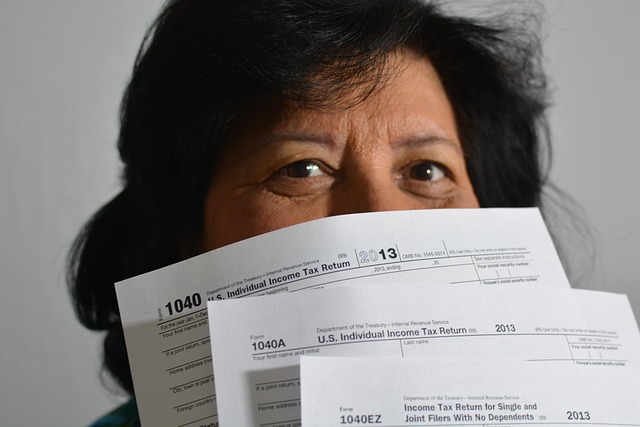

Navigating the complex world of taxes is crucial for achieving financial well-being. This article guides you through essential tax planning strategies, ensuring compliance and maximizing savings. We explore key aspects like understanding tax deductions and credits to unlock significant potential savings, and navigating IRS filing deadlines to avoid penalties. Learn about nonprofit tax filing considerations, tax-efficient investments, adapting to changing tax codes, and optimizing your filing status for better outcomes. By implementing these strategic moves, individuals and businesses can navigate complexities, increase refunds, and secure tax exemption eligibility.

- Understanding Tax Deductions and Credits: Unlocking Potential Savings

- IRS Filing Deadlines: Navigating Penalties and Interest Charges

- Nonprofit Tax Filing: Specific Considerations for Charity Organizations

- Tax-Efficient Investments: Strategic Moves for Retirement Accounts & Health Savings Accounts

- Adapting to Tax Code Changes: Staying Compliant and Maximizing Benefits

- Optimizing Filing Status: The Impact on Tax Liability and Refunds

Understanding Tax Deductions and Credits: Unlocking Potential Savings

Understanding tax deductions and credits is a powerful tool for maximizing financial savings. Taxpayers can significantly reduce their taxable income by taking advantage of these benefits, which are designed to encourage specific behaviors or support certain groups. For example, contributing to retirement accounts like 401(k)s or IRAs can lead to substantial tax savings, as the contributions may be tax-deductible and the earnings grow tax-free. Additionally, health savings accounts (HSAs) allow individuals with high-deductible health plans to save money for medical expenses tax-free.

By reviewing the IRS guidelines and staying informed about eligible deductions and credits, taxpayers can ensure they receive the maximum benefits. Nonprofit organizations, in particular, should focus on navigating complex rules regarding charitable donations and grant them appropriate tax exemptions. As tax laws evolve through annual changes in the Tax Code, it’s crucial to stay updated on these modifications to optimize filing status and take advantage of any new opportunities for tax-efficient investments. This proactive approach not only helps avoid IRS penalties and interest but also ensures individuals and businesses are fully utilizing their tax exemption eligibility.

IRS Filing Deadlines: Navigating Penalties and Interest Charges

Knowing IRS filing deadlines is paramount to avoid penalties and interest charges. The Internal Revenue Service (IRS) sets specific dates for both individuals and businesses to submit their tax returns, with consequences for late filings. For individuals, missing the deadline typically results in a late-filing penalty of 5% per month on the outstanding tax amount, with a maximum penalty of 25%. Businesses face even stricter implications, including potential interest charges and additional fees.

Nonprofit organizations, eligible for tax-exempt status under certain conditions, must also adhere to IRS filing requirements. Staying current with tax code changes ensures nonprofits maintain their exemption eligibility. Optimizing filing status, whether individual or business, can further mitigate tax liabilities by strategically aligning with available deductions, credits, and tax-efficient investments.

