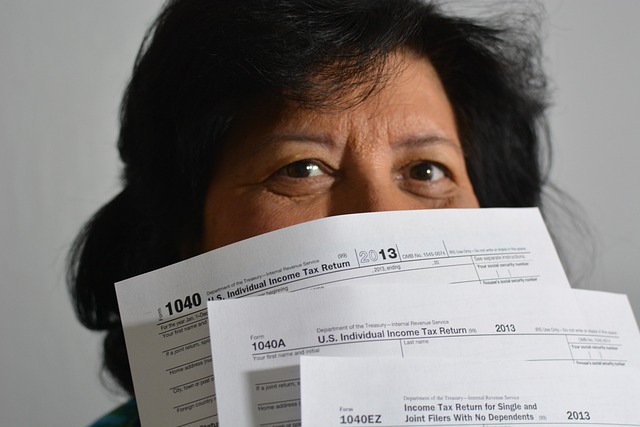

Navigating the complexities of tax laws and facing IRS challenges can be a formidable endeavor for individuals and businesses alike. An experienced Income Tax Advisor plays a pivotal role in these situations, offering tailored IRS representation and tax resolution services to manage disputes, audits, and other tax intricacies. These professionals leverage their expertise in tax optimization strategies, retirement tax planning, international tax services, capital gains tax advice, sales tax consulting, and payroll tax assistance to ensure clients’ compliance and achieve the most favorable outcomes. Their guidance is indispensable for self-employed individuals and those seeking to maximize investment returns while maintaining accurate and compliant financial reporting. This article delves into these services and how they can alleviate the stress of tax controversies, offering a path to peace of mind in the world of taxation.

- Navigating IRS Challenges: The Role of Income Tax Advisors

- Strategic Solutions for Effective Tax Optimization Services

- Comprehensive Retirement Tax Planning for Peace of Mind

- Expert International Tax Services for Cross-Border Taxation

- Capital Gains Tax Advice to Maximize Your Investment Returns

- Sales Tax Consulting for Accurate and Compliant Financial Reporting

- Payroll Tax Assistance: Tailored Support for Self-Employed Individuals

Navigating IRS Challenges: The Role of Income Tax Advisors

When confronted with the intricacies of the IRS system, enlisting the expertise of an Income Tax Advisor becomes invaluable. These professionals are adept at navigating the complexities of tax law, offering tailored Tax Optimization Services that align with individual financial objectives. They excel in various facets of taxation, including Retirement Tax Planning, ensuring clients maximize their retirement savings within the legal framework. For those with cross-border concerns, International Tax Services are crucial to comply with both domestic and foreign tax regulations. The advisors’ proficiency extends to Capital Gains Tax Advice, guiding individuals through the nuances of reporting and minimizing liabilities on significant asset transactions.

In addition to their strategic planning capabilities, Income Tax Advisors also provide Sales Tax Consulting, ensuring businesses adhere to state and local tax laws. Their expertise is equally critical for self-employed individuals, who require meticulous Payroll Tax Assistance to manage the complexities of managing their own payroll. These advisors are the cornerstone of compliance, offering detailed guidance that not only mitigates the risk of penalties but also ensures that all tax obligations are fulfilled accurately and on time. Their comprehensive approach to tax controversies encompasses representing clients in audits and negotiations with the IRS, striving for resolutions that uphold their financial interests. With a deep understanding of the ever-evolving tax landscape, Income Tax Advisors empower individuals and businesses alike to confront and manage IRS challenges effectively.

Strategic Solutions for Effective Tax Optimization Services

Navigating the complexities of income tax laws requires a seasoned professional with a deep understanding of the intricacies involved. An Income Tax Advisor brings to the table strategic solutions tailored to each client’s unique financial situation, ensuring optimal compliance and minimizing tax liabilities. These experts are adept at Retirement Tax Planning, helping individuals maximize their retirement savings while adhering to tax regulations. For those with international interests or obligations, International Tax Services provide guidance on cross-border transactions and compliance with multiple jurisdictions’ rules.

