Implementing robust tax strategies is vital for businesses aiming for financial success. By understanding complex compliance requirements, companies can steer clear of legal issues and penalties imposed by authorities like the IRS. This article explores key areas that empower business owners to make informed decisions. We delve into navigating tax exemptions, avoiding costly IRS penalties, optimizing nonprofit tax filing, exploring tax-efficient investments, adapting to code changes, and maximizing filing status. Mastering these aspects ensures compliance, enhances financial efficiency, and opens doors to significant savings.

- Understanding Tax Compliance Requirements: Navigating IRS Regulations

- Tax Exemption Eligibility: Unlocking Potential Savings for Nonprofits

- IRS Penalties and Interest: Avoiding Costly Pitfalls through Proactive Planning

- Nonprofit Tax Filing: A Comprehensive Guide to Compliance

- Tax-Efficient Investments: Strategizing for Financial Growth and Reduced Liabilities

- Tax Code Changes: Staying Ahead with Adaptable Strategies

- Optimizing Filing Status: A Key Component of Effective Tax Management

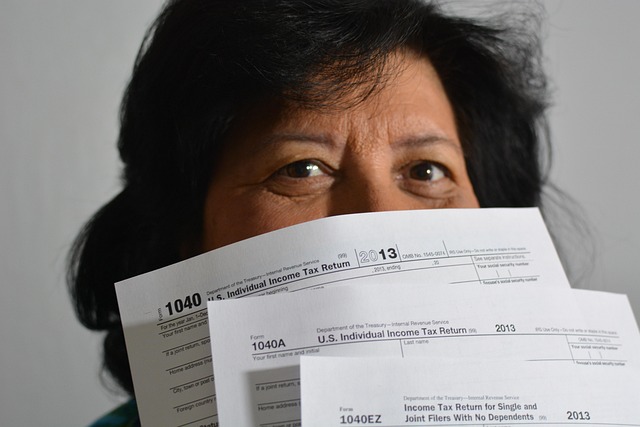

Understanding Tax Compliance Requirements: Navigating IRS Regulations

Navigating IRS regulations is a complex task for any business, but it’s especially crucial for nonprofits aiming to maintain tax exemption eligibility. The Internal Revenue Service (IRS) sets forth stringent guidelines that must be followed meticulously to avoid penalties and interest charges. Nonprofit organizations, in particular, must adhere to strict rules regarding their operations, revenue sources, and tax-filing processes. This includes proper documentation of expenses, accurate financial reporting, and timely submission of forms to maintain 501(c)(3) status.

Understanding the ever-changing Tax Code is essential for maximizing tax-efficient investments and optimizing filing status. IRS penalties can significantly impact a nonprofit’s financial health, so staying informed about any changes in regulations is vital. By carefully reviewing and interpreting these requirements, nonprofits can ensure they are making informed decisions that align with both their financial goals and the laws governing their operations.

Tax Exemption Eligibility: Unlocking Potential Savings for Nonprofits

For nonprofits, understanding tax exemption eligibility is a critical component of financial management. Organizations that qualify for tax-exempt status under the IRS rules are exempt from paying federal income taxes and may also be eligible for state and local tax exemptions. This can lead to substantial savings, freeing up funds that would otherwise be directed towards tax payments for program expansion, operational improvements, and other mission-related activities.

Nonprofit organizations must navigate complex tax code changes and ensure accurate nonprofit tax filing to maintain their tax-exempt status and avoid IRS penalties and interest. By optimizing their filing status, carefully considering tax-efficient investments, and staying informed about recent tax law updates, nonprofits can maximize their operational capacity and contribute more effectively to their communities.

IRS Penalties and Interest: Avoiding Costly Pitfalls through Proactive Planning

For businesses, particularly nonprofits, navigating the complex landscape of tax regulations can be a significant challenge. One of the most costly mistakes organizations make is ignoring potential IRS penalties and interest charges. These penalties aren’t just financial burdens; they can also damage an entity’s reputation and impact its long-term sustainability.

