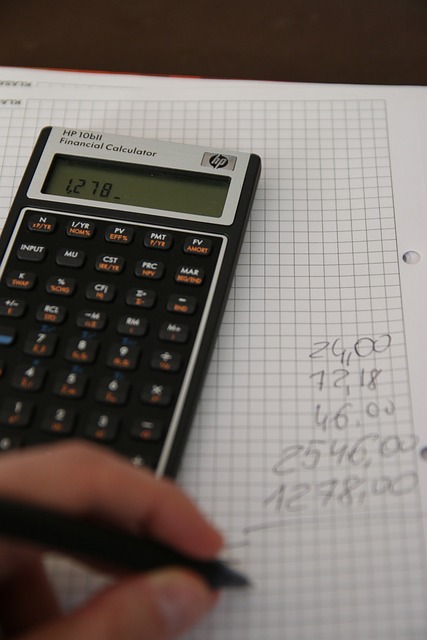

As year-end approaches for small businesses, strategic Year-End Tax Planning becomes paramount to ensure financial health and compliance. Our certified tax preparers at Taxpayer Relief Services are adept at crafting tailored strategies that align with your business’s unique financial landscape. They meticulously analyze your income, deductions, and tax credits to calculate the most advantageous outcome for your corporate tax solutions. By leveraging their expertise in tax saving methods, these professionals can help you defer income, accelerate deductions, and optimize your tax position. It’s crucial to review past year’s taxes, assess current business activities, and plan for future economic shifts. Our advisors stay abreast of the latest IRS updates to navigate changes in business tax policies effectively, ensuring your federal and state tax returns are filed accurately and on time. With a focus on minimizing your tax burden and maximizing savings, Taxpayer Relief Services is committed to providing you with the most efficient tax saving strategies for the upcoming fiscal year. Our goal is to position your small business for success by offering comprehensive tax preparation, filing assistance, and compliance support that is both proactive and responsive to your evolving needs.

The Role of Certified Tax Preparers in Small Business Success

Certified Tax Preparers play a pivotal role in the success of small businesses by providing expert guidance on Year-End Tax Planning. Their deep understanding of tax laws and regulations enables business owners to navigate complex corporate tax solutions with confidence. These professionals are adept at income tax calculation, ensuring that each dollar earned is considered within the framework of potential tax savings. By leveraging their expertise in taxpayer relief services, small business owners can rest assured that they are employing the most advantageous strategies for their financial situation. Certified Tax Preparers meticulously analyze a company’s finances to identify opportunities to minimize tax burdens and optimize savings. Their proactive approach allows businesses to allocate resources more effectively and plan for future growth without the overhang of unforeseen tax implications.

As IRS updates continuously reshape business tax policies, the role of Certified Tax Preparers becomes even more critical. They keep abreast of these changes, providing up-to-date guidance to small business owners. This ensures that all federal and state tax returns are completed with precision and accuracy. The expertise of these preparers not only helps in adhering to compliance support but also positions businesses to take full advantage of any tax benefits that arise. Their comprehensive approach to tax saving strategies encompasses a holistic view of the business’s financial landscape, leading to informed decisions and long-term financial stability. With the ever-evolving nature of tax laws, the support of Certified Tax Preparers is indispensable for small businesses aiming to thrive in an uncertain economic climate.

Understanding Income Tax Calculation and Its Impact on Your Business

Navigating the intricacies of income tax calculation is a pivotal aspect for small business owners, as it directly affects their financial health and strategic planning. Understanding the nuances of how taxes are calculated at year-end is crucial, as it enables informed decision-making throughout the fiscal year. Our business tax services specialize in demystifying this process, ensuring that each client’s unique situation is accurately represented in their tax calculations. By leveraging our expertise in income tax calculation, we help small businesses minimize their tax liabilities and optimize their financial performance.

Our seasoned certified tax preparers are well-versed in the latest tax laws and IRS updates, providing clients with year-end tax planning strategies tailored to their specific needs. These personalized strategies are designed not only to comply with federal and state regulations but also to identify opportunities for tax savings that align with the business’s goals. Our taxpayer relief services go beyond mere compliance; we offer comprehensive corporate tax solutions that consider cash flow management, deduction optimization, and investment planning. By partnering with us, businesses can navigate the complex landscape of income tax calculation with confidence, knowing that they are positioned to not only meet but exceed their financial objectives.

Leveraging Tax Saving Strategies to Enhance Small Business Profitability

Small business owners can significantly benefit from implementing year-end tax planning strategies to enhance profitability. By working with certified tax preparers, businesses can identify opportunities for tax savings that align with their unique financial situation. These professionals offer insights into effective income tax calculation methods and help navigate the complexities of corporate tax solutions. Timely and strategic planning is crucial as it allows business owners to make informed decisions that could lead to substantial reductions in tax liabilities. This proactive approach not only lessens the burden on small businesses but also positions them for sustainable growth by retaining more of their hard-earned profits.