Capital Gains Tax Advice is another critical service offered by these professionals, who skillfully navigate the nuances of asset valuation and timing to minimize capital gains taxes. Sales Tax Consulting is also a vital offering, as businesses must accurately calculate and remit sales tax in compliance with state and local regulations. Payroll Tax Assistance ensures that employers correctly manage payroll taxes, avoiding costly penalties and interest charges. Self-Employed Tax Help addresses the diverse tax concerns of freelancers and entrepreneurs, providing personalized strategies to manage their tax obligations efficiently and effectively. With a comprehensive approach to tax optimization services, these advisors empower clients to make informed decisions, ultimately contributing to their financial well-being and success.

Comprehensive Retirement Tax Planning for Peace of Mind

Engaging a seasoned income tax advisor is pivotal for comprehensive retirement tax planning, ensuring peace of mind for individuals as they navigate their golden years. These experts specialize in Retirement Tax Planning, crafting strategies that maximize the efficiency of your savings and investments against the backdrop of ever-evolving tax laws. By leveraging Tax Optimization Services, retirees can protect their assets from unnecessary tax burdens while enjoying their well-earned leisure time. Moreover, for those with international ties, International Tax Services are crucial to manage cross-border tax implications and capitalize on favorable tax treaties.

Capital Gains Tax Advice plays a critical role in maximizing the after-tax yield from the sale of assets. Sales Tax Consulting ensures compliance with complex sales tax regulations that can impact your financial standing. When it comes to managing payroll taxes, the expertise of these advisors is invaluable for the self-employed or small business owners who must maintain accurate records and adhere to compliance standards. With a comprehensive approach to tax concerns, these professionals provide the necessary guidance and support to manage your tax liabilities effectively, ensuring that you can focus on enjoying your retirement years without the stress of tax controversies. Their proactive advice and representation in dealings with tax authorities offer a reliable solution for achieving tax compliance and resolution, making them indispensable allies in your financial journey.

Expert International Tax Services for Cross-Border Taxation

Navigating the complexities of cross-border taxation requires specialized expertise, particularly for individuals and businesses with international transactions or assets. An Income Tax Advisor with a robust grasp of international tax laws is invaluable in this context, offering tailored Tax Optimization Services that align with global best practices. These experts help clients minimize their tax liabilities legally, ensuring compliance with the intricate web of double taxation treaties and cross-border reporting requirements. For those planning for retirement, International Tax Services extend to Retirement Tax Planning, ensuring that expatriates and globetrotters can enjoy their golden years without unnecessary tax burdens.

Capital Gains Tax Advice is another critical service offered by these professionals, particularly relevant for individuals or entities disposing of foreign investments or properties. Sales Tax Consulting is also a key area where advisors assist businesses in understanding and fulfilling their sales tax obligations across different jurisdictions, which can be particularly complex for e-commerce ventures with a diverse customer base. Payroll Tax Assistance ensures that employers, especially those with a mobile workforce or international employees, correctly calculate and remit payroll taxes. Self-Employed Tax Help is designed to support freelancers and independent contractors who operate across borders, offering guidance on the myriad of tax considerations unique to their status. With a comprehensive suite of services, these tax advisors are equipped to handle the nuances of international taxation, providing clients with peace of mind and strategic financial planning.

Capital Gains Tax Advice to Maximize Your Investment Returns

An income tax advisor plays a pivotal role in ensuring that individuals and businesses maximize their investment returns through effective capital gains tax advice. For those looking to optimize their financial gains, a savvy tax advisor can provide strategic insights into market trends and tax laws, which are crucial for making informed decisions about the timing of sales and investments. This meticulous analysis helps clients navigate the complexities of capital gains taxation, thereby maximizing returns while adhering to regulatory requirements. Additionally, these experts are adept at identifying opportunities for tax deferral or minimization strategies, ensuring that clients retain more of their hard-earned profits.