Proactive planning is key to avoiding these pitfalls. Nonprofits should ensure they’re aware of and in compliance with all applicable tax laws, including those related to tax exemption eligibility. Regularly reviewing and updating their filing status optimization strategies, as well as exploring tax-efficient investments, can help minimize liabilities. Staying informed about IRS penalties and interest charges allows organizations to make informed decisions that align with both financial goals and regulatory requirements, ultimately fostering a more stable and sustainable operational environment.

Nonprofit Tax Filing: A Comprehensive Guide to Compliance

Nonprofit organizations, like any other business, are subject to tax regulations and must navigate the complexities of tax filing to maintain their tax-exempt status. A comprehensive guide to nonprofit tax filing ensures compliance with IRS guidelines and avoids potential penalties and interest charges. Understanding the unique aspects of their financial operations is crucial, as these entities often rely on donations and grants, which can impact their tax obligations.

By reviewing the organization’s income, expenses, and assets, nonprofits can optimize their filing status and take advantage of available deductions and credits. Staying informed about changes in the tax code is essential, as these alterations can affect eligibility for tax exemptions. Filing accurately and on time not only ensures legal compliance but also fosters trust among donors and stakeholders, demonstrating the nonprofit’s financial responsibility and transparency.

Tax-Efficient Investments: Strategizing for Financial Growth and Reduced Liabilities

Strategizing for tax-efficient investments is a powerful way to boost financial growth while reducing liabilities. Businesses can explore various options such as tax-exempt bonds, which offer both income generation and potential savings on capital gains taxes. Additionally, understanding the IRS’s treatment of different investment types is key; some assets may qualify for favorable tax exemptions or deductions under specific circumstances. For nonprofits, managing tax obligations is crucial, especially with regard to filing requirements and staying compliant with IRS guidelines.

Optimal filing status optimization can also play a significant role in tax planning. Changes in the Tax Code often introduce new rules that impact taxable income, so staying informed about these updates is essential. By strategically choosing the right investment vehicles and navigating tax code changes effectively, businesses can take advantage of available deductions, credits, and exemptions, ultimately reducing their overall tax burden and maximizing savings.

Tax Code Changes: Staying Ahead with Adaptable Strategies

The tax code is subject to periodic changes, and keeping pace with these alterations is vital for businesses to maintain compliance and optimize their financial strategies. Tax Code Changes require organizations to adapt their approaches to stay eligible for tax exemptions and take advantage of new provisions. For nonprofits, staying updated ensures they meet the IRS’s standards and accurately file their tax returns, avoiding penalties and interest charges. By closely monitoring legislative updates, businesses can identify opportunities for savings through tax-efficient investments and filing status optimization.

Implementing adaptable strategies enables companies to make informed decisions regarding tax planning. This proactive approach helps in managing taxable income effectively, ensuring that organizations remain compliant while minimizing their tax liabilities. For instance, understanding recent changes might reveal new avenues for charitable donations, allowing nonprofits to enhance their financial performance and potentially reduce tax obligations.

Optimizing Filing Status: A Key Component of Effective Tax Management

Optimizing filing status is a crucial component of effective tax management for businesses. Nonprofit organizations can significantly impact their tax obligations by ensuring they meet IRS requirements for tax-exempt eligibility. This involves careful review and documentation to avoid unintended consequences, such as IRS penalties and interest. By understanding the nuances of the tax code changes, nonprofits can make strategic decisions regarding income and deductions, maximizing their tax-efficient investments.

Effective tax management also includes leveraging filing status optimization techniques. Businesses should regularly assess their financial performance to determine the most advantageous filing status. This might involve structuring operations to take advantage of specific tax provisions or timing tax reporting to align with significant financial events. Such strategic moves can result in substantial savings and enhanced financial efficiency, ensuring compliance with tax regulations while achieving long-term financial goals.

In conclusion, businesses that prioritize effective tax strategy implementation reap substantial benefits. By understanding compliance requirements, planning for investments, and staying informed about tax code changes, companies can optimize their financial health. Navigating IRS regulations, assessing eligibility for tax exemptions, and proactively managing taxable income are essential practices. Additionally, nonprofits must master the nuances of tax filing to ensure compliance. Ultimately, optimizing filing status alongside careful planning contributes to significant savings and enhanced financial efficiency.