Furthermore, leveraging tax saving strategies is an ongoing process throughout the fiscal year. It involves a dynamic understanding of the current IRS updates and how they impact business tax policies. Our taxpayer relief services stay abreast of these changes to provide up-to-date guidance. By offering tailored tax preparation and filing assistance, along with compliance support, our advisors ensure that every deduction is claimed and that businesses remain in full alignment with federal and state tax requirements. This diligence not only ensures accuracy in tax returns but also maximizes savings, which can be reinvested into the business to fuel innovation, expansion, or as a buffer against market fluctuations.

Corporate Tax Solutions: Tailored Approaches for Diverse Business Needs

Small business owners are well aware that managing corporate taxes requires a nuanced approach, given the complexities and ever-evolving tax landscape. Our corporate tax solutions are meticulously tailored to address the diverse financial needs of each business, ensuring that every strategic move aligns with your long-term objectives. By leveraging our expertise in year-end tax planning, we help you navigate the intricacies of income tax calculation and position your business for optimal financial health. Our certified tax preparers are adept at identifying opportunities for tax savings and implementing effective strategies to minimize your tax burden. They stay abreast of the latest IRS updates to provide you with up-to-date guidance, ensuring that your federal and state tax returns are not only compliant but also reflective of every possible relief and deduction. Our commitment extends beyond mere compliance; we aim to empower your business with taxpayer relief services that go beyond the traditional scope, providing a comprehensive suite of tax solutions designed to safeguard your financial interests and support your company’s growth trajectory.

The Importance of Staying Current with IRS Updates and Changes

As a small business owner, navigating the complexities of tax laws is a critical component of maintaining financial health and compliance. The Internal Revenue Service (IRS) regularly updates its regulations, which can significantly affect your company’s income tax calculation and overall tax liabilities. Staying abreast of these changes is not just an obligation but a strategic advantage. Our business tax services prioritize current knowledge, ensuring that our certified tax preparers are equipped with the latest information to provide accurate year-end tax planning. This proactive approach allows for the implementation of tax-saving strategies tailored to your business’s unique situation, helping you to optimize your financial position and reduce the tax burden.

In the ever-evolving landscape of corporate tax solutions, our advisors are your reliable partners. They offer not only comprehensive filing assistance but also ongoing compliance support. By staying current with IRS updates, we can anticipate changes that might otherwise catch you off guard. Our taxpayer relief services are designed to alleviate the stress and complexity associated with tax preparation, offering peace of mind that your returns are completed accurately and on time. This level of vigilance and expertise ensures that you benefit from every possible deduction and credit, maximizing your savings and allowing you to focus on what you do best—running your business.

Exploring Comprehensive Taxpayer Relief Services for Sustained Financial Health

Small business owners often face a complex array of tax challenges that can impact their financial health. To navigate these waters, our firm offers comprehensive taxpayer relief services designed to ensure sustained financial well-being. Our year-end tax planning is a proactive approach that allows business owners to anticipate and prepare for upcoming tax obligations. By engaging with our certified tax preparers, clients benefit from expert analysis of their financial situation, which informs the development of personalized tax-saving strategies. These professionals are adept at income tax calculation and skilled in employing corporate tax solutions that align with individual business needs.

Our commitment to staying abreast of IRS updates ensures that our clients receive up-to-date guidance on the latest tax policies. This vigilance is crucial for accurately completing federal and state tax returns, thereby minimizing tax burdens and maximizing potential savings. Our taxpayer relief services extend beyond mere compliance; we aim to be a strategic partner in our clients’ business operations. By leveraging our expertise in tax law and financial planning, we provide clients with peace of mind, knowing that their tax considerations are managed by seasoned professionals who prioritize their sustained financial health.

In conclusion, small business owners face a complex tax landscape that demands precise navigation. Our comprehensive suite of services, encompassing Year-End Tax Planning, guidance from Certified Tax Preparers, and dedicated Taxpayer Relief Services, stands as a pillar of support for entrepreneurs aiming to thrive amidst the intricacies of income tax calculation and the ever-evolving IRS updates. By leveraging our expertly crafted Tax Saving Strategies and bespoke Corporate Tax Solutions, businesses can not only meet their tax obligations but also position themselves for increased profitability and long-term financial health. With our commitment to accuracy and staying abreast of the latest tax laws, we empower small business owners to focus on what they do best—running their businesses—while we handle the complexities of tax compliance and optimization.