Nonprofit Tax Filing: Specific Considerations for Charity Organizations

Nonprofit organizations, in addition to their mission-driven work, face unique tax considerations when it comes to filing and compliance. To maintain their tax-exempt status, charities must adhere to strict regulations set forth by the IRS. One key aspect is ensuring they remain eligible for tax exemption under the Internal Revenue Code (IRC). This involves careful financial management and record-keeping, as even minor errors can lead to significant penalties and interest charges from the IRS.

When preparing their taxes, nonprofit organizations should focus on maximizing tax-efficient investments and staying updated with changes in the Tax Code. By optimizing their filing status and taking advantage of available deductions and credits, charities can reduce their tax burden. Regularly reviewing and adapting to these changes ensures nonprofits remain compliant and can better allocate resources towards their charitable initiatives.

Tax-Efficient Investments: Strategic Moves for Retirement Accounts & Health Savings Accounts

Strategic tax planning extends beyond mere compliance; it involves making smart investments that can lower tax liabilities and promote long-term financial growth. Retirement accounts, such as 401(k)s or IRAs, offer significant tax advantages. Contributions to these accounts are often tax-deductible, allowing individuals to reduce their taxable income in the current year. Moreover, earnings within these accounts grow tax-deferred, compounding over time without incurring annual tax payments.

Health Savings Accounts (HSAs) represent another powerful tool for tax-efficient investing. Eligible individuals can deposit tax-free contributions, which can then be used to pay for qualified medical expenses, further reducing taxable income. The flexibility of HSAs, combined with their tax benefits, makes them an attractive option for those seeking to optimize their tax code changes and filing status. This proactive approach ensures that investors not only stay compliant with IRS penalties and interest but also maximize their financial well-being through strategic tax exemptions and efficient investments.

Adapting to Tax Code Changes: Staying Compliant and Maximizing Benefits

Adapting to frequent Tax Code Changes is crucial for staying compliant and maximizing benefits. The tax landscape is ever-evolving, with new laws and regulations introduced annually, impacting individual and business taxpayers alike. To navigate this complexity, proactive financial planning is key. Regularly reviewing and updating tax strategies ensures that individuals take advantage of the latest changes, such as expanded tax exemption eligibility or modified IRS penalties and interest.

For nonprofits, staying informed about updated nonprofit tax filing requirements is essential to maintain their tax-exempt status. Additionally, businesses can optimize their tax positions by exploring tax-efficient investments and strategically managing their filing status. By embracing these proactive measures, taxpayers can not only avoid unnecessary IRS penalties and interest but also enhance their overall financial well-being, ensuring they remain compliant while maximizing potential savings.

Optimizing Filing Status: The Impact on Tax Liability and Refunds

Optimizing one’s filing status is a powerful strategy to navigate tax complexities effectively. Marrying the right marital status with careful consideration of income sources can significantly impact tax liability and refund amounts. For individuals, being married and filing jointly often presents tax benefits due to combined income and shared deductions. This strategic move could result in lower taxable income and potentially increase refund expectations. Conversely, single filers or those in complex relationships may explore options like head-of-household status or qualified widow(er) status, which offer specific tax exemptions and eligibility for certain credits, reducing tax burden accordingly.

In the realm of nonprofit organizations, optimizing filing status through accurate IRS reporting is equally vital. Nonprofits must adhere to stringent tax code changes, ensuring they meet requirements for exemption from federal income taxes. By staying updated with Tax Code alterations, nonprofits can avoid penalties and interest charges, maintaining their tax-exempt eligibility. Strategic nonprofit tax planning includes meticulous record-keeping, proper documentation of revenue sources, and compliance with regulatory bodies, ultimately fostering a robust financial landscape while upholding legal standards.

In conclusion, navigating tax planning with expertise is key to financial prosperity. By understanding deductions, credits, and filing deadlines, individuals and businesses can optimize their financial situations. Staying informed about tax code changes ensures compliance and allows for maximizing benefits. Regular strategic planning not only reduces liabilities but also increases refund potential. For nonprofits, specific considerations are crucial, while tax-efficient investments in retirement accounts and health savings accounts further enhance financial well-being. Embracing these practices leads to a more secure and prosperous future.