Retirement tax planning is another critical area where the guidance of a seasoned tax advisor can yield significant benefits. By leveraging their knowledge of income tax laws and retirement accounts, these professionals help individuals plan for a future where they can enjoy the fruits of their labor without undue tax burdens. Furthermore, for those with international earnings or investments, tax optimization services are indispensable. These services address the intricate web of cross-border tax issues, ensuring compliance with multiple jurisdictions’ tax laws and optimizing tax liabilities. Sales tax consulting and payroll tax assistance complete the spectrum of tax services offered by these experts. They help businesses stay compliant with ever-changing tax regulations and manage their tax obligations efficiently. For the self-employed, who often juggle complex financial matters alongside their business operations, having access to tailored tax help is invaluable, providing peace of mind and facilitating smoother fiscal management throughout the year.

Sales Tax Consulting for Accurate and Compliant Financial Reporting

Navigating the complexities of sales tax consulting is a critical component for businesses seeking accurate and compliant financial reporting. An Income Tax Advisor with expertise in this area can guide entities through the labyrinthine regulations that govern sales tax, ensuring that each transaction is accounted for correctly. This meticulous approach to sales tax compliance not only aids in avoiding penalties but also ensures that businesses benefit from tax deductions they are entitled to. For the self-employed or small business owners, the nuances of payroll tax assistance cannot be overstated. These professionals offer tailored solutions that align with individual business models, optimizing tax liabilities and contributing to a more robust financial position.

Furthermore, for those planning for retirement, Retirement Tax Planning is an indispensable service offered by seasoned Income Tax Advisors. They provide capital gains tax advice that allows clients to strategically plan the timing of asset sales to minimize tax liabilities. Additionally, International Tax Services are invaluable for businesses with cross-border transactions or those with operations in multiple jurisdictions. These advisors navigate the complex web of international tax laws, ensuring compliance and identifying opportunities for tax optimization. By leveraging their comprehensive knowledge of domestic and foreign tax codes, these tax professionals empower clients to make informed decisions that positively impact their financial health.

Payroll Tax Assistance: Tailored Support for Self-Employed Individuals

When self-employed individuals encounter challenges with payroll tax obligations, the guidance of an Income Tax Advisor proves invaluable. These professionals specialize in Payroll Tax Assistance, ensuring that freelancers, independent contractors, and small business owners navigate the complexities of payroll taxes with confidence. The intricacies of tax laws can be daunting, but a skilled advisor provides tailored support to manage these responsibilities effectively. They help calculate accurate withholdings, guarantee timely tax submissions, and advise on the best practices to avoid penalties or interest charges. For those looking to optimize their income through smart Tax Optimization Services, these advisors offer strategic advice that aligns with individual financial goals while remaining compliant with regulations.

Beyond domestic tax concerns, self-employed individuals often have unique needs when it comes to Retirement Tax Planning and International Tax Services. An Income Tax Advisor with a global perspective can navigate the multifaceted aspects of international tax laws, ensuring that clients maximize their retirement savings in a tax-efficient manner and comply with cross-border tax obligations. Capital Gains Tax Advice is another critical area where these experts excel, providing nuanced guidance to minimize tax liabilities associated with the sale of assets or business interests. Similarly, Sales Tax Consulting services are crucial for understanding and adhering to the ever-evolving landscape of sales tax regulations, which can significantly impact a self-employed person’s bottom line. With a comprehensive suite of Payroll Tax Assistance and Self-Employed Tax Help, Income Tax Advisors empower individuals to focus on their core business activities with the assurance that their tax liabilities are being managed by experts in the field.

When the intricacies of tax law become a challenge, the expertise of an Income Tax Advisor proves invaluable. From strategic tax optimization services to meticulous retirement tax planning, these professionals ensure that every aspect of your finances is handled with precision and care. Whether navigating international tax services or seeking capital gains tax advice to enhance investment returns, their guidance is tailored to each unique situation. Sales tax consulting and payroll tax assistance are also offered, particularly for the self-employed who require personalized support to maintain compliance. Ultimately, the role of an Income Tax Advisor is not just to resolve current disputes or audits but to provide a comprehensive suite of services that promote financial clarity and peace of mind. Their representation in IRS matters is a testament to their commitment to securing favorable outcomes for their clients.